Struggling families cut off from utilities being pushed further into debt, new report shows

A new report on electricity, gas and water disconnections shows struggling families without electricity are cutting back on groceries, maxing credit cards, delaying medical appointments and even getting loans from pawnbrokers to reconnect to the grid.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Struggling families without electricity are cutting back on groceries, maxing credit cards, delaying medical appointments and even getting loans from pawnbrokers to get reconnected to the grid.

A new report on electricity, gas and water disconnections has found utility companies who cut off skint households from essential services are pushing these Australians into even further debt and forcing them to make tough decisions about what to sacrifice at home in order to keep the lights, heating and taps running.

The ‘Close to the Edge,’ report, released today by the Public Interest Advocacy Centre’s Energy + Water Consumers’ Advocacy Program, has found that in order to get reconnected, 27 per cent of households cut back on buying food and groceries, 13 per cent delayed medical or dental appointments, 12 per cent used a credit card to get back on, and 12 per cent took out a loan through a pawn broker or money lender, further exacerbating their debts.

PIAC’s report found that the total number of gas and electricity disconnections in NSW during 2016-2017 was 32,916.

Electricity disconnections comprised more than 75 per cent of this figure.

The independent group surveyed more than 1000 Australians and did in-depth interviews with 15 NSW households doing it particularly tough.

“People have told us they are choosing between bills and rent, going without heating, cooling and showers to use less energy, and live in fear of their next bill,” PIAC spokesman Craig Memery told The Daily Telegraph.

“It’s clear that retailers can do more to help struggling households keep the lights on when they are going through hard times.”

MORE NEWS

Jarryd Hayne accused of biting woman on genitals

Renae Lawrence walks free from Bali prison

Officer in charge of offensive phone call probe stood down

PIAC’s report found that 66 per cent of disconnected households have at least one mental, intellectual, physical illness or disability in the house, and 71 per cent of people who were disconnected were facing at least one type of disadvantage, including being a sole parent or unemployed, or living with a disability.

“Identifying people who are struggling to pay as early as possible and getting them into a hardship program which is tailored to their individual circumstances, is a key way to reduce disconnections,” Mr Memery said.

“Retailers have options to make sure that disconnections themselves, and the cost to consumers, are kept to a minimum.”

The PIAC report suggests families struggling with financial hardship to reach out for assistance from the Energy Accounts Payment Assistance scheme, rebates, Centrepay, the appliance replacement offer, financial counselling, bill smoothing, monthly billing and the Energy and Water Ombudsman NSW.

Mr Memery is calling on retailers to reduce reconnection fees, which vary on a case-by-case basis, with 31 per cent of respondents paying $100 or less, and 15 per cent paying $200 or more.

“Disconnecting people from essential services because they can’t pay their bills, and then slugging them with a reconnection charge, is just kicking people when they are down,” he said.

PIAC are also asking for retailers to stop offering pay on time electricity discounts, which slug consumers with brutal late payment fees if they pay up just one day late.

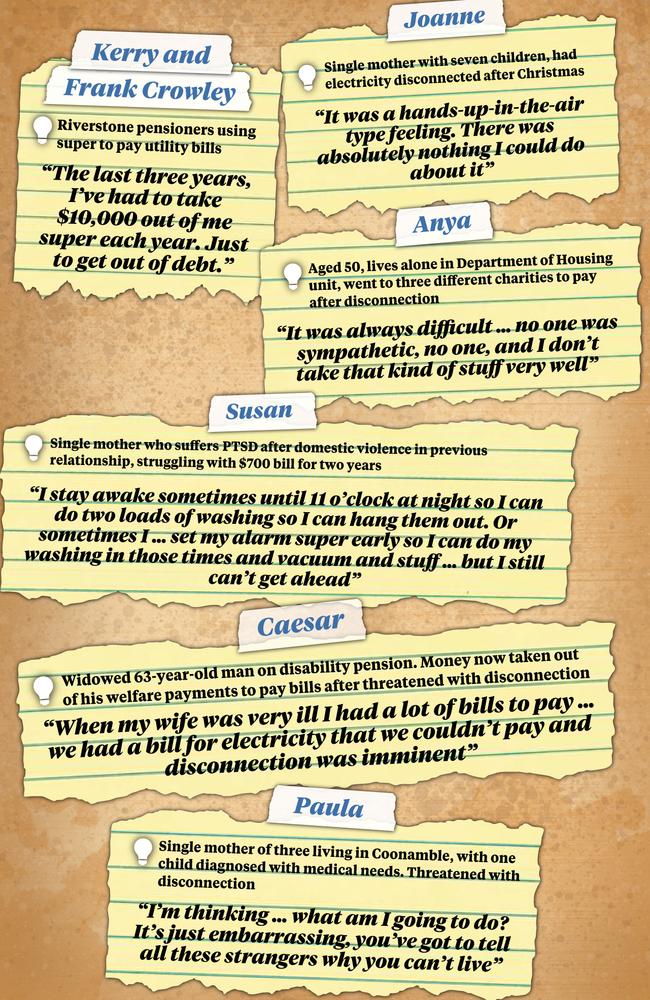

Riverstone pensioners Kerry and Frank Crowley told The Daily Telegraph they have been forced to dip into their superannuation savings to cover rising debts and utility bills.

“The last three years, I’ve had to take $10,000 out of my super each year, just to get out of debt. Now, I’ve got I’ve got about $30,000 left in super, and that will be gone the next three years and I’ll have nothing,” Mr Crowley, 55, said.

Mrs Crowley, 54, said after her husband was injured in a car accident 30 years ago, he has had a series of health issues. To make matters more difficult, their son also lives at home and is unemployed.

“You’re constantly on edge like you’re going to have the electricity cut off or you just don’t know, you hate going to the letterbox when you know the electricity bill is coming,” Mrs Crowley said.

“You don’t go on holidays because you can’t afford it. So you pretty much stay home most of the time because you know that the bills have to be paid first.”

ADDITIONAL REPORTING: JOCELYN AIRTH