Trading Presidents: Dr Shane Oliver on how markets will play the Trump card

Investment and economy guru Dr Shane Oliver says a Donald Trump presidential victory, and subsequent chaos, could well mean angst for Australia.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

The return to uncertainty and the destabilisation of the global order after a Donald Trump presidential victory could well mean angst for Australia, says AMP head investment strategy and chief economist Dr Shane Oliver.

He reckons saying bye to (president Joe) Biden would leave us vulnerable to wild global winds.

“As a relatively open economy with high trade exposure to China, Australia would be vulnerable to an intensification of global trade wars as a result of a Trump victory, particularly if it weighs on demand for Chinese exports,” Dr Oliver said.

For the latest expert opinion, sign up here for free Stockhead daily newsletters

He said the underlying challenge for Australia (and for the government coffers, the ASX and pretty much everything else) would be our over-dependence on the outsized exports of mining, materials and resources.

Any further deterioration in ties with China most particularly would almost certainly throw Canberra’s economic vulnerability into stark relief

“Resources shares would be most at risk and the Australian dollar would likely fall,” Dr Oliver said.

“Of course, similar fears existed during the last Trump trade war, and it didn’t turn out so bad.

“Much would depend on how other countries respond and how hard Trump goes.”

There’s broad consensus of the quietly accepting kind that Wall Street and pretty much anyone within a 6371km radius will experience increased volatility in the run-up to the US election set November 5.

Markets will experience increased volatility. Treasury yields will fluctuate. The US Dollar could become unhinged. Marriages will crumble, plate tectonics will agitate …

Or as Bill Murray, revising his Ghostbusters warning, might say: “dogs and cats living together”.

OK, we might be exaggerating just a tad.

But Dr Oliver warned that the pressure would start cooking should former president and Republican nominee Donald Trump remain ahead of incumbent US President Joe Biden in the polls.

He said the wait until the vote would give investors time to have a think about the risks and reactions of a return to those Trumpian themes – the fallout of a renewed US-led trade war, the uncertainty of key US relationships, defence spending, taxes, budgets, social cohesion …

“Or even the hit to both US jobs and the independence of the US Federal Reserve,” Dr Oliver warned Stockhead.

MORE FROM STOCKHEAD: Argonaut not fased by RE slump | Lithium can join party, says Gerrish | Bonds ‘help investors sleep soundly’

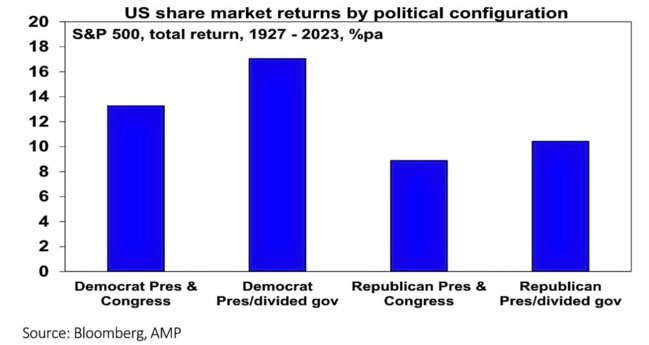

He said that historically, shares and their markets have performed better under Democrat than Republican presidents, with the best outcome typically being a Democrat president and Republican House or Senate control.

Dr Oliver is not the only one alluding to the flow-down affect of a Trump presidency.

In his wrap of ASX uranium prospects, Market Matters’ James Gerrish pondered the effect of a Trump presidency on a Biden policy that would likely be very good for Aussie producers.

The incumbent president has just signed the bill to ban the import of Russian-sourced enriched uranium into the US.

Obviously that would be a tremendous boost to ASX companies dealing in the resource, so it’s probably no surprise the bill was welcomed by Gerrish and co.

“We remain very bullish on the outlook for uranium in the next few years, seeing no hurdles to the upside, although (admirer of Putin) ex-pres Donald Trump may reverse this particular bill if he wins in November’s US election.”

Trading Trump

Stockhead: “It’s nearly four years since the tumultuous 2020 US presidential election and the next one is almost upon us. So far markets have paid scant attention to it or have instead focused on the upside if Mr Trump returns (thinking: lower taxes and less regulation) … can we assume all that’s going to change as the showdown to November 5 draws near?”

Dr Oliver: “Well that’s just a terrific question. With the first debate scheduled for June 27 and with a Trump victory running the risk of weakening US democracy and US global alliances and threatening a big ramp up in protectionism and a further reversal in free trade.

Being unable to run for a third term, a second Trump presidency will lack the electoral constraints of his first term (which led to the Phase One trade deal with China) and is likely to have less “adults in the room”.

“Here’s a few things to consider five months out:

Polls have Biden trailing

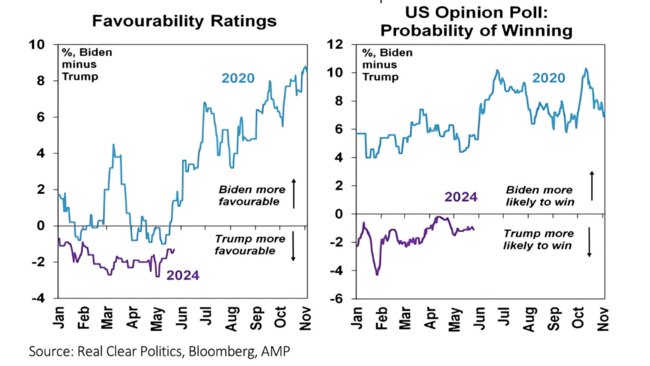

“Real Clear Politics poll average has Biden trailing Trump by 1 to 2 points in terms of favourability and presidential voting intentions,” Dr Oliver said.

“This is well behind where he was at the same point in 2020.”

Biden also lags Trump by around 1 to 9 points in key battleground states, whereas he was leading at this point in 2020, Dr Oliver said.

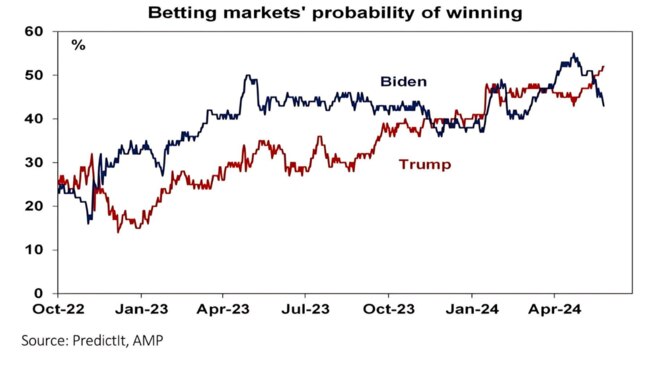

The ‘PredictIt’ betting market puts Mr Trump on 51 per cent probability of winning versus Mr Biden on 44 per cent, having just crossed over from favouring Biden.

“If Trump wins, it’s likely the Republicans would regain control of the Senate (where they have an edge as the Democrats need to defend more seats) and keep the House, resulting in a clean sweep,” Dr Oliver said.

Stockhead: “But, there’s still like (counts on fingers) five months to go. That’s an eon in Aussie politics … so you’re not suggesting we should just pack it in and call this one for the Republicans?

Dr Oliver: “Oh not at all. It’s too early to write Biden off.

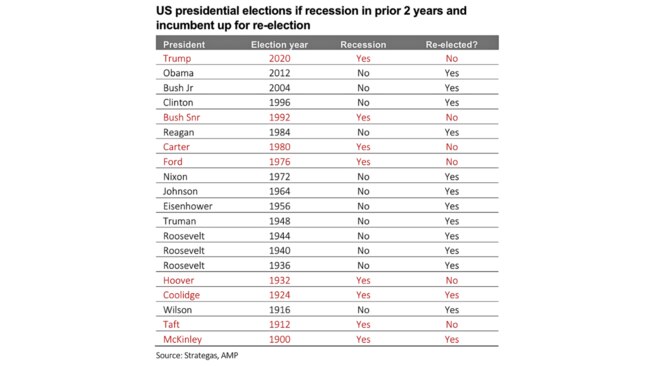

“First, the historical record indicates incumbent presidents tend to be re-elected if there is no recession in the two years before the election.

“Since 1932, all incumbents seeking re-election have failed if this was not the case. While leading indicators point to a high risk of recession, so far the economy has been strong.

“But how it behaves up to November is critical.

“Second, normally around July in the election year incumbent presidents start to see an upswing in support.

“Third, polls indicate that roughly 14 per cent are undecided and they often don’t make up their minds until the end of the party conventions (July/August).

“Fourth, around 20-25 per cent of Trump supporters indicate that they will reconsider if he is convicted of a crime. Of course, several of the stronger cases against him have been delayed likely leaving the arguably less threatening for Trump New York ‘hush money’ case.

“Finally … while third party candidate Robert F Kennedy is more of a threat to Biden than Trump, it’s likely he will be convinced to exit the race.

“Of course, it can all blow the other way if there is a surge in oil prices (e.g. if the Israel war expands to include Iran and Russia curtails its energy exports in the hope it will support Trump who as president will cut support for Ukraine) and the economy slides into recession.”

Visit Stockhead, where ASX small caps are big deals

Dr Oliver’s policy diffs, Trump v Biden

Taxation: “Trump would look to make the 2017 corporate and personal tax cuts (which took the corporate rate to 21 per cent and the top marginal tax rate to 37 per cent) permanent (as they expire in 2025 which would result in higher taxes under Biden) and to lower them possibly further.

Trade: “Trump is threatening to impose a 10 per cent tariff on all imports and a 60 per cent tariff on all imports from China. This would take the average US tariff rate from around 2.5 per cent to around 17 per cent, far surpassing the 3 per cent peak seen in Trump’s first term. “This may be ‘maximum pressure’ bluster, but while ‘we shouldn’t take him literally, we should take him seriously’.

“Biden has basically maintained Trump’s China tariffs and recently announced he will add to them (but only on 4 per cent of imports from China) and has dramatically ramped up subsidies for manufacturing in America.

“This is part of a broader global trend towards protectionism and deglobalisation.

“Trump (who sees the US trade deficit as a sign that America is being ripped off) would likely dramatically ramp this up accelerating the process of deglobalisation and adding to the likelihood of global trade wars as other countries retaliate on a far bigger scale than in 2018-19 and without political considerations getting in the way (as he can’t have a third term).”

- Immigration: “Immigration has surged under Biden making it a big issue and Trump will likely aggressively curtail both legal and illegal immigration.”

- Federal reserve independence: “Trump would seek to replace (chair) Jerome Powell, and his supporters are looking at ways to roll back the Fed’s independence.”

- Climate policy: “Trump will likely reverse the US’s net zero commitments and most of the policies Biden introduced to support it. Subsidies for green manufacturing are likely to be replaced with wider industry subsidies.”

- Regulation: “Trump is likely to slash regulation particularly benefiting the energy and financial sectors.”

- Budget deficit: “The deficit remains huge (at 6.3 per cent of GDP) owing to big government spending. It would likely get bigger under Trump’s tax policies.

Stockhead: Alrighty then. From an economic perspective, what might be some of the actions from the White House and what could we imagine some of the reactions might be?

Dr Oliver: “Trump’s policies in support of tax cuts and deregulation could help boost the supply side of the US economy via a boost to productivity (which is already on the mend and will be helped by the rapid take up of AI in the US).

“However, on balance Trump’s policies – with higher tariffs and hence higher import prices, sharply lower labour force growth and moves to weaken the Fed’s inflation fighting credentials – will likely add to inflation.

“There is also a risk that a higher budget deficit, with no sign of improvement at a time when US public debt is now very high (at 125 per cent of GDP), will result in a market backlash and higher bond yields.

“Furthermore, his brinkmanship and erratic policymaking style is likely to add to policy uncertainty which could hamper business investment.

“A lot will depend on the sequencing of his policy moves.

“If he runs with tax cuts first it could boost the economy in say 2025, but if he runs first with sharp tariff hikes, immigration cuts and an attack on the Fed it could be taken more negatively early on.

“In 2017 he ran with the positives first to help shore up the economy, but this time around he may run with negatives first as there will be no constraint from the desire to win another election.”

And likely market reaction

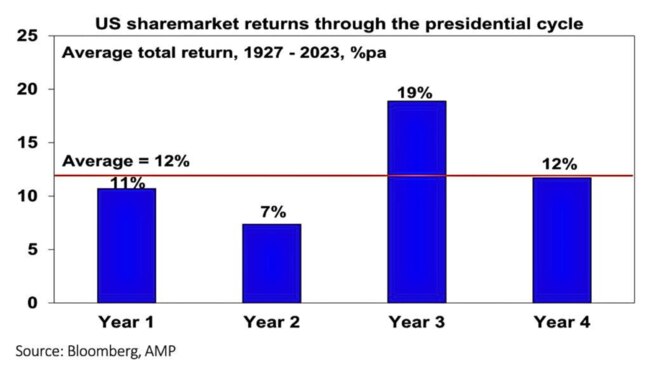

“Firstly, despite the heightened policy uncertainty the election year is normally an OK year for US shares. Since 1927, the election year, or year four in the presidential cycle, has had a return of around 12 per cent,” Dr Oliver said.

“Second, the run up to the election will likely see increased share market volatility if Trump remains ahead and investors start to focus on the risks of a new trade war, a hit to the US labour force and to the Fed under Trump.

“After Trump’s victory in 2016 shares soared 38 per cent to January 2018 as the focus in his first year was on business-friendly tax cuts and deregulation but they fell in 2018 as the focus shifted to trade wars.

“So, if there is a Trump victory, the share market’s reaction in the first 6-12 months will be heavily influenced by his sequencing of tariff hikes versus tax cuts.

“Third, historically US shares have done best under Democrat presidents with an average return of 14.4 per cent pa since 1927 compared to an average return under Republican presidents of 10 per cent pa.

“However, the best average result has actually occurred when there has been a Democrat president and Republican control of the House, the Senate or both and the worst average return has been when there’s been a clean Republican sweep.

“Finally, a Trump presidency would likely mean higher bond yields (with somewhat higher inflation and budget deficits) and a higher $US (partly reflecting higher global economic uncertainty and the impact of US tariffs).

Stockhead: OK. What would it all mean for how we go about our business here at home. What’d be the implications of a return to Trump for Australia?

“An OECD study showed that Australia could suffer a 1.2 per cent reduction in GDP as a result of a 10 per cent reduction in global trade between major countries.

“This is second only to Korea in OECD countries and reflects Australia’s high exposure to China. Resources shares would be most at risk and the $A would likely fall.

Much would depend on how other countries respond and how hard Trump goes (with a trade war).

“And of course, Trump may not win!

Stockhead: Okay … But … it’s just when you say it like that - with a sudden degree of emphasis - that I can only assume you’re pretty sure Trump’s going to win.

Dr Oliver: No. I’m not.

This content first appeared on stockhead.com.au

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

Originally published as Trading Presidents: Dr Shane Oliver on how markets will play the Trump card