Santos says NSW gas project could be given green light for a 2025 start

Santos could give the go-ahead for its $3.5bn Narrabri gas project in NSW as soon as next year, boosting hopes it could fill an expected supply gap later this decade.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Santos has revealed it could give the go-ahead for its $3.5bn Narrabri gas project in NSW as soon as next year, boosting hopes it could fill an expected supply gap later this decade, as pressure grows on regulators to green-light the major energy development.

The comments from chief executive Kevin Gallagher will add to growing urgency for Australian authorities to accelerate a decision on Narrabri, which continues to be held up by a Native Title Tribunal process.

The project could play a major role in easing Australia’s east coast gas shortfall, but it has attracted strong opposition and the federal government is wary of the political fallout.

Mr Gallagher said he expected the company to be in a position to make a final decision on whether to proceed with the project in 2025 as other major developments came to market, but said he could offer no certainty about when authorities would make a final determination. “I would never want to be the person predicting when Narrabri is going to make a (final investment decision) – I think we’ve been working on that project for 14 years.

“It predates me by quite a period of time,” Mr Gallagher said.

Santos is seeking to tap some 1500 petajoules of gas reserves from the Narrabri project.

Daily production of up to 200 terajoules has been predicted, accounting for about half of NSW’s current gas needs.

Companies will only make a final investment decision on a project after it has secured all environmental and government approvals, but Australia’s east coast faces sustained pressure to find new sources of gas.

ExxonMobil’s Longford facility supplies the bulk of gas to the east coast, but it is struggling to maintain production as supplies begin to wane.

The source is expected to be exhausted by 2028.

The Australian Energy Market Operator earlier this year warned gas power generators may have to burn diesel to meet demand as soon as next year in certain weather conditions or when supply is otherwise curtailed, reflecting the precarious state of east coast supplies.

While Santos has indicated its desire to explore the project, it continues to focus on developments that it says are about to unlock growth for the company.

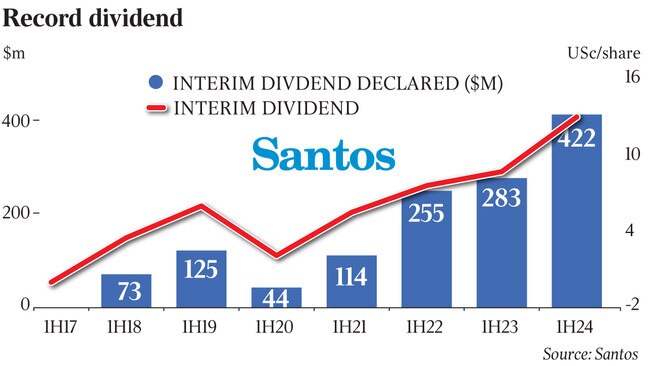

Mr Gallagher said confidence in its future was the reason behind a decision to issue a record interim dividend despite reporting a 19 per cent profit slump amid a fall in gas prices.

The group has bumped its interim unfranked dividend by 49 per cent to a record 13c a share.

Mr Gallagher said this showed that Santos was poised for a sustained phase of growth.

“The business is producing very strong cashflows, and that has resulted in the board endorsing a record dividend, up 49 per cent from this time last year,” Mr Gallagher told The Australian.

“I think that shows the board’s confidence in the outlook and the performance of the company, I think that’s a very good signal to the market.”

Santos’s growth projects are close to completion, with the Barossa project now 80 per cent complete and the Pikka project 60 per cent complete.

Carbon dioxide was set to be injected into the Moomba carbon capture and storage plant “imminently”, Mr Gallagher said.

Santos shareholders have grown increasingly frustrated by stagnant returns and the struggle to increase the share price, and their patience was tested as the company reported lower-than-expected income.

Revenue fell 9 per cent to $US2.71bn over the six months to June 30, which was slightly below market expectations.

Santos said net profit dropped to $US636m from $US790m a year earlier.

Santos shares closed 4.35 per cent lower at $7.42 on Wednesday after its revenue miss.

Mr Gallagher said the growth projects would boost revenue and capital expenditure would fall.

Santos said the $5.7bn Barossa LNG project would be the first and was on track for first gas by the third quarter of 2025.

The timetables were a little disappointing, analysts said, with some expecting the company to bring forward the first supplies, but Mr Gallagher said the company was pushing for as early a start as possible.

“Q3 starts on July 1, I would remind you of that, and it ends on September 30, and we are still driving very hard to be very early Q3,” he said.

Barrenjoey energy analyst Dale Koenders said the third Barossa well had been “successfully drilled and completed with better-than-expected reservoir results”.

The Barossa project was affected by several court challenges. Santos was forced to spend a year redoing its environmental plan after a successful challenge by an Indigenous elder, while works were delayed again following an ultimately failed bid to stop work on a 262km pipeline.

The Federal Court earlier this year rejected a claim from Simon Munkara, who had sought an injunction against Santos’s plan to develop a 262km pipeline for new liquefied natural gas (LNG) wells in waters off the Northern Territory. The court dismissed the claim and allowed Santos to pursue costs. Santos has indicated it will not seek costs from Mr Munkara but has moved against legal counsel at the Environmental Defenders Office.

The EDO has rejected any suggestion that it was the de facto claimant and says it is not liable for claims. However, the Federal Court has approved an application to see all of the EDO’s communications on the issue, a ruling that has alarmed environmental advocates.

On Monday, the Australian Conservation Foundation abandoned its legal bid to block Woodside’s $16.5bn Scarborough LNG project in Western Australia.

In 2022 the ACF asked the Federal Court to order a suspension of work on the project until an assessment was made about its potential environmental effects.

Woodside had secured approval for the project from the National Offshore Petroleum Safety and Environment Authority, but the ACF said the project should be assessed by the federal environment minister under commonwealth laws.

Originally published as Santos says NSW gas project could be given green light for a 2025 start