Before Sunrise: Finder’s one of the ASX companies driving Timor Leste’s resources revolution

Finder Energy shows how serious Timor-Leste is about attracting resources investment and why the jurisdiction stands out from the pack.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Timor Leste is keen to draw resource investment with minerals joining oil and gas on the menu

Finder Energy says the government has been very supportive and aligned with its goal of producing first oil quickly

Main focus now on securing finance to develop its Kuda Tasi and Jahal oilfields

Timor-Leste is one of the world’s youngest countries, only winning its independence from Indonesia in May 2002 following a 25-year occupation.

The scars of occupation left the country’s infrastructure in bad shape and with neither tourism nor manufacturing to rebuild, it turned to its oil and gas wealth with the development of the Bayu-Undan gas field providing a much needed boost to its economy.

However, the end of gas exports from Bayu-Undan in 2023 has cut-off this revenue source and raised the very real likelihood that the company’s sovereign wealth fund – estimated at about US$18bn ($29bn) – could run dry in the next decade.

With development of the Greater Sunrise gas field still in limbo due to the ongoing disagreement between Timor-Leste and Australia over where the gas will be piped to, the former has turned to its other resources to diversify its economy.

To date, Timor-Leste has awarded a spate of resource tenements aimed at encouraging investment in its mineral resources with Tivan (ASX:TVN) picking up copper-gold exploration licences covering 344km2 in mid-March 2025.

It joins fellow Australians, Estrella Resources (ASX:ESR), Beacon Minerals (ASX:BCN) and privately-owned Iron Fortune who are all seeking to help develop the country’s resources.

That’s not to say that Timor-Leste has forgotten about oil and gas either, with Finder Energy Holdings' (ASX:FDR) experience a case in point.

Supportive jurisdiction

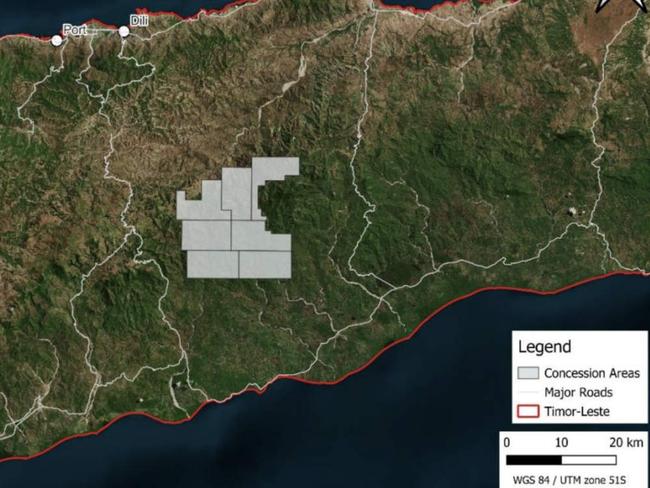

Speaking to Stockhead, FDR managing director Damon Neaves told Stockhead that, unlike Sunrise, the company’s PSC 19-11 which hosts the Kuda Tasi and Jahal oilfields and a number of other discovery oilfields and prospects, is located exclusively within Timor-Leste’s jurisdiction.

“When the boundaries were redefined in 2019 and the JPDA (joint petroleum development area) fell away, the area of our project became exclusively Timor-Leste. We really only have a relationship with Timor-Leste in connection with our project,” he said.

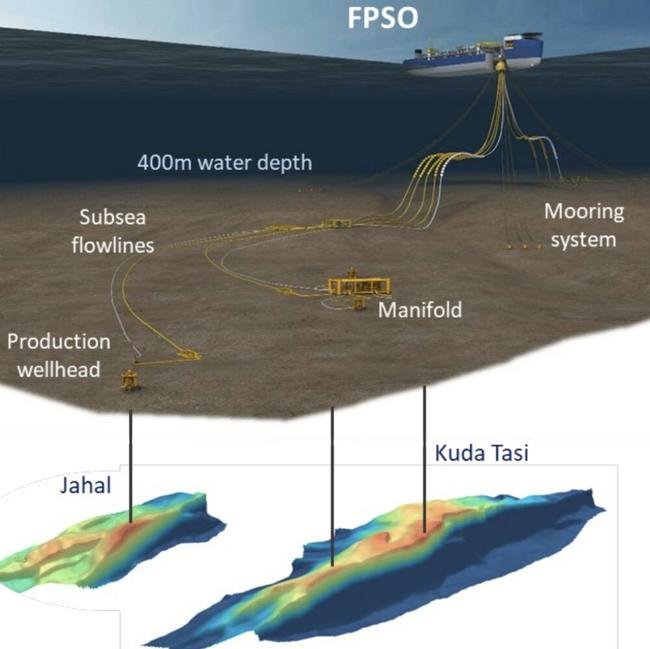

“Finder’s project is a lot simpler because we don't have any pipelines, any onshore infrastructure either way. It's an FPSO (floating production, storage and offtake) so it's literally a vessel floating above 150 kilometres offshore the south coast of Timor.

“It doesn't get piped anywhere and an offtake tanker just sails up next to our FPSO and takes the oil and off it goes to a refinery in Singapore or Korea, wherever it's being sold to.”

FDR acquired a 76% stake in PSC 19-11 in August 2024 for an upfront payment of just US$2m, a further payment of US$6.5m on making a final investment decision and a 5% royalty on production.

That’s a steal for 34 million barrels of discovered oil at Kuda Tasi and Jahal as well as the potential to find plenty more.

When asked about Timor-Leste’s regulatory regime, Neaves said it was it was overwhelmingly positive and that the company had received a warm welcome from the government despite being relative newcomers.

“We had our PSC signing ceremony in September last year and there was enormous pomp and circumstance around that event. We had probably half of the cabinet attend,” he said.

“It was quite an extraordinary show of support for us and our project.

“The Kuda Tasi and Jahal oil fields that we're bringing into production would be, I believe, the next fields to come into production in Timor-Leste.

“Although they're relatively small, certainly when you compare it to projects like Sunrise at five or more TCF of gas. It's smaller from a state economic point of view, but I think our project will be quite a significant demonstration of what can be done in Timor in terms of getting a project up and running and into production quickly.

“I think it's going to send a strong message to the world.”

He added that discussions with the government have been really supportive and aligned in the goal of producing first oil quickly.

“I'd say they've really shown quite strong leadership and support in a way that we haven't encountered in bureaucracies in other jurisdictions in which we've worked, particularly Australia and the UK,” Neaves noted.

“I'm really impressed, particularly with the regulator for oil and gas, the ANP, and its leadership.”

While FDR has encountered plenty of resistance working on oil and gas projects in Australia and the UK North Sea, it'd been very different in Timor-Leste according to Neaves.

“There's a real appreciation of how important resource development is for their future prosperity,” Neaves said.

“It is a poor country. It's had a very difficult history with the Indonesian occupation for 25 years and they are looking to rebuild but they don't have a big tourist industry nor any significant manufacturing.

“What they do have is undeveloped resource potential and they will need foreign investment and expertise to unlock all of that.”

Finder oil development

FDR is progressing development of the Kuda Tasi and Jahal oilfields, with the company on track to complete reprocessing of the Ikan 3D seismic data before the end of this month.

While the company does not expect this work to result in significant changes to the two oilfields beyond helping with optimised placement of development wells to maximise production and recovery, it is a different story in the south of the PSC.

“It's complicated in the south because you have these shallower reef build-ups that make the velocity modelling for seismic imaging more challenging, but with the sort of modern processing flows, we can clean that all up and get a much bigger picture,” he said.

“It's going to be, I think, more significant in the south, where we have other discoveries. We've got Krill and Squilla, and we've got other exploration targets.”

Dynamic reservoir modelling of the Kuda Tasi and Jahal oilfields has predicted that initial flow rates could range from 25,000 to 40,000 barrels per day depending on the oil-handling capacities of the selected floating production, storage and offtake vessel.

Modelling using Eclipse dynamic reservoir simulation software also found that the two fields would produce ~10 million barrels of oil in the first 18 months of production due to the high-quality reservoir sandstones of the Laminaria Formation.

Confidence in the predicted flow rates is high due to the significant dataset available on the Kuda Tasi and Jahal reservoirs, which includes five well penetrations, logging and pressure data, well bore samples as well as core and flow tests.

Low-risk, near-field prospects also have the potential to significantly increase project resources and represents significant upside potential as they can be tied back into the proposed Kuda Tasi/Jahal FPSO or to a future development hub around the discoveries in the south of the PSC.

Neaves adds that the company is currently doing engineering work to understand the development concept, design and costings.

“We are doing a lot petrophysics and the reprocessing coming to completion but our main focus is figuring out how to fund the Capex," he said.

“We are talking to various groups about that. We're running an industry farm out, we're talking to contractors, looking to them to take on some of the cost and risk in the development and help share the burden of development.

“All of that's happening this year. So there’s a number of sort of major catalysts in terms of both the project and the funding to be finalised this year.

“At this stage, we expect to make FID towards the end of next year, but we think we can bring that forward significantly depending on where we get to with this current round of discussions.“

At Stockhead, we tell it like it is. While Finder Energy is a Stockhead advertiser, it did not sponsor this article.

Originally published as Before Sunrise: Finder’s one of the ASX companies driving Timor Leste’s resources revolution