Mum-and-dad business facing ‘horrifying’ reality after ‘devastating’ bank move

It’s already a billion dollar problem in Australia but experts are warning an “avalanche” is coming and people aren’t protected.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

When a phone call came through from Matt McKell’s bank alerting him to almost $7000 in fraudulent transactions on his credit card, he had no idea he would later be blamed for scammers stealing his money.

Mr McKell, who runs a small block of holiday apartments on the NSW south coast with his wife Ellen, initially thought the phone call from the Commonwealth Bank of Australia (CBA) at the end of 2023 was a scam – so he hung up.

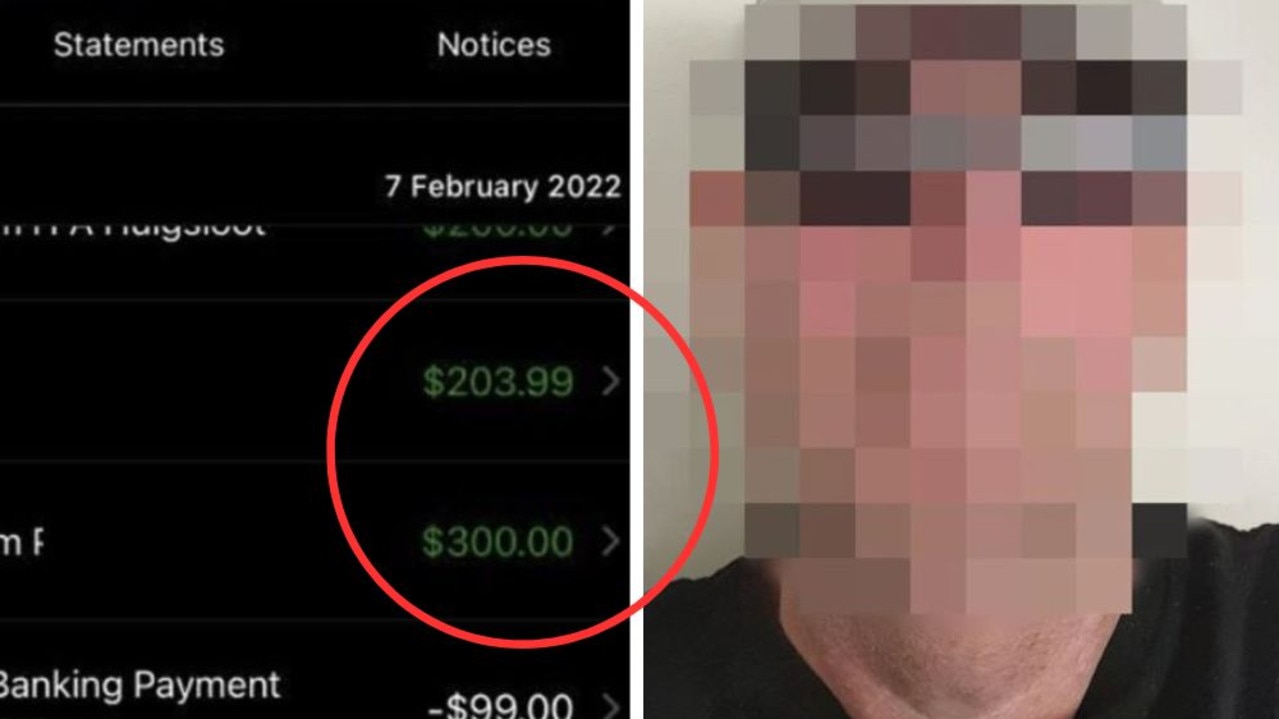

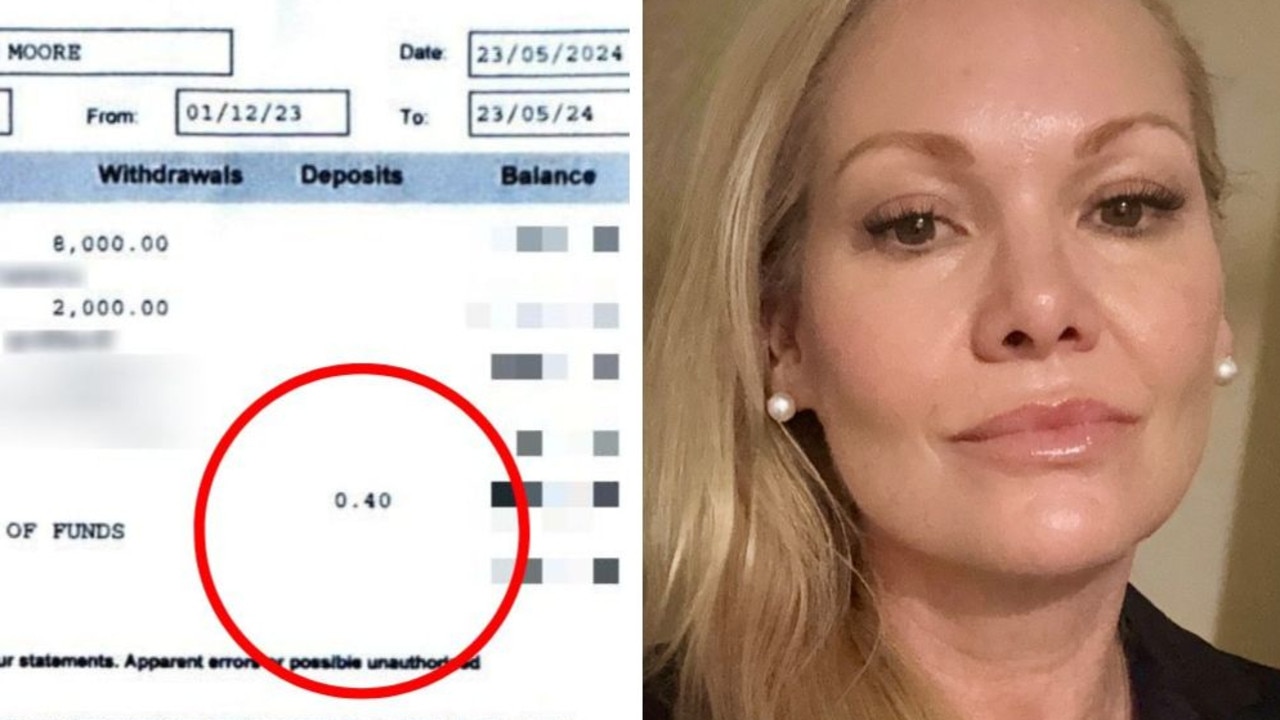

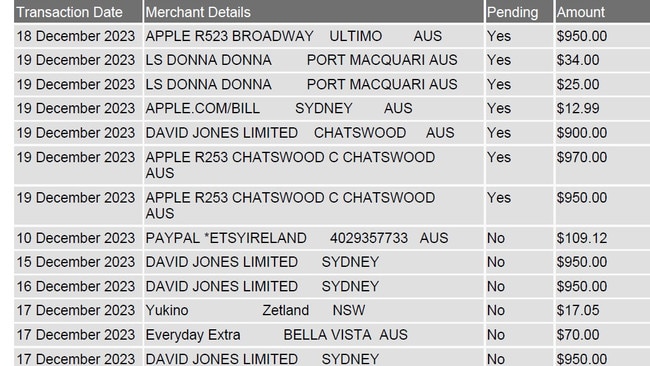

But when he checked their online bank account he was horrified to uncover 14 fraudulent transactions across four days – mainly spent in Sydney – including in Apple stores, as well as David Jones.

The McKell’s are lending their support to a news.com.au campaign People Before Profit, calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK.

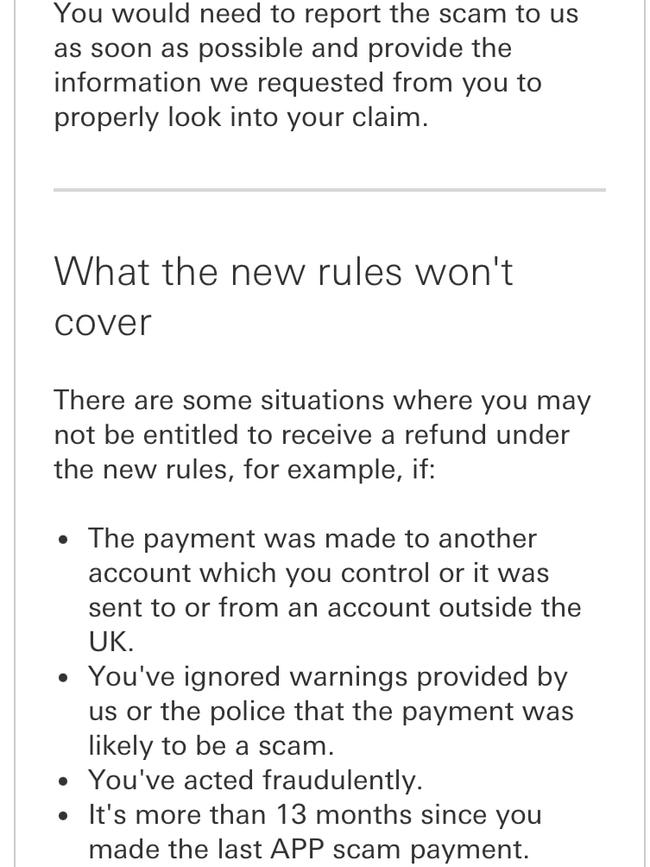

In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days unless in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFIT. SIGN THE PETITION

The couple were later shocked when the CBA accused them of being a part of the scam.

“We were hung out high and dry. They weren’t really interested in proving how they identified that it was our fault,” Mr McKell claimed.

“I think one of the really frustrating things is from a criminal perspective the police aren’t interested in dealing with it and banks aren’t interested, so you fall in a huge hole and you’ve got nowhere to go.”

For the McKell’s, the CBA investigation ruled that based on the “balance of probabilities”, the disputed transactions occurred because the couple set up a digital wallet with the card details and a secure NetCode or provided the information to a third party.

“That loss was suffered at the hands of a scammer, not the bank. The bank cannot right the wrongs of a scammer and must determine liability in accordance with the provisions of the ePayments Code,” the bank wrote to the couple.

Mrs McKell said dealing with CBA was “devastating”.

“We don’t have an Apple store or David Jones near us as we are four hours north of Sydney,” she said.

“It’s ludicrous as we still had the cards in our pocket but we can’t show any codes that have been sent as we don’t have records of it.

“The banks have had all the power and we are a mum and dad business – we are self employed – and it takes a lot of effort and toilets to clean and beds to make to make up $7000.”

Mr McKell said the bank initially offered the couple $1000 to resolve their complaint but this was withdrawn when they weren’t satisfied.

He looked into making a complaint with the Australian Financial Complaints Authority (AFCA) but he didn’t think the process was worth it.

“I wasn’t prepared to go down the rabbit hole as it was like pushing sh*t up a hill. Even though it was a lot of money for us to lose,” Ms McKell said.

The couple also had to stump up the $7000 to pay off the credit card.

“If we didn’t we would be paying interest on $7000 on something that was stolen from me. That’s just horrific,” he said.

“I became pretty depressed and gave up, which is not right but I had no fight to do it.”

A CBA spokesperson said the bank acknowledges the financial and emotional impact scams have on customers and the community.

“To help protect customers, we regularly send one-time security codes that customers must use to confirm some transactions and authorise certain banking activities,” they said.

“In this instance, we sent a one-time security code, or ‘NetCode’, to the customer’s mobile number. It appears that the NetCode was shared with a scammer. This enabled the scammer to access money from the customer’s account.”

The Australian government claims it is on track to tackle the billion dollar issue with its yet to be passed Scam Prevention Framework.

But scam victims, politicians and eight Australian consumer groups have called out the lack of mandatory compensation within the framework as deeply concerning.

They argue Australia is already a honey pot for scammers with an absence of regulation and industry inaction leaving scammers to hunt in a lucrative market.

The group including Choice, the Consumer Law Action Centre and Financial Counselling Australia have mapped out the pathway for victim’s to get compensation under the framework revealing up to five stages and 30 steps using its external dispute resolution.

It could also take between 18 months and two years for an outcome – with no guarantee of scam victims’ getting any money back at the end too

Under a compulsory reimbursement scheme, it would take just three steps for victims to be repaid what is often their life savings, consumer groups showed.

Consumer Action Law Centre’s CEO Stephanie Tonkin said mandatory reimbursement for scam victims would be the “best model to fix the scam problem in Australia”. Yet that approach is not on the table.

The government’s proposed framework would also put in place a case-by-case system in which a victim carries the burden of proving their case against multiple businesses – including resourced multinationals like the big four banks and Meta – to get their money back, Ms Tonkin added.

She also voiced concerns that obligations to prevent scams wouldn’t kick into effect until 2026 – when Australians will have lost billions more – warning that there is still “worse to come” for scams.

“I’m hearing of extraordinary deep fakes, and the use of AI and biometric information in scams in the US, and it’s only a matter of time before it’s on shore here,” she said.

“I feel like some of the reticence to setting up a reimbursement system is because the problem is going to get more complex and possibly harder to prevent.”

Consumers groups have also argued under the framework there will be “avalanche” of complaints to AFCA without a scheme where victims are compensated.

Many Aussies will ultimately drop out of the process before any money is paid back, they added.

“I am concerned about how businesses will manage the influx of multi-party complaints, and how AFCA will deal with a likely large increase in case-by-case disputes with multiple business. To put it in context, 600,000 scams were reported in 2023,” Ms Tonkin said.

“At the very least, we have called on government to streamline the process for victims – to add a presumption that a business will compensate a victim if the business can’t prove they have met their obligations under the framework.

“It’s not as good or streamlined as a reimbursement framework, but we hope this change will help victims recover compensation and faster.”

AFCA reported an unprecedented 34 per cent jump in complaints last year with 10,000 scam-related – a record for that type of complaint, a spokesperson revealed to news.com.au.

Ms Tonkins added scam victims face difficulties when scammed and trying to recover the money.

“People are made to feel stupid, they lose faith in their confidence and are told it’s all their fault rather than being told that scammers are highly capable and qualified international criminals,” she said.

“Any one of us could fall victim to the sophisticated scams that are out there now.”

Assistant Treasurer Stephen Jones told news.com.au that no where else in the world was taking the government’s approach to scams.

“Nobody had everything in place that was needed. And what we needed to do was take a whole of economy approach that looked at the way that scams or scam criminals contact their victims and put in place more preventive measures,” Mr Jones said.

He claimed compensation would be paid if telcos, social media and banks fail their obligations under the framework with “efficient, fair and effective” processes.

“It’s one of the reasons that we’ve given a new function to the Australian Financial Complaints Authority. They will have the power and ability to work with consumers and to hear complaints that are raised under these frameworks,” he said.

“The first and simplest way, however, is to have the complaint resolved at source so no consumer loses money.”

Mr Jones would not reveal when the framework would come into effect.

“We’re working at a breakneck pace and we want those things to be in place as soon as possible,” he noted.

Australian Banking Association CEO Anna Bligh said banks are an important part of the fight against scans.

“They have an obligation to do everything they can to protect their customers and that they are prepared to put money into in a building better systems and changing practice so that people are safer,” she said.

“What they’re saying though is that no matter what they do it only goes so far.”

She said social media giants and telcos also hold a huge responsibility to prevent scams and that the implementation of the National Scam Centre has seen scams decrease in Australia.

“We’re up against various sophisticated international criminal gangs and as soon as you remedy one scam, these guys start thinking of another one and that’s why it’s important that this is something banks never take their eye off,” she said.

“That’s one of the reasons why I hope that the National Scam Centre becomes a bipartisan, that it doesn’t matter if you have changes of government over the next 20 years but that this will continue to exist and bring the players together around the table. We can actually solve it.”

She added it was necessary for regulatory framework to ensure that telcos, social media giants and banks all had the same obligations and were all liable for compensation if they failed in their obligation to protect Australians from scams, rather than following the UK model.

Ms Bligh also backed the use of AFCA in disputes declaring them an “independent umpire”.

sarah.sharples@news.com.au

More Coverage

Originally published as Mum-and-dad business facing ‘horrifying’ reality after ‘devastating’ bank move