RareX’s building non-Chinese rare earths supply chain with Kenyan consortium

Iluka’s Eneabba facility is critical to the RareX consortium’s plan to leverage Australia’s US tariff exemption on rare earths for Mrima Hill.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Special Report: RareX’s consortium with Iluka Resources to secure and develop the Mrima Hill project in Kenya could be the first step in the building of a non-Chinese rare earths supply chain.

- RareX, Iluka receive positive feedback from Kenyan high commissioner to Australia Dr Wilson Kogo

- Proposal to process ore at Iluka’s Eneabba facility critical to leverage Australian exemption on US tariffs for rare earths

- Company progressing its Australian projects in parallel with Kenyan push

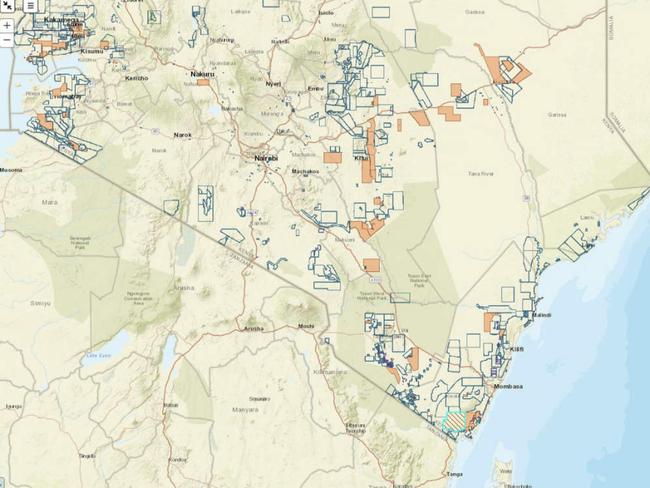

There are several reasons why this might come about with the first being that Mrima Hill ranks as one of the top five undeveloped rare earth deposits in the world, while another is Iluka’s under-construction rare earths processing facility at Eneabba, WA.

Said facility’s location in Australia also allows the consortium to leverage Australia’s exemption on US tariffs for light and heavy magnet rare earths, which will give it a significant competitive edge against Chinese supply that is not only subject to export controls but also facing very heavy tariffs.

RareX (ASX:REE) and its partner are in the box seat to secure the project in joint venture with the National Mining Corporation of Kenya (NAMICO), with a positive response from Kenya’s High Commissioner to Australia Dr Wilson Kogo a point in their favour.

At a recent strategic roundtable convened by the Kenyan High Commission, the consortium and its key supporters such as Ausenco, AMC Consultants, Curtin University, WSP and Canaccord Genuity presented their proposal which highlighted their vision for a responsibly developed, strategically aligned project that prioritises local training and skills transfer, environmental and community stewardship.

This received overwhelmingly positive feedback from Dr Kogo.

No stranger to Mrima Hill

In a video presentation, managing director James Durrant noted that the company has been involved in Mrima Hill since 2019.

Since then, it has developed a vision and leveraged its experience on carbonatite projects for the proposal, including REE’s experience derisking them and their critical metallurgy.

RareX also leveraged individual experiences from around the world including Africa in developing large-scale projects in partnership with governments, its intellectual property around critical minerals as well as technical and commercial partnerships.

“This represents a structured and phased investment approach to this project, allowing Iluka to bring their critical minerals capabilities to the table while RareX focuses on the initial development of this fantastic project,” Durrant added.

“It is important to recognise there’s a formal process that the company has to go through with the Kenyan government to progress its application into an acceptance and ultimately into a joint venture with NAMICO, which is the intended end goal later this year.”

He added the social licence to operate was absolutely critical and would be placed front and centre once the joint venture started work on Mrima Hill.

Kenya is no stranger to Australian miners, having hosted Base Resources’ Kwale mineral sands operation before the mine’s closure and its owners sale to Energy Fuels.

Iluka support critical

Durrant notes that Iluka is a key partner in Mrima Hill as their processing capability at Eneabba will play a major role in monetising the asset.

“Iluka have that in hand with government backing from the Australian Federal Government,” he said.

“That partnership is a really important part of us being able to prosecute that vision of leading the early development and turning this project into an operating asset.

“The framework that we have got with Iluka has provision for early flexibility with long-term increased equity ownership and Iluka are going to be a very good partner for us on this journey.”

This will support the company’s vision of developing significant rare earth assets and supporting the global supply chain for those critical metals.

Not the only card in the deck

While Durrant acknowledged the Kenyan consortium was a very significant part of its business development activities, it is not its only focus.

“We must maintain development on our existing portfolio, our Cummins Range project which continues to show very important critical mineral characteristics and our exploration portfolio,” Durrant said.

That includes the Khaleesi project in WA, where RareX recently received Exploration Incentive Scheme funding to drill for high grade gallium and rare earths.

With progress in Kenya a key catalyst over next six months, RareX is also hoping to see heavy rare earths exploration results coming out of its Mt Mansbridge project and drilling results at Khalessi.

“Cummins Range obviously now has the gallium and scandium to really explore,” Durrant added.

“I think it is an exciting journey all round for us and our shareholders.”

This article was developed in collaboration with RareX, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as RareX’s building non-Chinese rare earths supply chain with Kenyan consortium