NSW company liquidations rise in April as zombie firms wind up

Bowls clubs, large travel agents and at least a dozen construction firms are among the firms that hit the wall in April. FULL LIST

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A total of 116 NSW businesses went into liquidation in the last month as suburban salons, regional cafes and a major travel agency hit the wall.

In the wake of most government support payments ending, including the JobKeeper scheme, business collapse data for April reveals the number of NSW firms in liquidation trended up from 104 in March and 82 in February.

A further six NSW firms entered administration in April bringing the number of companies on the list to 122.

Construction companies continue to be regular casualties despite the booming housing market.

JB Masonry, founded in 2014, entered administration in April, joining a slew of others across concreting, carpentry and plumbing services.

The pandemic economy, which has largely returned to normal, continues to severely impact internationally exposed businesses as well.

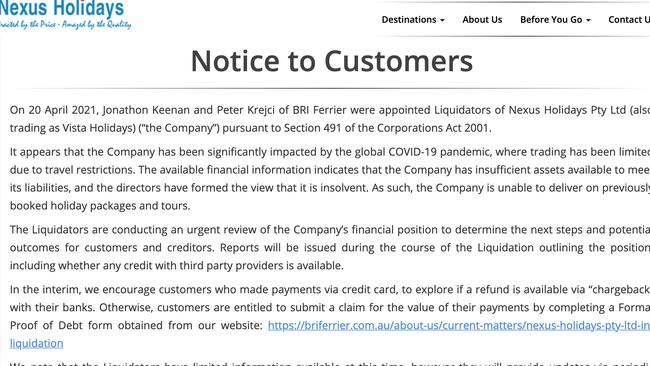

Global travel agency Nexus Holidays, which once traded across 17 locations, put its Pitt St company into liquidation saying it no longer had enough funds to continue.

The business, founded in 1996 and headquartered in China had opened its Australian office in 2007, survived the Global Financial Crisis but succumbed to more than a year of closed borders.

A notice on its website told customers is had insufficient funds to deliver previously booked holidays and there would be an update from the liquidators this week.

Lovelife Production, the proprietor of three cafes The Missing Piece, Hattrick Café Restaurant and The Vogue Café in Macquarie Park also went into liquidation.

Mobile phone retailer SUPERFONE, which was fined $300,000 in March after being taken to court by the competition commissioner for misleading telemarketing claims, also collapsed.

The business had been found to have wrongly sold phone plans to vulnerable Australians.

Regional hospitality companies were also hit, with the list including companies linked to Hog’s Breath Cafe Forster, The Entrance Bowling Club and Espresso Warriors at Dapto and Shellharbour.

The Entrance Bowling Club in Central Coast, which was ripped through by a fire in March last year, entered liquidation just days after the club’s general meeting on April 21 and weeks after the club spent up to refit and ready itself for reopening.

SM Solvency Accountants partner Brendan Nixon said he was surprised business failure numbers hadn’t increased more to date.

“There has been an increase in inquiries but it’s not where it was pre-COVID,” he said.

He said many businesses were not yet being chased by creditors or the tax office, noting the impending resumption of claims from the ATO would not show up in insolvency numbers for several more months.

“I do understand the ATO is due to resume its debt collection activities before 30 June,” he said.

“The ATO will be ramping up its debt collection and audit activities in the next couple of months and then there’ll be a delay of 3-6 months before the issuance of findings and statutory demands, which puts the pressure on directors to make the hard decisions about their company.”

Mr Nixon said for some businesses liquidating the company was aimed at preventing legal claims.

“It’s interesting to see the other reasons people want to put companies into liquidation

It might be construction companies who are concerned about warranty claims, or which are in legal proceedings and have run out of funds,” he said.

Another leading liquidation expert said many companies had been kept alive in order to receive final government stimulus measures before now being shut down.

Revive Financial partner Jarvis Archer said the “clean up” of zombie companies was under way.

A zombie company is defined as a failing firm that needs a bailout to successfully operate.

“While the end of JobKeeper has not brought the predicted tsunami of insolvency appointments, the numbers are bigger,” said Mr Archer.

“Many companies we’re seeing have been dormant for months, often since the first COVID lockdowns in early 2020, but have been kept open to obtain the final government stimulus payments before being shut down.”

Mr Archer said the trigger point for many businesses would not be the end of JobKeeper and other assistance, but the move by the ATO to collect overdue tax debt. “The ATO is still being fairly restrained at the moment” Mr Archer said.

In an average year about 8000 businesses are placed into external administration according to Australian Securities & Investments Commission data, but last year this dropped to 5000, meaning 3000 companies that should have become insolvent are due to fail this year as props such as JobKeeper come to an end.