Miners boost mixed ASX; Domino’s tanks

Profit warning prompts Domino’s downgrades. Delays at Fortescue project. Sayona falls on lithium mine review. Incitec lifts on capital return. ACCC supermarket inquiry announced.

Profit warning prompts Domino’s downgrades. Delays at Fortescue project. Sayona falls on lithium mine review. Incitec lifts on capital return. ACCC supermarket inquiry announced.

Buoyed by a rally in material stocks on Wednesday, the Australian share market edged higher to finish in the green.

Nanosonics tumbles. Pilbara lifts as cuts capital spending. Miners and lithium stocks up. Kogan jumps on earnings beat. Rio’s $1bn solar power deal. Newmark up on BWP merger.

Buoyed by a rally in health care stocks and a positive lead from Wall Street, the local market climbed for a third straight session – its longest for the year.

ASX closes up 0.4 per cent. Healthcare stocks up 1.2% as a sector, Woodside lines up a Pluto stake sale, Elders and Incitec book profit.

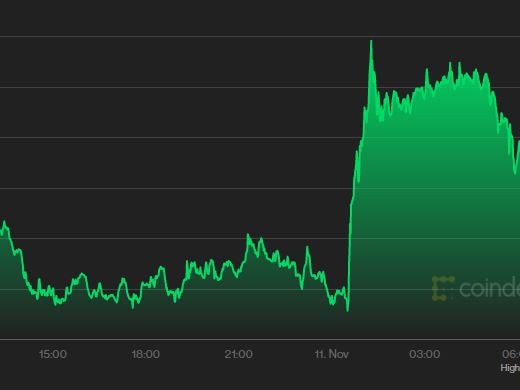

In a strange twist, 88 per cent of the population are banned from trading crypto but the remainder are free to do as they wish.

The crypto has lost 10 per cent of its total value just days after hitting new records, and financial analysts can’t agree on the cause.

Materials and energy stocks lifted Australian shares to finish the week strongly following a run of sell-offs.

Australia’s share market recovered strongly from Thursday’s fall on high US CPI data. The S&P/ASX 200 closed up 0.8 per cent to 7443.

The ASX 200 recovered to close 0.6 per cent lower on strong iron ore futures. Miners gained led by Fortescue but Nearmap and Xero were among the worst hit.

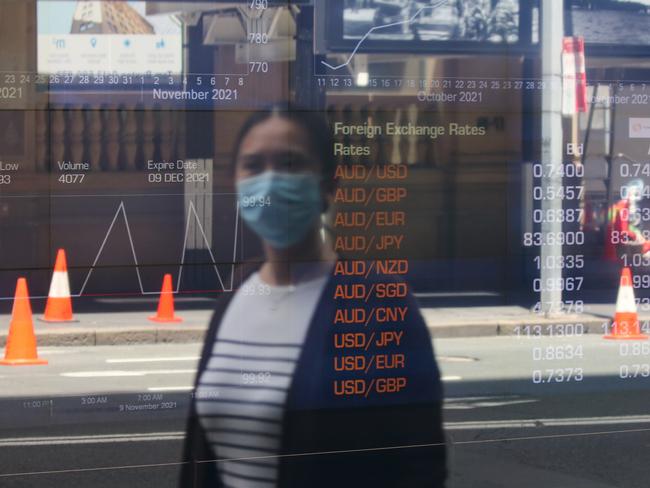

Inflation in the United States has reached its highest level in 31 years, with the price of food, petrol and housing rising sharply.

People have flocked to the cryptocurrency after a dire prognosis of the state of the US economy — but as always it was a rollercoaster ride.

ASX 200 closed down 0.1% after Singapore iron ore futures fell. Major miners BHP and Rio are in negative territory with steel giant BlueScope the worst hit. Chalice the top gainer.

A supermarket worker can head comfortably into retirement at the ripe age of 35 after a lucky $8k investment made him more than $1.3m.

Original URL: https://www.dailytelegraph.com.au/business/markets/page/193