Why fundies Goehring and Rozencwajg are riding the resources bull thesis

How undervalued are commodities and mining and energy stocks? These fund managers think they’re at 150-year lows, and see a new bull run on the horizon.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

American natural resources investors Goehring and Rozencwajg are bringing their fund down under

The pair, well known for their contrarian commentaries on commodity markets, have been on a roadshow in Australia this week

US natural gas, crude oil, uranium and gold are their core investing themes

US fundies Goehring and Rozencwajg have taken their bullish resources thesis Down Under, prepping the launch of a new fund to take advantage of a potential rerate in "undervalued" materials stocks.

Assisted by Swiss-based ARM Capital and Australia's Mantis Funds, the American natural resource investors with $1.2 billion of funds under management have been on a roadshow this week, drumming up support from family offices, wealth advisors and high net worth investors across the country.

Amid this week's market turmoil, they think the time is right for the launch of a new Australian vehicle targeting an initial FUM of $10 million.

Their theory is that an unwind of the so-called "carry trade" that saw US tech equities storm and leave mining and energy stocks in the dust is on the horizon.

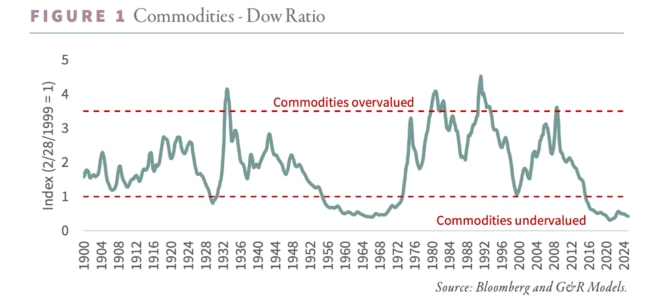

Led by Leigh Goehring and Adam Rozencwajg, former executives at US$4bn hedge fund Chilton Investment Company, they think commodities and mining and energy stocks have never been as undervalued as they are today.

"If you look at the weighting of energy and materials in the S&P, it typically averages about 15 to 16% over 100 years or so," Rozencwajg told Stockhead.

"Big bull markets end with energy as high as 30% of the S&P. Right now, we're at 3%, so we're extremely, extremely low.

"The stocks all made their bottoms in 2020, and that was a 150-year low in terms of everything, whether you look at commodity prices versus stocks or commodity equity versus commodities or commodity equities in the indices.

"You're not at those dark days. But, when you look at the full cycle, you're almost indistinguishable, if I were to chart it, from the bottoms."

How a carry trade unwinds

Rozencwajg said the impetus to launch a fund specific to the Australian market reflected its deep understanding of the resources landscape.

"We've been quite keen to come here and look for capital because there's a strong affinity and an understanding of resource stocks and of metals and mining, energy, uranium, what-have-you," he said.

"And I think a strong understanding amongst retail, institutional, and wealth advisors, all, about commodity cycles.

"So I think it's always been part of our plan and the reason that we're doing it now is we think that the time as far as where we are in the cycle ... is now and we really don't want to not have a product in the market going forward."

In the grand scheme of things, he said commodities remain a "contrarian call".

"The consensus norm is not to add major materials exposure to a portfolio and so there's always a level of challenge and difficulty to do that because it goes against the conventional wisdom," Rozencwajg said.

"And in investing it's very difficult to not be with the herd, but for better or worse that's where excess returns are generated – is by doing something that's different than the herd."

They see the recent boom in tech-focused growth stocks, exemplified by the Nasdaq's superstar Magnificent Seven as being the latest carry trade, a situation due to unwind when macroeconomic events shake confidence in the story of companies like Nvidia and Tesla.

When that happens, the theory goes, investors tend to shift back to real assets like commodities with more predictable earnings profiles.

Four pillars: Gas, crude, uranium and gold

G&R have four core themes they focus on the most at the moment: gas (and specifically US natural gas), crude oil, uranium and gold.

US natural gas prices have been at an 80% discount to export prices for a decade, according to Rozencwajg.

But he sees an uptick in demand coming as US shale production, which spurred a surge in US gas and oil exports, is beginning to flatline.

"We've been out of the gas market for a long time and then call it two years ago, maybe a little longer now, we decided to get involved because we started to see cracks forming in the supply base for US shale production," he said.

"Shale production stopped growing basically three years ago already. And we anticipated that probably a year before it happened.

"And as a result, we felt that with all the new LNG demand coming on – because we have another batch, another wave coming online now – and with a huge amount of gas-fired power needed for AI data centres, along with supply that for the first time since the shales were developed is now declining, we felt that it was no longer justified to have a US price 80% below world price."

Two mild winters in 2022-23 and 2023-24 kept inventories well-stocked, hitting an eight-year high ahead of the 2024-25 winter. But the most recent northern winter has been more "normal", Rozencwajg says.

"I think that the idea of a US$4 gas price in light of a US$12 dollar world price is not sustainable anymore. And that's probably the commodity that has the potential to double or triple the most."

While crude prices have been smashed this week on fears of a global recession, Rozencwajg thinks it's "entirely possible" a slowdown in US shale supply could send them from their Covid lows of US$20/bbl to US$200/bbl, in line with bull runs seen in the 1970s and the mid-2000s.

In the uranium market, Rozencwajg says there's "simply not been enough new mine development".

Volatile spot prices have taken the wind out of uranium developers' sails recently.

While term contract prices – which more aptly reflect the bulk of yellowcake sales – are sitting near decade-long highs at ~US$80/lb, spot prices heavily influenced by hedge fund trading have fallen over 40% off their early 2024 highs of US$107/lb to US$64/lb.

That mismatch means developers are more reliant on market sentiment to set the incentive price than fundamentals.

At the same time demand in China and elsewhere is increasing, Rozencwajg said.

"We like uranium. I think this has a lot of legs to it because it's such an efficient source of energy," he said. "And the tech companies are now waking up to it, too."

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Originally published as Why fundies Goehring and Rozencwajg are riding the resources bull thesis