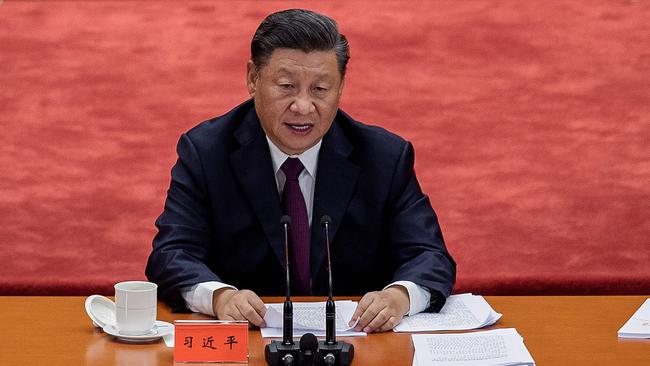

Terry McCrann: Understanding our big China game

When China makes decision that affect us, all sorts of games could be in play that have absolutely nothing to do specifically with Australia; then again, they could be very precisely aimed at us, writes Terry McCrann.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

THE only thing sillier than trying to work out why ‘China’ – as in, China Inc – has done something to us, is asking it why it did whatever it did.

China has purportedly instructed some (or all?) of its steel mills and power companies to cut back and even stop buying both met and energy coal from us. We’ve supposedly sent them a ‘please explain’.

All this shows a complete failure to understand the mountain of complexities in and around how ‘China’ – to repeat, China Inc – works, from President Xi, percolating down through various bureaucracies, the party (both vertically and geographically horizontally) the Red Army, and into the SOEs (State Owned Enterprises), mixing and overlapping with what might be called the private sector.

All sorts of games could be in play that have absolutely nothing to do specifically with Australia; then again, they could be very precisely aimed at us. Whichever, nothing much can be achieved in ‘finding out’: what, we think, if we can identify a power game played between, say, an SOE in Shanghai and a particular bureaucrat in Beijing to help or hinder some major private sector player, we can somehow ‘persuade’ Xi or some underling to intervene on our behalf?

Our approach to China must be one of rigorous, what I would call, ‘informed ignorance’ built on completely unemotional self-interest. Ours certainly and obviously, but also theirs.

They will buy from us what they want, when they want, within the dynamics of all those China Inc complexities. Yes, from time to time, ‘they’ might ban some of our exports or slap tariffs on them like they did to barley. But to see that simplistically as all policy-driven, coherently if unpleasantly, from the top, and so responsive to what we might have done – like playing tough guy; and worse, so that it can be flipped by us playing nice – doesn’t only miss the point but promotes exactly the wrong response.

Being ‘nice’ and subservient is not going to guarantee a seamless trade, investment and political future. Being gratuitously aggressive is equally not a good idea, but it won’t necessarily cost in the long run.

As I say, they will buy what they want irrespective of how ‘nice’ or ‘nasty’ we are. Just as they don’t limit the sale of their TV’s (and phones) only to customers that are nice to them.

PEAS AND THIMBLES FOR SUCKERS

There are two keys to understanding the voracious greed of private equity and how they turn that into profit for themselves.

The first is that they aim to buy cheap and sell expensive. Correction, ultra cheap and ultra expensive.

Did anyone mention Myer and the shares sold by PE at $4.10 and now at 20c? Oh, and it helps if you don’t pay tax on any profits between the buy and the sale.

Anyway, heck, doesn’t everyone, at least try to do the same? Indeed, the late Kerry Packer – James’s father – spent a lifetime doing exactly that, buying cheap and selling expensive and often the same asset and more than once.

He did it most famously with the family ‘jewel’, the Nine Network, but he did it also with many other deals, that were actually a primitive form of PE.

This points to the second feature – you build the cheap/expensive, entry/exit, around a clever mix of sophisticated financial engineering, leverage, and more basic ‘pea and thimbles’.

This enables you to make it look as if you are overpaying and underselling when in fact you are doing the exact opposite with both.

We see this with the Carlyle and PEP play for the Link financial administration group – dressing up the $5.20 ‘offered’ as really something more than that, with what is actually nothing more than a straight out ‘pea and thimble’ twist.

Well, when I say, ‘we’ see it, I have to exclude Link’s biggest shareholder Perpetual from that – in so quickly endorsing the $5.20, Perpetual has demonstrated it has rather embarrassingly bought the ‘pea and thimble’, as they also say, ‘hook, line and sinker’.

The PE duo are putting it about that their deal would liberate hidden value in Link’s key sub-asset, its 44 per cent stake in digital conveyancing business PEXA.

In accepting the $5.20 Link shareholders could opt for all-cash or a mix of cash and PEXA stock.

This is supposed to upscale the offer, if you as a Link holder had a higher value for PEXA than the PE duo.

Say the PEXA bit was valued in the offer at $2 per Link share. The $5.20 would then be $3.20 for ‘everything else’.

But if you thought that PEXA bit was really worth, say $2.50, you’d supposedly be ‘getting’ $5.70. If worth $3, you’d be getting $6.20 (both added on to the $3.20).

Miracles still happen: not one but two Father Christmases – Carlyle and PEP.

Yes, and you’d also be getting a share in a certain bridge in a certain city with a harbour.

Let me try to explain it to Perpetual and any other Link holder.

The real maths is that if you think PEXA is worth $2.50, you are selling all the rest of Link for $2.70; if you think the PEXA bit is worth $3, you are selling the rest of Link at $2.20.

It’s the $5.20 that doesn’t change. The more you think PEXA is worth the cheaper you are selling all the rest of Link.

Bottom line: Link holders do not have to give away the ‘rest of Link’ cheaply just to ‘liberate’ the value in PEXA. The company could do it directly without paying PE a multi-million dollar, ahem, ‘fee’.

Originally published as Terry McCrann: Understanding our big China game