Property profits as safe as houses for investors

The vast majority of residential properties are returning profits when they are put on the market – another reason investors are competing once more with homeowners.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

As investors rush back to the property market, a new report says 92 per cent of residential sales are profit-making – the highest level in a decade.

The figures coincide with the latest data on housing finance, which show the value of investor lending at the end of last year reached record levels in dollar terms.

Property investors across Australia are looking at a median profit of $270,000 when they sell a property, with sellers having a typical retention period of 8.8 years, according to research group CoreLogic.

In a challenge to the investment dictum that property must be held for a decade to make profits, the figures reveal that properties held for a period of more than 30 years had a median gain of $745,000, but properties held for less than two years had a median gain of $120,000.

Eliza Owen at CoreLogic says: “This is an unusual number indicating profits being made quite quickly. It reflects just how strong prices are right now and it may even entice more investors into the market.”

Among the small number of residential properties sold at a loss in recent months, the report, which examined more than 90,000 sales, found the median loss was $37,000.

With quick profits on offer in the market and mortgage rates remaining low, Maree Kilroy at BIS Oxford Economics says: “The issue is that investors simply can’t see similar opportunities in other areas such as cash and bonds.

“We expect prices to keep rising this year and property investors will know that we have yet to see immigration and overseas student numbers start to recover.”

According to Kilroy, new investors are willing to enter the property market even though there is now a consensus among analysts that prices may decline next year.

“Investors are looking longer term and they are also watching rents rising,” she says.

“We have not seen rents rise for quite a while in this market and in recent times the market was extremely constrained as the Covid-19 crisis made renting a difficult proposition. Now rents and prices are rising at the same time.”

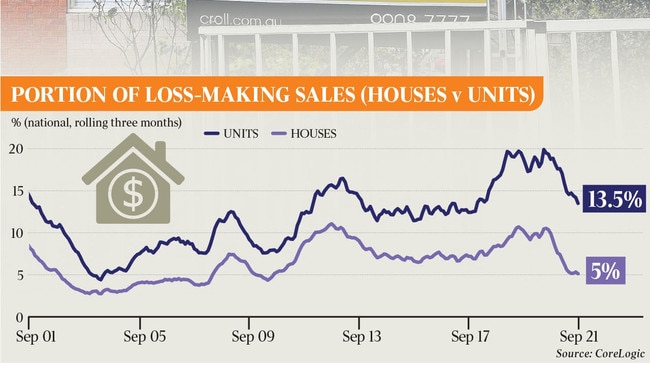

In common with recent surveys that show detached house prices rising faster than apartment prices, the resale of detached houses also has a higher chance of making a profit than those for units. Resale profits for houses are sitting at 95 per cent against 85 per cent for apartments. However, the gap between the two sectors is narrowing.

At CoreLogic, Owen suggests the one area of weakness in which investors have been losing money in recent times is the inner-city apartment market, particularly in Melbourne.

However, she suggests the steep rise in house prices – which gained more than 20 per cent last year – may now finally begin to flow towards apartments in the months ahead. “Affordability may now mean limited growth in the detached house market and gradually deflect demand towards higher-density housing options,” Owen says.

Certainly, there is every reason to believe residential investors will continue to move into the market as rates remain low and both rents and capital values continue to move higher – especially when market opportunities extend to regional Australia, where prices traditionally lagged the bigger cities.

Regional Australia had a higher rate of profit from resales, at 93 per cent in the last quarter, than the combined capital cities, at 91 per cent.

Several regional centres have emerged as standouts in recent months, especially seachange and “tree change” markets, along with towns where office workers can successfully relocate from the major cities.

Bendigo, an increasingly popular location for skilled workers leaving Melbourne, recorded the highest percentage of profit-making sales nationwide with a 99.8 per cent score for the Victorian town, followed by the city of Hume, in Melbourne’s northern suburbs, Queensland’s Sunshine Coast and Ballarat in central Victoria.

Despite the median profit from residential properties now hitting $272,000, a separate report this week – from Eventus Financial – says it has pinpointed the top 20 investment locations across the nation that can be accessed by investors with a $100,000 deposit.

The report found that all of the top 10 most promising suburbs were either in NSW and Victoria.

Among the top NSW suburbs were Safety Beach, Valley Heights, Millthorpe, Kariong, Wickham and Medowie.

In Victoria, the suburbs were Tyabb, Belgrave, Tecoma and Sandhurst.

The flood of investors back into the market will not be missed by the prudential regulator – investors borrowed at four times the rate of homeowners in recent months and the Australian Prudential Regulatory Authority has already imposed some brakes on the wider market through tighter loan serviceability rules last year.

As Kilroy at BIS Oxford Economics suggests, APRA has in the past intervened to cool investment activity in housing through moves such as caps on the volume of investment loans that can be offered by banks.

It has the capacity to do this again if the housing market overheats – this could accelerate any ultimate softening in prices later this year.

More Coverage

Originally published as Property profits as safe as houses for investors