Closing Bell: ASX rallies; ETF industry surges past $250bn; BHP chair to pass baton

The ASX rallied to close 0.43% higher. Australia’s ETF industry has hit an all-time high. And there’s movement in the BHP boardroom.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

After opening lower the ASX rallied back to close 0.51% higher

Commonwealth Bank closed 2% higher after reporting strong half-yearly results

Australia's ETF industry has best ever month in January and surges to new record FUM

And there's movement at the top in the BHP boardroom

The ASX lifted its game to close stronger on Wednesday after being down at the open. The benchmark S&P/ASX 200 kept rising throughout the afternoon session to close up 0.51%.

The equity market was pushed along by a rally from Commonwealth Bank (ASX:CBA), which fluctuated in the morning session to close 2.10% up and at one point hitting a new record high of $165.77 after reporting its half-yearly results.

Australia's largest bank, a bellwether for the market and economy, revealed a strong H1 FY25 with cash net profit after tax (NPAT) of $5.13 billion, aligning with expectations and up 2% on the previous corresponding period. It also announced a nice little 5% increase to its interim dividend to $2.25 per share.

The Reserve Bank of Australia is due to meet for the first time in 2025, with the central bank largely tipped to bring the cash rate down 25 bps from 4.35% to 4.1%.

Meanwhile, Australia’s ETF industry recorded its best ever month in January with total funds under management (FUM) surging to a record of just over $250 billion on strong cash flows of $4.6 billion and the total market cap increasing by $11.1 billion, according to the Betashares January ETF review.

The total industry assets now stand at $257.4B – a new all-time high.

Regarding the surge, Vanguard's ETF Investment Product Manager, Andrew Jones, noted:

"With the universal adoption of ETFs and continued growth in the number of investors using ETFs, we see the ETF cash flows in 2025 continuing to be very strong, quite likely exceeding $30bn for the industry, like we saw in 2024.

"Global equities remained the most popular asset class for investors, attracting $1.76 billion or 38% of the total net cash flows.

"However, Australian equities were back in favour, with investors channelling in $1.37 billion, which represented 30% of the total net cash flows."

In other big news hitting the headlines this afternoon, BHP (ASX:BHP) has made a boardroom shuffle. A chairman succession, actually.

The mining giant has announced that current chair Ken MacKenzie will retire from the company's board on 31 March 2025, with Ross McEwan to take his place on the same day.

Per a BHP announcement:

Ken MacKenzie joined the Board in September 2016 and has been Chair since September 2017. During this period, Ken has overseen the strategic transformation of BHP’s portfolio towards futurefacing commodities, with a strong focus on safety, disciplined capital management, world-class capability and culture, and a differentiated approach to creating social value.

McEwan, a former National Australia Bank CEO, has been an independent non-executive director of BHP since April 2024, and, the company notes, "has over 30 years’ global executive experience, including in the financial services industry, with deep expertise in capital allocation, risk management and value creation in complex regulatory environments".

Markets were mixed on Wall Street overnight with the S&P 500 index closing flat, the Dow Jones index up 0.2% and the technology-focused Nasdaq falling 0.3%.

Meanwhile across Asia today, stock markets were mostly mixed with the countdown on to much anticipated US CPI data later overnight, which investors will be watching closely for signs of persistent inflation in the world's largest economy that could delay rate cuts.

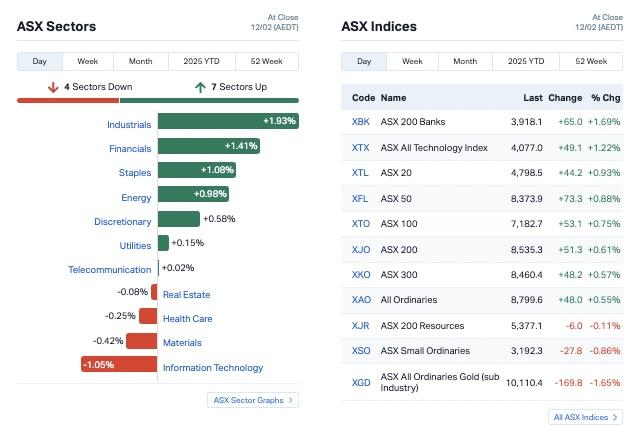

Five of the 11 ASX sectors were in the green today with Industrials leading the gainers, up 1.74% and tech the biggest laggard, down 1.43%.

This is how the ASX was looking at close.

ASX small cap leaders

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CRS | Caprice Resources | 0.059 | 127% | 135,786,054 | $11,518,957 |

| FRS | Forrestania Resources | 0.015 | 50% | 10,472,364 | $2,439,635 |

| 1TT | Thrive Tribe Tech | 0.003 | 50% | 364,999 | $4,063,446 |

| AKN | Auking Mining Ltd | 0.006 | 50% | 11,992,479 | $2,299,115 |

| LNU | Linius Tech Limited | 0.0015 | 50% | 1,000,000 | $6,151,216 |

| CMO | Cosmo Metals | 0.024 | 41% | 1,912,155 | $2,226,879 |

| BSX | Blackstone Ltd | 0.055 | 34% | 7,135,570 | $24,394,877 |

| CTO | Citigold Corp Ltd | 0.004 | 33% | 311,500 | $9,000,000 |

| LAT | Latitude 66 Limited | 0.047 | 31% | 383,568 | $5,162,425 |

| DVL | Dorsavi Ltd | 0.009 | 29% | 1,079,231 | $5,118,665 |

| BXN | Bioxyne Ltd | 0.051 | 28% | 9,700,053 | $81,969,149 |

| SSH | Sshgroupltd | 0.15 | 25% | 59,328 | $7,907,982 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 10,814,011 | $12,677,188 |

| TYX | Tyranna Res Ltd | 0.005 | 25% | 200,000 | $13,151,701 |

| YAR | Yari Minerals Ltd | 0.005 | 25% | 62,403 | $1,929,431 |

| GNM | Great Northern | 0.016 | 23% | 1,706,401 | $2,010,178 |

| AZL | Arizona Lithium Ltd | 0.011 | 22% | 1,578,071 | $41,056,331 |

| VRL | Verity Resources | 0.017 | 21% | 141,441 | $2,222,018 |

| OLY | Olympio Metals Ltd | 0.036 | 20% | 116,900 | $2,609,294 |

| FRX | Flexiroam Limited | 0.006 | 20% | 2,000 | $7,586,993 |

| BVS | Bravura Solution Ltd | 2.765 | 20% | 5,066,468 | $1,035,697,745 |

| RLF | Rlfagtechltd | 0.043 | 19% | 303,849 | $11,569,911 |

| SGQ | St George Min Ltd | 0.04 | 18% | 20,760,005 | $42,110,375 |

| AVR | Anteris Technologies | 12.7 | 17% | 34,051 | $188,995,613 |

| CPU | Computershare Ltd | 41.59 | 16% | 2,420,537 | $21,057,751,025 |

Caprice Resources (ASX:CRS) rose 127% after returning multiple zones of thick, shallow high-grade gold at the Island gold project in the minerals-rich Murchison region of WA.

Initial Phase 1 drilling carried out in December 2024 returned gold assays of up to 28m at 6.4g/t from a down-hole depth of 114m including 4m at 16.4g/t from 130m at the Vadrians Hill target and 12m at 3.9g/t from 90m including 6m at 5.9g/t from 94m at the Baxter target.

Both holes also intersected shallower gold intersections of 27m at 3g/t from 48m including 5m at 6.9g/t from 69m, and 9m at 2.8g/t from 27m including 3m at 5.8g/t from 30m.

The multiple thick, stacked gold lodes intersected at depth and down-plunge from surface workings remain open in all directions with drilling constrained to less than 100m vertical depth.

Forrestania Resources (ASX:FRS) was up 50% after announcing it had completed a non brokered placement of 36 million shares to new and existing sophisticated investors, raising $360,000.

Forrestania said Ultra Capital founder and CEO Daniel Raihani will become a substantial shareholder with a 7% holding. Directors have also indicated support for the raise committing a total of $50,000, subject

to shareholder approval.

Funds will be directed to drilling programmes at the Ada Ann prospect at the Bonnie Vale project, near Coolgardie in WA, where a RC drill programme carried out has extended gold mineralisation over a 225m strike length, remaining open to the north, south and at depth.

WA-based gold and base metals explorer Cosmo Metals (ASX:CMO) was up 41% after announcing it had inked deal to buy high grade NSW gold, antimony and copper projects.

The company noted it has entered into a Binding Heads of Agreement to acquire 100% of the Bingara and Nundle gold-antimony and copper projects in the New England Orogen geological region of northern NSW, subject to shareholder approval.

ASX small cap losers

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AOK | Australian Oil | 0.002 | -33% | 180,000 | $3,005,349 |

| EDE | Eden Innovations | 0.001 | -33% | 865,000 | $6,164,822 |

| H2G | Greenhy2 Limited | 0.002 | -33% | 355,153 | $1,794,553 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 296,986 | $57,867,624 |

| CRB | Carbine Resources | 0.003 | -25% | 100,000 | $2,206,951 |

| GGE | Grand Gulf Energy | 0.0015 | -25% | 2,040 | $4,900,774 |

| MOM | Moab Minerals Ltd | 0.0015 | -25% | 1,050,000 | $3,133,999 |

| PSL | Paterson Resources | 0.0085 | -23% | 3,501,668 | $5,016,417 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 180,857 | $15,392,639 |

| GMN | Gold Mountain Ltd | 0.002 | -20% | 41,876 | $11,448,058 |

| ICR | Intelicare Holdings | 0.008 | -20% | 1,514,762 | $4,861,881 |

| RGL | Riversgold | 0.004 | -20% | 8,760,075 | $8,418,563 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 77,390 | $4,026,248 |

| S66 | Star Combo | 0.13 | -19% | 28,103 | $21,613,277 |

| AS2 | Askari Metals | 0.0115 | -18% | 6,778,393 | $3,727,226 |

| AGH | Althea Group | 0.019 | -17% | 2,449,627 | $11,680,241 |

| EV1 | Evolution Energy | 0.015 | -17% | 1,516,468 | $6,527,709 |

| ERA | Energy Resources | 0.0025 | -17% | 74,443 | $1,216,188,722 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 1,069,492 | $9,597,195 |

| ROG | Red Sky Energy | 0.005 | -17% | 642,855 | $32,533,363 |

| WC1 | West Cobar Metals | 0.017 | -15% | 446,433 | $3,518,248 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 769,239 | $24,001,094 |

| DTM | Dart Mining NL | 0.006 | -14% | 1,009,803 | $4,186,389 |

| EVR | Ev Resources Ltd | 0.006 | -14% | 26,746,779 | $13,527,523 |

| MKL | Mighty Kingdom Ltd | 0.006 | -14% | 203,547 | $1,512,444 |

In case you missed it

Lithium Universe (ASX:LU7) has inked an MoU with Polytechnique Montréal to advance lithium processing technologies and strengthen Canada’s critical minerals supply chain. The partnership aims to support education, training, and research in the sector, positioning Canadian expertise as a leader on the global stage.

St George Mining (ASX:SGQ) has secured the backing of leading engineering firm Xinhai to drive the development of its high-grade Araxá project in Brazil. The two companies plan to finalise a strategic partnership within nine months, with Xinhai providing expertise in metallurgical testing, mineral processing, and plant design. Today, Xinhai has invested $8 million in St George’s $20 million equity raising to support the project acquisition.

Critica (ASX:CRI) has unveiled Australia’s largest and highest-grade clay-hosted rare earths deposit at its Jupiter project, part of the broader Brothers project in Western Australia. The resource includes a high-grade component of 500Mt at 2,200ppm TREO, within a total 1.8Bt at 1,700ppm TREO. Critica says it is well-funded to advance metallurgical test work and drill satellite targets, with six discrete REE discoveries in the region.

At Stockhead, we tell it like it is. While Caprice Resources, Lithium Universe, St George Mining, Critica, Trigg Minerals, Koba Resources and Titanium Sands are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Note: At the time of writing, the author has shares in BHP.

Originally published as Closing Bell: ASX rallies; ETF industry surges past $250bn; BHP chair to pass baton