Closing Bell: ASX goes nuclear, surging 0.89pc to approach all-time highs

The ASX rose 0.89%, nearing record levels as uranium stocks propelled the Energy sector amid broad market strength.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX climbs to within 0.85pc of all-time highs

Uranium stocks take off, driving Energy sector higher

ASX 200 Total Return Index notched new record yesterday in show of market strength

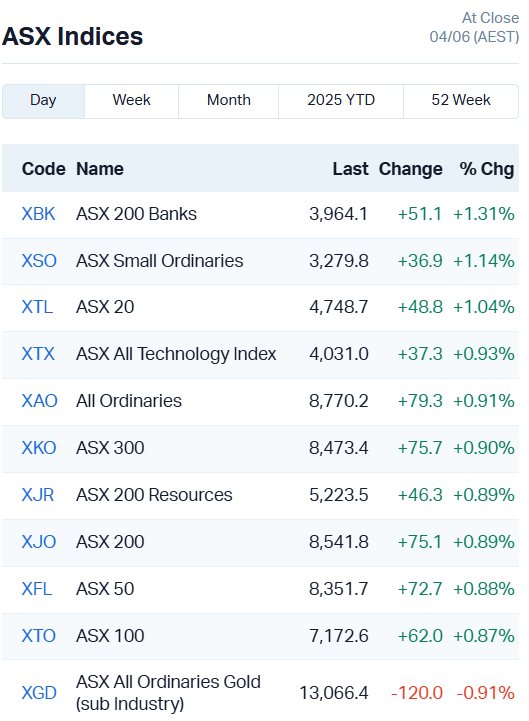

The Aussie market has surged higher after starting the day on a very strong note, maintaining momentum throughout the full day of trading to make a very convincing gain of 0.89%.

The ASX is less than 1% off a new all-time high after today’s trade, returning to levels not seen since February – just before US President Trump began firing off tariffs in rapid succession.

The ASX200 already hit a new all-time high in terms of total return on Tuesday, as Market Index reported earlier today.

The ASX 200 Total Return Index (XAOA), which tracks dividend and capital gains as well as stock movements to give a more in-depth measure of the market’s real performance, broke through to 112,434 points yesterday.

With two more trading days left in the week, there’s a good chance the ASX will also hit new highs within the next few days.

That said, Friday night is D-day for the call between Trump and Chinese President Xi Jinping, which has every chance of reigniting trade war fears.

ASX glows nuclear green

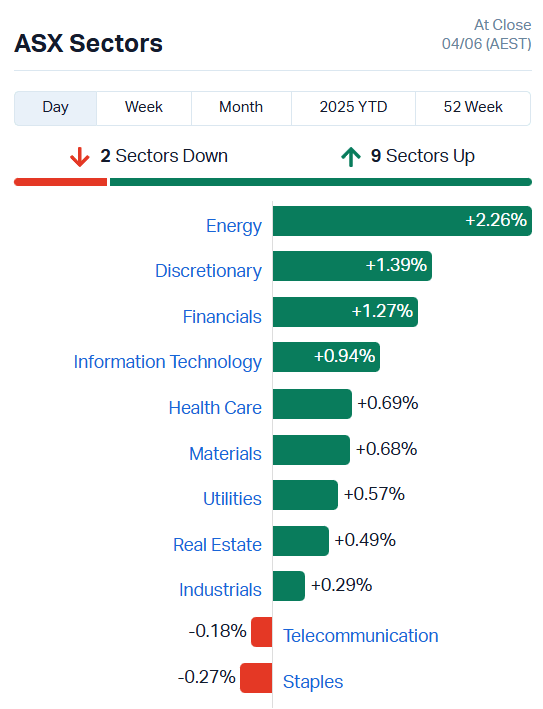

While the market’s performance today was supported by broad strength across multiple sectors, Energy stood out, surging 2.26%.

The seven major banking stocks and our Tech sector also put in some work, raising their indices 1.31% and 0.93% respectively.

Nonetheless, it was once again uranium mining stocks that shone brightest, casting the ASX in a decidedly fluorescent green shade.

Paladin Energy (ASX:PDN) finished the day up 9.9%, while immediate rival Boss Energy (ASX:BOE) gained 7.9%.

A little further down the pecking order, Deep Yellow (ASX:DYL) jumped 5.9%, and Bannerman Energy (ASX:BNM) added 7%.

There was plenty of love to go around for the small caps, too.

Eclipse Metals (ASX:EPM) surged 26%, Cauldron Energy (ASX:CDN) 7.1%, Alligator Energy (ASX:AGE) 6.6% and Elevate Uranium (ASX:EL8) 5.2%.

Demand for uranium has been rising in lock step with data centre build-outs by major technology companies, as they seek reliable baseline power that won’t derail their emissions targets.

This latest rally was set off by Meta’s 20-year deal to source power from an Illinois nuclear power plant to fuel its AI data centres, as Eddy Sunarto reported earlier today.

The momentum for uranium has been building even faster since Trump imposed a raft of executive orders designed to kick-start the US nuclear power industry.

You can check out Stockhead’s coverage of the EOs and what they mean for Australian uranium companies here.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CDE | Codeifai Limited | 0.014 | 100% | 7285387 | $2,282,222 |

| JAY | Jayride Group | 0.002 | 100% | 627513 | $1,427,889 |

| MOM | Moab Minerals Ltd | 0.0015 | 50% | 1984441 | $1,733,666 |

| OVT | Ovanti Limited | 0.003 | 50% | 2118077 | $5,587,030 |

| ARV | Artemis Resources | 0.007 | 40% | 2268993 | $12,642,647 |

| CRN | Coronado Global Res | 0.145 | 38% | 49206952 | $176,027,642 |

| MTB | Mount Burgess Mining | 0.004 | 33% | 2716123 | $1,055,108 |

| PNT | Panthermetalsltd | 0.016 | 33% | 2549312 | $3,610,855 |

| RNX | Renegade Exploration | 0.004 | 33% | 2060594 | $3,865,090 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 314559 | $7,254,899 |

| GED | Golden Deeps | 0.024 | 33% | 1292908 | $3,188,263 |

| IAM | Income Asset | 0.028 | 33% | 4420148 | $19,548,287 |

| PEB | Pacific Edge | 0.105 | 31% | 37268 | $64,953,278 |

| PGD | Peregrine Gold | 0.15 | 30% | 442735 | $9,757,490 |

| ADN | Andromeda Metals Ltd | 0.014 | 27% | 97462154 | $41,946,774 |

| SHN | Sunshine Metals Ltd | 0.014 | 27% | 33522956 | $22,964,093 |

| EPM | Eclipse Metals | 0.019 | 27% | 72449714 | $42,987,285 |

| LKY | Locksleyresources | 0.115 | 26% | 28183390 | $13,346,667 |

| DTR | Dateline Resources | 0.145 | 26% | 77980472 | $329,338,302 |

| ELS | Elsight Ltd | 1.1 | 26% | 1886786 | $159,023,560 |

| IS3 | I Synergy Group Ltd | 0.005 | 25% | 384615 | $2,002,920 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 547575 | $18,739,112 |

| BM8 | Battery Age Minerals | 0.06 | 22% | 2842557 | $5,972,699 |

| GCM | Green Critical Min | 0.022 | 22% | 60961689 | $35,337,209 |

| THR | Thor Energy PLC | 0.011 | 22% | 3743647 | $6,397,109 |

Making news…

Coronado Global Resources (ASX:CRN) has locked in a $150 million loan deal with Oaktree to help ride out low coal prices and keep its liquidity plan on track. CRN will get $75 million upfront, with the rest available over the next year.

The three-year facility is backed by receivables and inventory, and comes at a fixed rate below its current high-yield debt. The cash will support day-to-day operations while it finishes expansion projects at Mammoth and Buchanan.

Andromeda Metals (ASX:ADN) has also secured credit approval from Merricks Capital for a $75 million debt facility to help fund the development of its Great White Project.

The loan runs for 78 months, with repayments kicking off a year after the project is built, and wraps up with a 50% bullet at the end. It’s not a done deal yet, and first drawdown depends on Andromeda locking in the rest of the funding needed to give Stage 1A+ the green light.

Income Asset Management (ASX:IAM)had a record month of revenue in May, raking in $2.85m to bring a total of just over $4m home for the quarter so far.

The company reckons it's well placed to finish the quarter out with above average revenue, anticipating revenue from a “strong pipeline” to finish the financial year on a high note.

IAM’s funds under advice lifted to more than $2.37b, notching 28% growth since May 2024.

A new contract with a European defence OEM customer has netted Elsight (ASX:ELS) a deal worth $7.9m. The company will provide its Halo drone operation management product under the contract, with potential to expand to other offerings.

The deal is the third announced since April, bringing total contracts for this specific customer to $22.8m, a 600% increase over 2024 revenue numbers.

A 70% owned subsidiary of Volt Resources (ASX:VRC) in Ukraine will begin a new graphite production campaign in June at the Zavalievsky Graphite mine despite the ongoing conflict there.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CR9 | Corellares | 0.002 | -33% | 100000 | $3,016,820 |

| EDE | Eden Inv Ltd | 0.002 | -33% | 8578999 | $12,329,643 |

| BRX | Belararoxlimited | 0.059 | -30% | 3333716 | $13,253,417 |

| BMO | Bastion Minerals | 0.0015 | -25% | 5820000 | $1,807,255 |

| HLX | Helix Resources | 0.0015 | -25% | 291250 | $6,728,387 |

| PRM | Prominence Energy | 0.003 | -25% | 4125 | $1,556,706 |

| QXR | Qx Resources Limited | 0.003 | -25% | 8684232 | $5,241,315 |

| BEL | Bentley Capital Ltd | 0.009 | -25% | 53972 | $913,535 |

| TAS | Tasman Resources Ltd | 0.019 | -24% | 460694 | $4,603,565 |

| CAV | Carnavale Resources | 0.004 | -20% | 100001 | $20,451,092 |

| ERA | Energy Resources | 0.002 | -20% | 2975863 | $1,013,490,602 |

| OLI | Oliver'S Real Food | 0.004 | -20% | 110000 | $2,703,660 |

| TEM | Tempest Minerals | 0.004 | -20% | 1709216 | $3,672,649 |

| TMX | Terrain Minerals | 0.002 | -20% | 1712757 | $5,621,392 |

| ALY | Alchemy Resource Ltd | 0.005 | -17% | 2845795 | $7,068,458 |

| GGE | Grand Gulf Energy | 0.0025 | -17% | 3821204 | $8,461,275 |

| OMG | OMG Group Limited | 0.005 | -17% | 18933990 | $4,369,769 |

| NUC | Nuchev Limited | 0.16 | -16% | 57936 | $27,804,468 |

| CPO | Culpeominerals | 0.011 | -15% | 1998059 | $3,528,886 |

| 8CO | 8Common Limited | 0.017 | -15% | 93112 | $4,481,898 |

| EQX | Equatorial Res Ltd | 0.12 | -14% | 100000 | $18,402,349 |

| FGH | Foresta Group | 0.006 | -14% | 1098845 | $18,570,345 |

| HHR | Hartshead Resources | 0.006 | -14% | 6061225 | $19,660,775 |

| NFM | New Frontier | 0.012 | -14% | 1463300 | $20,408,295 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 831825 | $11,196,728 |

IN CASE YOU MISSED IT

The Australian Mines (ASX:AUZ) Sconi project has piqued the interest of German commodity trader HMS Bergbau as the two begin offtake talks.

Geophysical remodelling has given Miramar Resources’ (ASX:M2R) Whaleshark project new bite, identifying multiple high-potential IOCG targets within the project area.

A $75m debt facility will furnish Andromeda Metals (ASX:ADN) with funding to support development of the Great White project.

Rumble Resources (ASX:RTR) has intersected more high-grade gold and critical mineral tungsten in its drilling at the near-term Western Queen Project.

Pursuit Minerals (ASX:PUR) is engaging with prospective offtake and strategic partners, having dispatched high-purity carbonate samples for evaluation.

ADX Energy (ASX:ADX) will receive a larger share of oil production and revenue from its Anshof oil field in Austria after reaching an agreement to acquire Xstate Resources’ (ASX:XST) 20% interest in the Anshof Field Area.

Star Minerals (ASX:SMS) has wrapped up a $1.6m placement as it moves to start drilling to boost resource confidence at Tumblegum South gold project.

Drilling has confirmed wide copper mineralisation at the Tambo South target within Belararox’s (ASX:BRX) highly prospective Toro-Malambo-Tambo project in Argentina’s San Juan Province.

TRADING HALTS

BetMakers Technology Group (ASX:BET) – cap raise

Dominion Income Trust 1 (ASX:DN1) – cap raise

Toys'R'Us ANZ Limited (ASX:TOY) – recapitalisation plans

At Stockhead, we tell it like it is. While Titanium Sands and ADX Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX goes nuclear, surging 0.89pc to approach all-time highs