Nvidia’s Jensen Huang maps out plan to control the new industrial revolution

Jensen Huang is betting Nvidia’s future is far bigger than the chips powering today’s AI boom.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

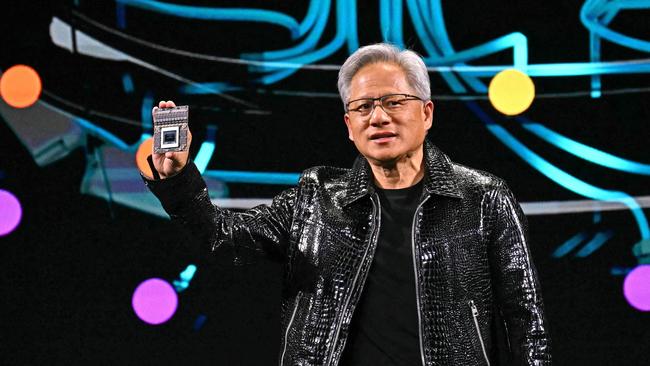

Forget the show reels, leather jackets and slick graphics. Jensen Huang wants to move Nvidia beyond chip-making to become the beating heart of the industrial economy.

That’s the real pot of gold for the $US3.7 trillion chip giant, which counts a swag of Aussie super funds including Unisuper, REST, AustralianSuper and HESTA as investors.

In just over two years, Nvidia has been on a stellar run that has turned it from a niche tech player into a force of nature, vying with Apple to be the world’s most valuable company.

The reason for the rapid rise? Nvidia sits in the middle of the AI boom, supplying the ever-powerful chips which give life to the new generation of tech.

Even this week, Nvidia shares hit another fresh high, capping off returns of nearly 200 per cent in just a year.

Through a much-anticipated keynote speech at the annual CES tech conference in Las Vegas, Nvidia’s founder Huang mapped out a longer term vision that he believes will not only sustain the tech giant’s weighty valuation, but continue to grow it.

Nvidia today has an unassailable lead in developing the world’s most powerful processing unit, the Blackwell GPU. It is so far ahead in the technology race that it gets the lion’s share of the hundreds of billions now being spent by Microsoft, Meta, Google, Apple and Amazon on the AI arms race and building data centres at scale.

Blackwell might be Nvidia’s core business, but nothing stands still for very long in Silicon Valley.

It will only hold that position until a rival like AMD, Taiwan’s or China’s chipmakers or some unknown name makes a breakthrough and eventually finds a way to build an even more powerful chip that’s much cheaper to buy and less expensive to run. This moment might be years away, but that day is coming.

Huang sees a bigger future for Nvidia beyond hardware: being involved in every part of the industrial economy, developing the high-end robotics and software that drive warehouses or even workplace assistants. He wants Nvidia to own the single operating system for robotics, much like Microsoft or Apple is to desktop computing.

Three steps

Huang breaks Nvidia’s future down to the three areas: agent robots, self-driving cars, and finally humanoid robots for factories.

“If we have the technology to solve these three, this will be the largest technology industry the world’s ever seen,” he said in the 90-minute presentation.

Through this he is calculating that over time that for every dollar spent on AI hardware, where Nvidia is playing, $20 will eventually be spent on AI software.

And those prepared to spend the most on AI will be businesses, given the potential for productivity gains and boost to profit. The deeper the relationship with business, the more sustainable Nvidia’s earnings become.

“There are millions of factories, hundreds of thousands of warehouses that’s basically the backbone of a $50 trillion manufacturing industry. All of that has to become software-defined. All of it has to have automation in the future, and all of it will be infused with robotics,” he said.

He says a robotic system could be a factory, a car through autonomous driving, or a human-form robot. He is developing Nvidia Cosmos, the AI that powers robots and self-driving cars. This puts it in the race against Elon Musk’s Tesla.

Huang calculates that carmakers will want to use a single autonomous driving operating system rather than multiple variations. Through the CES speech, Huang announced that Japanese giant Toyota was partnering with Nvidia to develop the next generation autonomous driving system. This gave Toyota’s shares a bounce in Tokyo on Tuesday.

Huang believes autonomous driving, already a $US4bn industry for Nvidia, will be the world’s first multitrillion-dollar robotics industry. And in the workplace, Nvidia is developing AI models powered by its Llama software that can “teach” other AI models in specific tasks or industries. It has AI “agents” designed for the workplace that will compete head on with Microsoft. These agents can break down tasks and retrieve data or deliver high-quality response to questions. These assistants are moving ever deeper into white collar work – representing savings for business but also questions over the workforce of the future.

Collectively, Aussie super funds have bet more than $20bn on the tech star. This means all of us have a serious interest in Huang getting Nvidia’s robotics call right.

Buyouts at WiseTech

WiseTech is showing it is business as usual for the logistics tech player following last year’s drama that triggered the exit of founder and chief executive Richard White.

Since listing nine years ago, WiseTech had a big appetite for acquisitions under White, running more than 50 deals over the period, with a collective value of nearly $2bn.

Acquisitions were on hold for much of last year, but since the exit of White there have been two deals.

The latest is a smallish buyout of Sydney-based ImpexDocs, a provider of digital documents for logistics tracking. While the price wasn’t disclosed, WiseTech will partially fund the deal with the issue of more than $7m worth of shares.

ImpexDocs’ founder, Manish Desai, will continue to run the business. WiseTech has a history of using acquisitions to retain its talent. Significantly, the deal was overseen by White’s longtime operational executive, Vlad Bilanovsky. That comes on the heels of WiseTech buying BSM Global, a tech player, to support its flagship CargoWise product. BSM’s founder Jason Flemming will also remain under the ownership of WiseTech.

Last October, White stepped down as chief executive to take on a consulting role that reports directly to the WiseTech board. The move was seen as a circuit-breaker amid the legal disputes mounting around his private life. Executive search firm Russell Reynolds has launched a global search and is understood to be eyeing Silicon Valley candidates that could run the $42bn tech player.

The coming year is shaping up as critical for WiseTech as it bets on three breakthrough logistics products, including the ramp-up of CargoWise Next.

eric.johnston@news.com.au

Originally published as Nvidia’s Jensen Huang maps out plan to control the new industrial revolution