Reserve Bank determined on doing ‘what is necessary’ with cash rate to tame inflation

An under-pressure RBA boss has returned from his summer break fired up with a new determination to fight inflation and the still too hot economy.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Reserve Bank governor Philip Lowe has a simple message for households. More rates pain will come in the next few months.

For homeowners looking for signs that RBA would pause for now after Tuesday’s 25 percentage point rate hike, will be sorely disappointed. Expect another 25 percentage point move as early as March and possibly another in April.

Indeed an under-pressure Lowe has returned from his summer break fired up with a new determination to fight inflation before it becomes too entrenched.

The RBA “will do what is necessary” to get inflation back under control, Lowe said.

The good news out of this is we are closer to hitting our rates peak, with all indications inflation will start cooling towards the end of this year.

The highwire act Lowe faces is not to crash the economy as he attempts to slow the pace of inflation. On the current path Australia is set to avoid slipping into a recession over the next years but a tougher than expected path where interest rates are forced to push above 4 per cent would substantially change the equation.

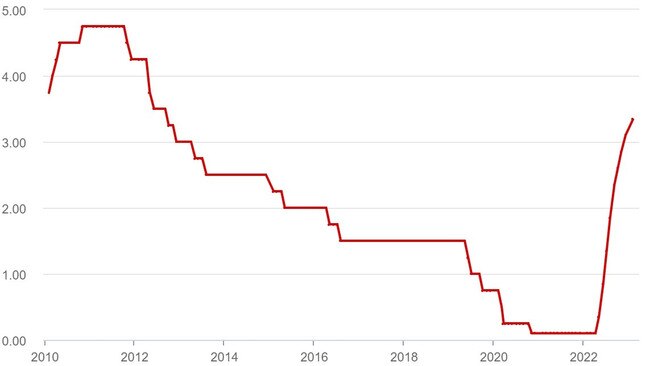

Lowe’s RBA on Tuesday – as widely expected – hiked the official cash rate by a quarter of a percentage points to 3.35 per cent, putting the official borrowing rate at the highest level in more than a decade.

Apart from January, when thankfully the RBA takes a break, the latest move means Australians have been hit with an interest rate rise every month from last May. Further interest rate rises will be needed “over the months ahead,” Lowe added.

The economy is starting to react to the higher cash rate but the view inside the central bank is it is still running too hot.

Tuesday’s 0.25 per cent rise, which is expected to be passed on in full by the banks, will add another $80 to the monthly payment on a typical $500,000 mortgage. This means the total increase in monthly payments since May translates to nearly $12,000 a year in higher repayments. At some point consumer spending will have to give.

It is of little comfort but Australia’s rapid-fire increases haven’t been as bad as some where inflation had spread like wildfire. New Zealand is sitting on a cash rate of 4.25 per cent while the powerful Federal Reserve has set US rates at least at 4.50 per cent.

Banks are reporting slight growth in lending losses, although from a record low base, and even one major bank boss this week quietly confided credit card spending into January is “flying along”, led by travel and entertainment.

In addition consumer spending boomed across Melbourne during the two week Australian Open. Significantly consumers are still using their massive savings buffer accumulated through the Covid-19 years which suggests there is more spending to come.

The major driver of spending remains unemployment which remains at around 50 year lows. Even so, there are mixed signals given consumer confidence remains low on concerns over the rising cost of living.

One area to watch is retail sales and so far the big retailers including JB Hi-Fi and Myer are reporting robust numbers into the new year.

This week furniture retailer Nick Scali said sales orders were holding up into January, although the pace of growth was slowing. Still the chief executive Anthony Scali said: “Interest rates aren’t impacting (customers) as much as you would have expected”.

Official numbers showed retail sales fell by a bigger than expected 3.9 per cent in December, although there is an increasing view that Black Friday online sales are pulling a lot of Christmas activity forward to November.

Globally the mood is shifting from a hard landing to something a little softer. Energy prices including oil and gas come down following milder than expected European winter, while supply chains are starting to return to normal as China reopens from its Covid lockdowns. Indeed expectations are growing the US can also avoid a recession while China will hold up global growth – which is good for Australia.

The key issue for the RBA is the inflation story. Lowe says high inflation makes life difficult for people and damages the functioning of the economy.

At 7.8 per cent it is running too fast and now the impact of wage rises filtering through could set off the next round.

There are signs that supply side inflation pressures are easing in Australia, but services inflation – which is largely labour driven is still rising.

A key number the RBA will be watching will official Wage Price Index figures due for release later this month.

Bank economists expect the cash rate will peak between 3.6 per cent and 3.85 per cent by the middle of this year, although this figure could nudge higher after Tuesday’s moves.

Inflation is still expected to start falling by later this year, although remain elevated.

If we can hold on for that, Lowe might have just pulled off his own soft landing.

johnstone@theaustralian.com.au

Originally published as Reserve Bank determined on doing ‘what is necessary’ with cash rate to tame inflation