Donald Trump is looking for rare earths worth billions … in all the wrong places

Donald Trump is targeting Ukraine’s rare earths. But he’s missing a trick in Australia, which has established production and resources.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

US looking to secure rare earths in places such as Greenland and Ukraine

This is aimed at securing supply of a whole basket of valuable critical minerals

Australia offers both established production and plenty of resources to meet future demand

The value drivers for rare earths might be muted right now, but no one believes this to be a permanent state of affairs, certainly not US President Donald Trump, who has ramped up his rhetoric about buying Greenland and securing critical minerals in a quid pro quo for Ukrainian aid.

In a speech before a joint session of Congress, the 47th President reiterated his desire for the US to purchase Greenland from Denmark, vowing that it would happen one way or another.

Denmark, which technically owns the world’s largest island – and the largely autonomous Greenlanders – have their own say in this though.

The former says that Greenland had to decide its own future while Greenland’s Prime Minister Mute Egede – whose government is currently in caretaker mode – didn’t mince words, saying outright that Greenlanders did not want to be Americans, a point backed overwhelmingly by opinion polls.

Nor is Greenland the only place where Trump is looking to secure REEs for America’s use. Trump put domestic mining of rare earths on the agenda in his congressional address – US rare earths miner MP Materials is now 52% up YTD on the Nasdaq, including a 15% rise after the ramble, despite reporting a US$65m loss for 2024.

And the Ukrainian critical minerals deal is still on the table. But there remains the question: As it looks to break its reliance on China and its supply chain, is that really where America will secure its supply of the defence metals it needs?

Australian option

Trump may well be barking up the wrong tree.

Rather than starting from scratch in Ukraine – with the added complication of having to end the war first – Resources Minister Madeleine King has suggested that the US look to Australia for its REE needs.

“So, while they can go right ahead and pursue what they’re doing with Ukraine or with the talk about Greenland, what my position would be is that we have a string of rare earth projects right across the country from west to east,” King said.

“Australia presents an opportunity for us both with our mineral wealth that might be a somewhat more stable and welcoming environment to extract rare earths than some others.”

Lynas (ASX:LYC) managing director Amanda Lacaze, whose company is the top producer outside China and has a deal with the US Department of Defense to build light and heavy rare earths separation facilities in Texas, concurred.

“Our view would be very simple: the best way to get guaranteed supply in the West is to buy product from Lynas because we have it,” she said during an earnings call.

King added that supply could also come from projects being developed by Iluka Resources (ASX:ILU) in WA, Arafura Rare Earths (ASX:ARU) in the Northern Territory and Australian Strategic Materials (ASX:ASM) near Dubbo in NSW.

These projects have received about $2.65bn in taxpayer support, including $1.65bn in the form of a loan for Iluka to build Australia’s first integrated rare earths refinery.

“It’ll be the US administration that decides what it wants to do, of course, but this is a stable country with very known and well explored deposits of critical minerals and rare earths, and with the capacity to mine,” King added.

While Ukraine's actual rare earths endowment is a black box – its existing mines largely produce steel raw materials – Australia's deposits have already been discovered, drilled and undergone high quality metallurgical testwork. And even with raw material supply, the bottleneck for the west, where investment from the US is actually needed, is further downstream in the magnet plants dominated by China.

Red Metal (ASX:RDM) managing director Rob Rutherford told Stockhead that while REE projects were not rare, the production facilities for permanent rare earth magnets were.

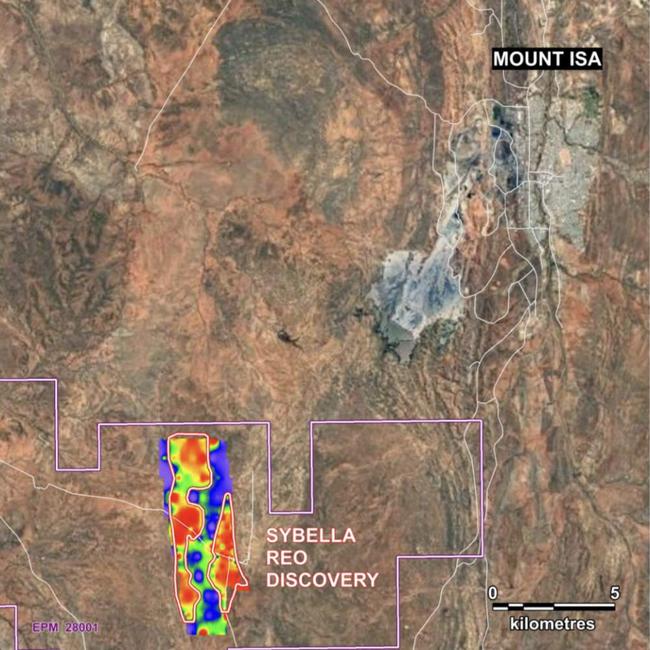

His company has found a unique granite hosted source of rare earths at its Sybella project in Queensland, which could be cheaper to operate than other known deposit styles like carbonatites and ionic clays.

“I strongly believe the Australian government should be building rare earth magnet facilities in partnership with manufacturing nations such as Europe, US, Korea or Japan with the guarantee that Australian mines supply the raw REO materials,” he said.

“The longer term demand forecast for magnet metals is strong, but to get a REE project up and running in this environment you need a technically simple, low cost project like Sybella, then a clear line of site to market your REO products."

ASX juniors with REE resources

Besides Lynas and companies who are well advanced in their development plans, there are a number of junior ASX-listed companies that have already established resources, placing them well ahead of any Ukrainian prospects.

Red Metal (ASX:RDM)

While many operators have resource tonnages measured in the millions of tonnes, RDM’s Sybella project near Mt Isa, Queensland, turns the knob all the way up to 11 with its resource of 4.8 BILLION tonnes grading 302ppm neodymium and praseodymium and 28ppm dysprosium and terbium.

The advantages continue to stack up with the resource starting from surface, which makes it easily accessible, while the significant at surface resource of 788Mt at 297ppm NdPr and 28ppm DyTb contained within weathered granite presents early mining opportunities.

Early-stage drilling, metallurgical and comminution studies have already indicated the feasibility of a low-cost, low-capital, heap leach processing option while metallurgical test work has already produced a mixed rare earth concentrate with 48.7% total rare earth oxides and magnet REOs making up 39.5% of this product.

Recent infill drilling intersected wide zones of magnet REEs, confirming the continuity of mineralisation at the eastern Kary Zone.

This returned results such as 162m at 337ppm NdPr and 30ppm DyTb from 18m to EOH (SBRC148) and 108m at 349ppm NdPr and 38ppm DyTb from 12m to EOH (SBRC143) that are consistent with results from adjacent traverses 400m to the north and south.

RDM is currently planning the drilling of large diameter diamond core holes to collect coarse, non-pulverised, weathered granite samples for column leach test work, along with recommencing infill drilling to define a higher confidence indicated resource at Sybella.

“Proving we can effectively column leach the weathered granite should crystallise this project's value in the minds of investors and put Sybella on par or ahead of the highly prized Brazilian clay deposits,” Rutherford said in an announcement on February 10, 2025.

Ark Mines (ASX:AHK)

Also operating in Queensland is AHK with its Sandy Mitchell project that currently has a high confidence measured resource of 71.8 Mt at 1,732.7ppm monazite – a mineral containing REEs – equivalent.

There is potential for exploration to deliver scale that could place it in similar ballpark as Sybella given the exploration target of 1.3 billion tonnes to 1.5 billion tonnes at 1,286 to 1,903 ppm MzEq.

A scoping study released in December has placed a $120-150m cost on a development underpinned by the current measured resource.

This is expected to generate annual EBITDA of $45m-$53m, and annual post-tax-free cash flow totalling ~$25m-30m while payback is expected within 3-4 years from first rare earth mineral concentrate production.

Ease of mining is another advantage with the project featuring surface mineralisation with minimal topsoil and no overburden.

Processing is expected to be simple with in situ processing using gravity only, with no chemicals, salts or acids required.

This also eschews the need for tailings dams and waste piles, making mining both more economic and environmentally friendly.

Critica (ASX:CRI)

Over in resource-rich Western Australia and still very much in giant territory is CRI and its high-tonnage and high-grade Jupiter clay-hosted project with its resource of 1.8Bt grading 1700ppm TREO.

This includes a higher-grade component of 500Mt at 2200ppm and just to whet appetites further, it is part of the broader 1352km2 Brothers Project that’s 60km west of Mount Magnet and just 10km from the Mount Magnet-Geraldton bitumen highway.

This resource was defined just 12 months since it was discovered in November 2023 with C and aircore drilling, delineating a 40km2 discovery area with shallow, broad and continuous mineralisation.

Metallurgical test work to date has successfully produced a concentrate with grades of up to 13,310 ppm TREO, an effective upgrade factor of over 9.3x, by reducing the mass by 95%.

Two future energy sources (the mid-west gas pipeline and transmission power lines) have also been identified close to the project, with Lynas Mt Weld mine and rare earths concentrator only 450km away.

Meanwhile, Iluka is planning a rare earth refinery at Eneabba, which is well within trucking distance of Jupiter.

In 2025, CRI will focus on additional exploration and evaluation works, including further comprehensive metallurgical test work and the drill testing of satellite targets in the coming months.

Lanthanein Resources (ASX:LNR)

While LNR is currently focused on gold and other commodities, it also owns a resource of nearly 1Mt at 0.32% (3200ppm) TREO for the Lyons 11, 12 and 13 prospects within its Lyons rare earths project in WA’s Gascoyne region.

Some 40% of the TREO consists of valuable NdPr.

Notably, the project is directly adjacent to Hastings Technology Metals' (ASX:HAS) Yangibana REE and niobium project that could is now the the subject of a joint venture with Andrew Forrest's Wyloo Metals.

While more work needs to be done, Lyons is assumed to have similar mining and metallurgical factors as Yangibana given that both projects are hosted in the same Yangibana Ironstones.

Access to the project area is very good with a combination of well-maintained gazetted and station roads.

Victory Metals (ASX:VTM)

Busily working to increase its already significant resource of 247.5Mt at 520ppm TREO is VTM, which in late February launched a 110-hole aircore drilling campaign totalling 6600m to test the exploration target outside its North Stanmore resource ~6km north of Cue.

Proving up this target of up to 230Mt at 600ppm could almost double the scale of the clay-hosted project, which is never a bad thing.

North Stanmore also stands out in valuable heavy REEs such as dysprosium and terbium making up ~35% of the TREO.

Drilling is expected to be completed in late March 2025 with assays to follow while a scoping study is due for completion before the end of the March 2025 quarter.

The company is also continuing studies to compliment a mining licence application and discussions over strategic partnerships and offtake to capitalise on what it notes is surging global demand for heavy rare earths, scandium and hafnium.

Indiana Resources (ASX:IDA)

Rounding out our tour of junior Australian REE plays is IDA where exploration at the Minos prospect within its Central Gawler Craton exploration project in South Australia has yielded drill hits with grades of up to 7428ppm TREO including up to 3643ppm MREOs.

Drilling to date has returned assays that confirmed the continuity and high-grade of the mineralisation and provided additional sample material for metallurgical test work.

Initial hydrometallurgical testing focused on beneficiation and leaching of selected clay hosted REE aircore samples has successfully recovered 90.5% TREO, 87.8% HREO and 90.8% LREO.

These results indicate the flotation concentrates (minus 0.15mm fraction) are amenable to hydrochloric acid leaching and further test work is required to determine optimal leach conditions.

At Stockhead, we tell it like it is. While Red Metal, Ark Mines, Lanthanein Resources, Indiana Resources and Victory Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as Donald Trump is looking for rare earths worth billions … in all the wrong places