HyTerra backs white hydrogen in quest to pick low-hanging decarbonisation fruits

White hydrogen looms as a low-emission, low-cost key to reaching some of the ‘low-hanging fruit’ of decarbonisation, says a pioneering ASX stock.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

The road to net zero emissions requires a multi-pronged approach – using renewables, hydrogen, and increased efficiency – to make a near-term impact, as it’s not possible to electrify everything.

An efficient way to start may be addressing the “low-hanging fruit” – industries and sectors that can be quickly decarbonised by swapping out, say, a feedstock manufactured using a process with high carbon intensity with the same feedstock made using a low or zero carbon process.

The use of hydrogen presents great potential for decarbonising the low-hanging fruit.

For the latest energy news, sign up here for free Stockhead daily newsletters

While many people aren’t overly familiar with hydrogen, as it is not a traded commodity such as gold and silver, it is nonetheless interwoven into our daily lives in many ways.

Notable examples of sectors and products that use hydrogen include fertilisers and refining, with the first being the very definition of a low-hanging fruit with the potential for massive impacts.

The fact that these industries can’t be electrified easily just adds to the appeal of decarbonising them.

For instance, ammonia fertiliser requires significant amounts of hydrogen, which at this point comes largely from fossil fuels.

Replacing this fossil fuel-derived hydrogen with gas produced using cleaner methods will make an immediate difference to our emissions, particularly since fertiliser production is projected to keep growing as the world’s population does.

While most people in the know will point towards the use of green hydrogen – created using electrolysers powered by renewable energy to crack water into oxygen and hydrogen – as being the obvious choice, HyTerra (ASX:HYT) executive director Benjamin Mee believes the answer can be found under our feet.

The case for white hydrogen

While he doesn’t disagree that green hydrogen can clean up ammonia production (or other industries that use hydrogen), Mee believes white hydrogen (also known as gold or natural hydrogen) found in reservoirs similar to those that host oil and gas represents a low-cost option that also wins the emissions sweepstakes.

“White hydrogen is basically hydrogen made naturally by the earth and as a result there is an immediate advantage from a cost and carbon perspective that could be central to the future of the hydrogen industry,” he told Stockhead.

“At the front end you have very low cost, maybe the lowest cost, potential in the hydrogen business.

“Second, it has a very low carbon intensity because you didn’t spend all that effort to mine materials needed to manufacture solar panels, wind turbines, electrolysers and all the bits and pieces needed to produce green hydrogen.

“So, white hydrogen should be able to compete against grey hydrogen, which is fossil fuels based, in terms of cost and would beat them hands down in terms of carbon.

(It) competes against green hydrogen by at very least matching carbon emissions but at a lot lower cost.”

Mee said the latter was a significant point, noting that the lowest cost producer always won in the short term.

MORE FROM STOCKHEAD: Stealth gas approval may just be start | Nuclear debate now trench warfare | Renewables cost a plus for green hydrogen

He expected that in the long-term, customers would factor in life-cycle carbon emissions when considering the different methods of hydrogen production.

Mee pointed out that the oil and gas industry was very good at calculating carbon emissions and this rigour would be applied to all forms of hydrogen.

“Today we look at colours like white, grey, yellow, blue, green etc. These colours help us identify how hydrogen is made,” he said.

“In the near future, I believe the discussion will shift more to what is the life cycle intensity of what we trying to achieve.

“That’s where the attributes of white hydrogen will support the cause.”

And while it is an emerging source of energy, white hydrogen also benefits from being able to apply existing skillsets and technologies from mining, oil and gas, and managing water to the extraction of the gas.

Mee pointed out that drilling for hydrogen, which was essentially a brand new energy source that no one really understood yet, had similarities to drilling for geothermal energy.

Both used methods from the optimised oil and gas industry.

Challenges ahead

It is not all sunshine and rainbows though.

As one would expect from trying to develop a new energy source, there are challenges involved in bringing white hydrogen to the market.

And co-operation within the industry could be limited.

Mee noted that there was no one plan for finding and extracting hydrogen.

“Companies are actually developing that recipe now because it is so new,” he said.

Further complicating this challenge was that companies could be expected to keep their recipes – essentially intellectual property – pretty close to their chests. This meant there would not be much data sharing between companies in the coming years.

“The second challenge is explaining it, the education of what it can be to the market and helping to create that demand and resilience to any hydrogen economy that pops up around the world,” Mee added.

“Third is the legislation that still needs to be in place. That’s evolving as we see now in Western Australia, as an example.”

Mee noted that some countries – such as the US, where HyTerra was operating – were already well advanced in this area, noting that it was a great jurisdiction with all the incentivised regulation ready to go.

Nemaha Ridge poised to go

HyTerra is a global early mover.

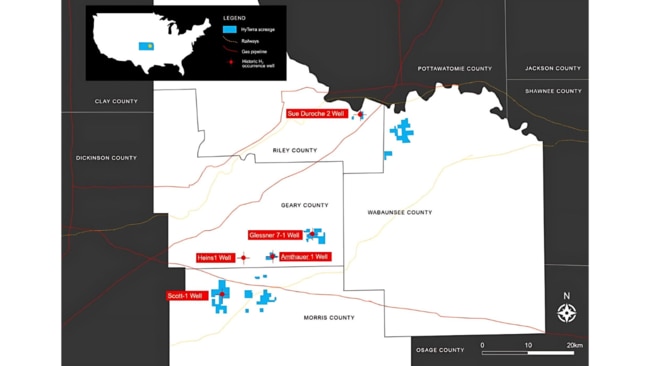

Central to HYT’s efforts to prove its own production recipe and be a frontrunner in the white hydrogen space is its wholly owned Nemaha Ridge project in Kansas, between Kansas City and Wichita, in the centre of a major industrial and manufacturing hub.

The project has 12,720 acres (5147ha) of exploration leases with good proximity to existing railways, roads, and pipelines that connect it to a long list of potential offtakers nearby including ethanol and ammonia manufacturers, and petrochemical plants.

There’s also significant evidence that hydrogen is present, with the company’s acreage hosting historical wells with hydrogen and helium occurrences in the region, some returning up to 92 per cent hydrogen and 3 per cent helium.

Mee said the company had gone in and looked at the wells along with the other thousands of wells across the US.

“We liked the jurisdiction, proximity to industry, and we liked the rocks,” he noted.

“We then came up with the geological model that could explain why those occurrences are there and we leased those occurrences.”

Taken together, Nemaha Ridge has all the basics required for project resilience.

“You want to have proximity to customer, you want to have low-cost extraction and you want to have good rocks and good play diversity,” Mee said.

“You have got to have a lot of things to try. More shots on goal from the start.”

HYT has already tagged Nemaha Ridge with a best estimate prospective resource of 100.2 billion cubic feet of hydrogen and 0.47Bcf of helium, and plans to continue leasing more acreage to build its position.

Visit Stockhead, where ASX small caps are big deals

It recently raised $6.1 million through a placement and fully underwritten rights issue, placing it in the position to drill in Q3 2024.

Mee notes that Kansas has rigs available and has an existing services industry, ensuring that oil and gas service providers can be hired as required.

“The trick now is to go find the hydrogen and understand it, drill it out, and replicate that globally and we are looking at different opportunities around the world,” he added.

HYT will first drill some exploration wells, decide on appraisal wells and flow testing before making a decision on commerciality and building a pilot plant to demonstrate early commerciality.

“While we do that, we still need to explore, keep building and leasing to build scale in our priority areas,” Mee said.

“To do that, we have to start derisking and handling subsurface uncertainty and that’s what we are good at. You can only do that through geophysical surveys, geological surveys, and drilling.”

He added that while there were plenty of potential hydrogen opportunities in the US, the company was also looking globally as there were different geological models to unlock.

“It is going to be quite interesting to see what we do next.”

This content first appeared onstockhead.com.au

At Stockhead we tell it like it is. While Hyterra is a Stockhead advertiser, it did not sponsor this article.

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

Originally published as HyTerra backs white hydrogen in quest to pick low-hanging decarbonisation fruits