Health Check: Can Syntara produce the next multibillion-dollar Aussie blood cancer drug?

Syntara hopes to emulate the success of Ojjaara, a $2.6 billion home-grown myelofibrosis therapy approved in the US.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Syntara aims for FDA ‘breakthrough’ therapy status for its myelofibrosis drug candidate

FAK! More promising results from Amplia’s pancreatic cancer trial

Oh, you shouldn’t have! Broker Morgans’ Christmas biotech hamper

Armed with encouraging interim results from its phase 1/2a myelofibrosis trial, Syntara (ASX:SNT) plans to meet the US regulator to discuss a pivotal study aimed at marketing approval for the potential breakthrough therapy.

Aired at the American Society of Hematology’s annual get-together overnight, the results showed that Syntara’s drug candidate SNT-5505 compared favourably with other drugs for the rare condition.

This included “excellent” tolerability and improvements in symptoms (including spleen volume reduction, which is not a feature of other drugs).

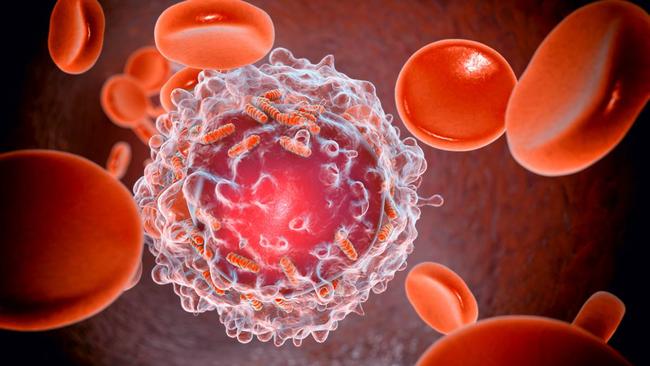

Affecting about 15 in one million people, myelofibrosis is a bone-marrow cancer that disrupts normal blood cell production.

The disease normally presents around the age of 50 and patients can expect to live only for five years.

SNT-5505 targets pan-lysyl oxidase, an enzyme closely implicated in inflammation and fibrosis.

In contrast to standard of care janus kinase (JAK) inhibitors, SNT-5505 clears fibrosis from the bone marrow and inhibits a growth factor receptor to enable increased production of healthy blood cells.

The company said the patients had had a suboptimal response to previous drugs, notably the JAK inhibitor ruxolitinib and a “high disease burden”.

Carried out cross 19 sites in Australia, South Korea, Taiwan and the US, the study combined SNT-5505 with ruxolitinib.

The open-label study enrolled 16 patients with intermediate or high-risk myelofibrosis, with average ruxolitinib usage of 3.2 years.

At 12 weeks of treatment, 46% of the evaluable patients (six out of 13) had achieved a 50% improvement in their Total Symptom Score, a standard primary endpoint for myelofibrosis trials.

This improved to 80% (four out of five patients) who reached 38 weeks of treatment.

Also, 30% patients achieved a “clinically meaningful” spleen volume reduction of 25%, with 20% of them seeing a reduction of 35%.

Formerly known as Pharmaxis, Syntara will release further interim data in the first half of 2025 and final data in the second half.

On receipt of the final, 52-week data, the company will seek a chinwag with the US Food & Drug Administration (FDA) to discuss a pivotal phase 2c/3 study.

Syntara CEO Gary Phillips says the “increasing and durable” benefit of SNT-5505 could differentiate SNT-5505 from other myelofibrosis drugs, notably the JAKs that provide symptomatic relief but do not ameliorate the disease.

A notable 'other' drug is the Australian-developed Ojjaara (momelotinib), approved by the FDA last year.

Developed by the formerly ASX-listed Cytopia, the drug changed ownership several times before Glaxosmithkline acquired it in 2022 for US$1.9 billion ($2.6 billion) – the highest ever paid for an Australian-originated drug.

Naturally, biotechs never waste such announcements and Syntara stock is in trading halt pending a $15 million capital raising. This will be via a placement at 6 cents apiece, a 10% discount to Monday’s frozen closing price of 6.7 cents.

The placement is in two tranches: an immediate $12.4 million and a further $2.6 million, with the latter subject to shareholder approval early next year.

FAK yeah! Amplia's encouraging pancreatic cancer trial results

In other news on the anti-fibrosis trial front, Amplia (ASX:ATX) has disclosed more data from its ongoing phase 2a advanced pancreatic cancer study that tests its drug candidate in combination with a standard-of-care chemotherapy.

Amplia’s molecule AMP-945 (narmafotinib) aims to inhibit a focal adhesion kinase (yes – FAK) protein which is over-expressed in pancreatic and other cancers.

In its trial, dubbed Accent, nine patients recorded a partial response, which means at least a 30% decrease in the overall size of tumor lesions, sustained for at least two months.

The study combines narmafotinib with the widely used chemo agents gemcitabine, branded as Abraxane.

Given the trial has enrolled 26 patients to date, this makes for a 35% response rate, “significantly better than the 23% reported for the historical trial being used as the benchmark for this study”.

The median duration period on trial for the 26 patients was 172 days, a 47% improvement over the historic average of 117 days.

Currently 11 patients from the initial 26 enrolled remain on trial. This may sound like a lot of attrition, but bear in mind that pancreatic cancer is one of the most fatal cancers.

Recognising this, the primary endpoints for the trial (apart from safety) are the response rate and duration on trial, with the secondary endpoints of progression-free survival and overall survival (how long the patients live, no matter their condition or quality of life).

The company says recruitment of the final 24 patients is ahead of schedule, with 12 enrolled after recruitment re-opened in October.

Recruitment is expected to complete by the end of the March quarter.

The trial is being carried out at sites in Australia and South Korea. As for the latter, the company says the current political unrest there has not affected the study.

And by the way, Amplia CEO Dr Chris Burns co-developed the aformentioned Ojjaara.

Building a biotech basket

Broker Morgans suggests an ideal biotech basket that combines the ‘moonshots’ with the up-and-comers and established commercial plays.

“Our tilt remains toward later-stage companies with prior efficacy signals and short time-horizons to meaningful catalysts,” the firm says.

So, what’s in the firm’s Christmas hamper, a potential gift for those who have everything already?

Comprising up to 15% of the portfolio, the speccie moonshots are Neurizon Therapeutics (ASX:NUZ) with its motor neuron disease program and Percheron Therapeutics (ASX:PER) with its Duchenne muscular disease trial (results pending).

Stocks on the cusp of greatness (20-35% of the basket) are Dimerix (ASX:DXB) (phase III kidney cancer results next year), Clarity Pharmaceuticals (ASX:CU6) (expect a stream of radiopharmacy trial results) and Opthea (ASX:OPT) (two phase III eye disease trials).

The remainder compromises companies with clinically validated or commercialised assets: EBR Systems (ASX:EBR) (pending US approval for heart leads), Avita Medical (ASX:AVH) (wound healing), Neuren Pharmaceuticals (ASX:NEU) (Rett syndrome drug) and Imricor Medical Systems (ASX:IMR) (trials in ventricular tachycardia and atrial flutter).

Unlike gifts, the price tag is important. Many of these stocks have had a decent run already but some of them have retracted over the last six months, notably Neuren and Dimerix.

At Stockhead, we tell it as it is. While Dimerix, Neurizon and EBR Systems are Stockhead advertisers, they did not sponsor this article.

Originally published as Health Check: Can Syntara produce the next multibillion-dollar Aussie blood cancer drug?