Australia’s biggest gold bug Hedley Widdup likes the look of these innovative ASX explorers

At Lion Selection Group, Hedley Widdup is at the helm of one of Australia’s top junior gold investors. Here’s where Lion is upping its stake.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Lion Selection Group's Hedley Widdup likes the look of gold juniors

He's accumulating in companies with track records of finding gold where the old timers thought it was barren

Lion recently put $500,000 into Sunshine Metals, taking its stake to 7%

Hedley Widdup's Lion Selection Group (ASX:LSX) timed its swing back into the gold equities market perfectly with the latest gold rush, deploying $36 million into Aussie gold juniors since January 2022, and inking a 53% return on those outlays as of March 31.

Its latest investments continue the theme, with the gold stock picker deploying $4 million into a $23m placement for WA developer Saturn Metals (ASX:STN) and $500,000 into a $3m cash call from Queensland explorer Sunshine Metals (ASX:SHN).

Since Lion made the decision to funnel its earnings from the sale of its share of the Pani gold project in Indonesia into Aussie golds, the price of the underlying commodity has surged, taking miners along for the ride.

From ~US$1800/oz in early 2022, gold is now trading at close to US$3000/oz. In Aussie dollar terms the safe haven metal has doubled from ~$2500/oz to $5000/oz in a virtual hockey stick rise.

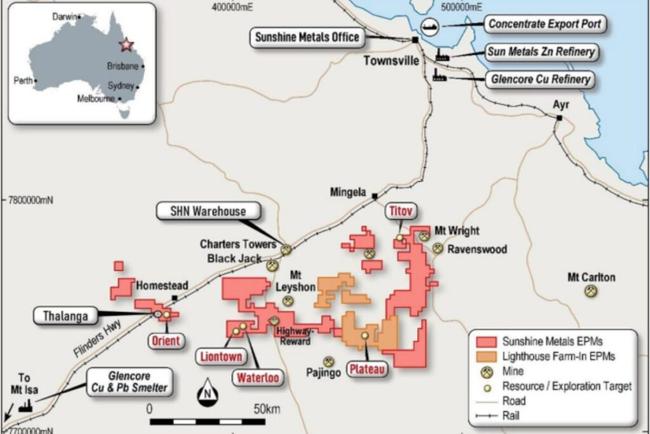

Sunshine Metals (ASX:SHN) has quietly built a resource in excess of 900,000oz on a gold equivalent basis at its Ravenswood Consolidated project in North Queensland, near the historic gold mining town of Charters Towers and on the doorstep of the multi-million ounce Ravenswood gold mine.

Widdup has backed Sunshine and the innovative approach taken by its managing director Dr Damien Keys, who brings 'been there, done that' credibility after his involvement in Spectrum Metals' remarkable Penny West gold discovery in WA, the catalyst for a $208 million takeover by Ramelius Resources (ASX:RMS).

"One thing that he's been very successful with over the years is taking a dataset, pulling it apart, putting it back together again, and then good geological work coming from that," Widdup said.

"This guy's strode into areas which are allegedly data-rich in the past and found things."

Rapid growth

The latest mineral resource estimate increase at Ravenswood Consolidated in December took the project, previously considered zinc dominant, to 904,000oz AuEq including 6.99Mt at 4g/t AuEq, including a 68% increase in contained gold metal to 299,168oz.

The key VMS hosted Liontown deposit clocked in at 4.5Mt at 3.6g/t AuEq for 511,000oz AuEq.

"They've really wrung out a lot of the data which they acquired. They've done drilling of their own as well to test some of the artefacts of that and they've done well from that," Widdup said.

"The thing which has really impressed me the most has been just going back to the bare bones of interpreting what's going on in the area. Where Liontown is, there's a number of old workings. It's never been put into context properly around how Liontown fit with the ones which were nearby.

"Are they along strike of each other? Are they folded? All sorts of questions.

"That's where the innovation comes in. I'm not sure it's really something that you'd call an unusual application of a technology. It's more just a very diligent application of doing the geology and doing it properly from basics and they've done a fantastic job with that – so from that comes a new model.

"They're calling it the Liontown Dome and this links all of the workings in the Liontown area, puts them on one geological feature which is a piece of stratigraphy which has been folded into a dome shape, and that illuminates a huge amount of exploration potential. Once you can feel like you understand how they all relate to each other you can start to test things."

Golden touch

Ironically, when Lion Selection Group first invested in Sunshine, it was a base metals investment intended to provide a touch of diversity to its portfolio.

But Widdup said on the second or third intercept Lion realised it was "more gold dominant than we'd thought".

"What they did in putting the model back together there was to identify where there might have been high grade feeder shoots. So this is just literally where the fluids have had their first interaction and started to dump the metals as they've been depositing on the seafloor," he said.

"And the highest activity areas are going to be where the highest gold grades are. So that's what they did and they drilled a couple of intercepts which were circa 20 metres at 20 grams. So quite thick.

"That doesn't represent the whole tabular nature of the orebody. What it represents is a fairly narrow shoot-like thing and I think they think there's going to be more than one of those in the deposit as well."

At a market cap of around $8m, Sunshine's latest placement clocked in at $3m at an issue price of 0.6c, with Lion's backing taking its stake to 7%.

The plan is to both accelerate mining studies and drill at four shallow oxide gold targets, the kind that could be developed quickly and toll-milled in the current record gold price environment.

"So the threshold around how you develop a deposit, what you need to install from scratch, I think a lot of those things exist already and the concept of needing to be an absolute greenfields development, I think in my mind, is falling away because there there are existing milling facilities or even just sites where there was a milling facility where the capex threshold will be lower," Widdup noted.

"The ability to commercialise things like close to surface oxide gold resources – that's where you start with the VMS (volcanogenic massive sulphide) resource which they've estimated – I think is pretty good as well.

"They've said that in their announcement for raising the money, that they need to look at how they commercialise those gold resources because I think that's the first opportunity to use the regional milling that exists.

"After that you're left with a slightly purer approach, in that you know all that's left after that is fresh underground sulphide ore."

Widdup expects the story to grow "keenly" over the next 12 months: "So I don't think it's the last investment that we're going to be making in them, it's a team we'd like to follow and we can see the way it's evolving. All of that is quite pleasing."

Other innovators

Another stock Lion is invested in which Widdup says is finding gold which other explorers overlooked is Great Boulder Resources (ASX:GBR).

The $60m capped explorer has a resource of 668,000oz at 2.8g/t at its Side Well project near Meekatharra, and recently announced an MoU to access the mothballed Burnakura mill.

"The geology is really just the eastern limb of a fold which hosts the Meekatherra field down its western limb. Forever people thought that it wasn't prospective and most people had steered away from it," Widdup said.

"Great Boulder had picked it up and persevered and they've been finding resources down there.

"Just this concept of doing the geology properly, collecting data, assessing it with a set of eyes which is not biased by whatever people used to think, and pulling a dataset apart and then putting it back together again, I think is the approach which has paid dividends for both of those companies that both managed to expand their resources quite significantly."

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

At Stockhead, we tell it like it is. While Sunshine Metals is a Stockhead advertiser, it did not sponsor this article.

Originally published as Australia’s biggest gold bug Hedley Widdup likes the look of these innovative ASX explorers