NAB’s profit falls as CEO Irvine warns on Trump tariff plans

There will be negative implications to the global economy if Donald Trump goes ahead with his tariff agenda, NAB CEO Andrew Irvine says, after reporting a drop in annual cash profit.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Donald Trump’s election win will not delay the first Reserve Bank rate cut early next year, but rate cuts later in the year and into 2026 may be pushed back if the US president-elect follows through on his election promises, National Australia Bank chief executive Andrew Irvine has warned.

Speaking to The Australian after handing down his maiden full-year result for the bank, Mr Irvine pointed to Mr Trump’s tax and tariff plans as potentially creating inflationary headwinds for the US Federal Reserve, which “could have ramifications” for Australia.

In the near term the rate outlook will be centred on domestic supply side inflation and state of the employment market,” Mr Irvine said.

“More medium term, I think there could be implications depending on what policies he actually delivers and does he drive his tax cut agenda – and he needs legislative power to do that.

“If he does implement significant tax cuts, then it’s possible the Fed won’t lower as much as they otherwise would. And then, does he actually go through with the tariffs on China and the rest of the world? “I don’t think that’s going to change the near-term outlook for rates but would probably impact the back end of next year, or into 2026.”

Mr Irvine was speaking after NAB reported its full-year numbers that showed a jump in arrears as businesses and homeowners struggle with higher loan repayments. Arrears rose to 1.39 per cent, up from 1.13 per cent a year ago.

The economy was now at its toughest point in the cycle, Mr Irvine said.

“I think arrears are going to probably continue at the level they’re at, possibly they could trend a little bit up. But I think we’re at the toughest point in the economic cycle right now,” he said. But arrears in the small and medium business segment were likely to push higher, he warned.

“The SME cycle will lag the consumer cycle,” he said.

“So we would expect that when we hit a point of peak arrears in the home lending books, it’s likely that the SME cycle will follow that. We’re prepared for that and we fully expect it.”

The upcoming May federal election added further uncertainty to the outlook for businesses, he said.

“Business people don’t like uncertainty, so there’s a possibility that if that gets confusing, business owners might pause and slow down and wait. That’s certainly a risk for us,” he said.

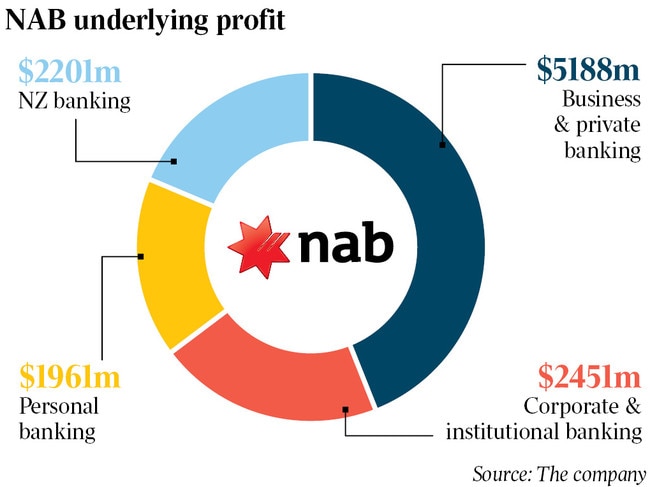

Earlier, NAB reported an 8.1 per cent slide in cash profit for the full year as margin pressures in home lending hit its bottom line, but these pressures eased in the second half.

Cash profit fell to $7.1bn for the 12 months to September 30, down from the $7.7bn reported in 2023, with earnings broadly stable on the first half. The home lending hit came through in the cash earnings in its personal bank, which cratered 20 per cent to $1.17bn on lower revenue and higher expenses.

Analysts had expected the bank’s full-year cash profit to be $7.06bn. NAB shares fell more than 2 per cent in early trade but recovered to close down 0.2 per cent at $39.33.

Revenue slipped 2 per cent, while net interest margin, a key measure of profitability, fell three basis points to 1.71 per cent, with the bank putting the blame on strong home lending and term deposit competition.

Mortgage growth over the year was subsystem at 3 per cent “as we balanced growth against competitive pressures. We will continue to manage portfolio returns through a disciplined approach in this dynamic market,” Mr Irvine said.

The bank has since stepped back into the market but would step out again if competition became too hot again.

“In the last four to six weeks we have seen the intensity of pricing increase,” Mr Irvine said. “It’s not yet at the levels it was in the first half, but this is a dynamic market, and it’s changing week by week. We will continue to be disciplined, and if the economics go backwards we may choose to step away (from home lending) a little.”

Amid margin pressure in home lending, the bank saw growth in its SME franchise, with business and private banking lifting deposits 7 per cent, as business lending jumped 8 per cent.

But NAB took some impairments in the small and medium business segment, with manufacturing in particular a weakness.

Expenses increased 4.5 per cent in the year, driven by salary increases and restructuring costs, as well as technology and compliance spending.

Morgan Stanley banking analyst Richard E. Wiles said the result was in line with consensus, but trends were “a bit softer than anticipated”.

“Loan losses were flat half-on-half but higher underlying losses from single names were offset by provision releases,” Mr Wiles said.

NAB declared a final dividend of 85c a share, bringing the full-year payout to $1.69 a share. That compares to 2023’s full-year dividend of $1.67 a share.

Former CEO Ross McEwan, meanwhile, took home a bumper $2.5m in 2024, with his $1.27m salary topped up with bonuses.

More Coverage

Originally published as NAB’s profit falls as CEO Irvine warns on Trump tariff plans