LNG buyer JERA warns of significant Australian job losses unless local industry fixed

Japan’s biggest buyer of LNG has threatened to take its business elsewhere, at the cost of thousands of jobs, unless urgent policy changes are made to fix Australia’s $70bn export industry.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Japan’s biggest LNG buyer has delivered a bombshell to Australia’s $70bn export industry, saying it will look to rival nations for supply and warning of thousands of job losses unless urgent policy changes are made to fix the state of the local industry.

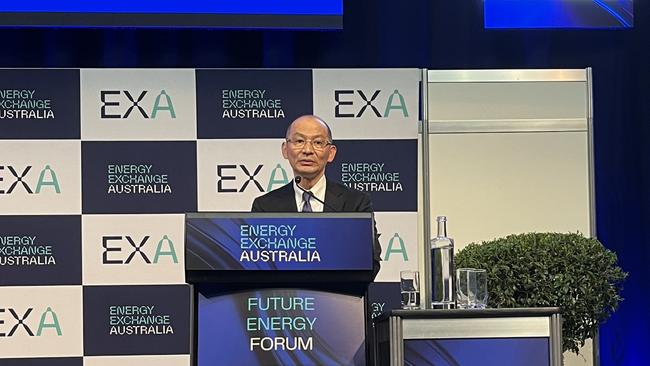

JERA executive Hitoshi Nishizawa sounded the alarm about the longstanding trade relationship in Perth in front of the Japanese energy giant’s operator partners Woodside Energy, Chevron, Inpex and Santos.

Mr Nishizawa, JERA’s senior vice-president of LNG, said long-term supply deals were due to expire from 2030 just as new supply came online from the US.

“In contrast to Australia, in the US there are expectations of abundant future new supply, cheaper prices, lower cost of production and labour, and faster project approvals for LNG projects,” he said.

“This may very well impact Australian LNG in terms of competition for additional long-term sales of LNG – to JERA and to others – in future round sales campaigns.”

JERA handles about 35 million tonnes of LNG a year.

A big investor in Australian LNG projects as well as a customer, it is frustrated by approval delays, the prospect of strike action under industrial relations changes and the retrospective application of the safeguard mechanism, the Albanese government’s flagship emission reduction policy for heavy industry.

Mr Nishizawa said JERA would look elsewhere for supply, with the US and Middle East set to grab a big share of its contracts.

“While Australian LNG is expected to continue to make up part of Japan’s long-term energy mix, in the future it may not be the first choice as it has been in the past,” he said.

“In order to ensure future long-term LNG trade with Japan, serious action to address the competitiveness of Australian LNG is needed now.

“The clock is ticking, and inaction could potentially cost Australia thousands of jobs, billions of dollars in lost revenue and weaken regional trade partnerships.”

In terms of JERA’s massive upstream investment in Australian LNG, Mr Nishizawa said cost and policy support mattered.

“The cost of LNG production affects the decision of all buyers about where to invest in the LNG upstream. Higher labour costs and industrial action have an impact on the cost, as well as the supply stability of Australian LNG,” he said.

“Australia faces a number of challenges to remain globally competitive in energy. In addition to policy and regulatory uncertainty, slow approval times for projects and mixed messaging on support for the gas sector, generally it costs more to invest in Australia and, as a buyer, we are sensitive to the impact of higher labour costs and industrial action on the cost of Australian LNG.”

JERA, Japan’s largest power generation company, agreed to pay $US1.4bn for a 15.1 per cent stake in Woodside’s Scarborough LNG project in February 2024.

However, sources said JERA now wanted to sell its 12.5 per cent stake in Santos’ $5.8bn Barossa gas development in northern Australia just four years after entering the project.

The unexpected move could see JERA’s share of the facility picked up by a private equity player such as MidOcean Energy, after it previously snapped up Tokyo Gas’ stakes in four LNG projects around Australia.

Mr Nishizawa said policy certainty was crucial for long-term investment and sales agreements.

“It is no secret that Japanese confidence in Australia was shaken by retrospective application of the safeguard mechanism to projects. For JERA, it was applied to the Barossa project in a post-FID (final investment decision) manner,” he said.

Mr Nishizawa lived in Perth for nearly a decade earlier in his career and was responsible for starting up JERA’s LNG upstream businesses in Australia, so he has a vast knowledge of how the industry landscape has changed.

Japan is one of the largest foreign investors in Australia’s gas industry, but the intervention of the Albanese government in 2022 through its mandatory code of conduct – the centrepiece of which included a $12 a gigajoule cap on new gas – stoked alarm from Tokyo.

The head of Japan’s biggest oil and gas company, Inpex, said in 2023 that Australia could provoke global instability should it continue with policies that amounted to “quiet quitting” of the LNG industry.

Mr Nishizawa warned the Future Energy Forum, a major industry gathering sponsored by the WA government, that some in Australia appeared blind to the prospect of widespread job losses and a massive revenue hit from a decline in the LNG industry.

“An important point here, and one that I don’t think is really well understood (is that) deadlines are approaching for long term Australian LNG procurement contracts,” he said.

“What many people may not have recognised – including politicians – is that around 2030 and on some SPAs (sale and purchase agreements) and equity agreements will expire.

“This means that given the duration of around 20 years or so for long-term contracts, that a significant volume of current Australian LNG contracts with Japan, which started their deliveries in the mid-2010s, are due to end around 2030 onwards.

“It means that some key contracts for Australian LNG will end at around the same time that cheaper, abundant supplies of gas are due to come on to the market.

“Australian LNG will face fierce competition with other global suppliers for future sales.”

More Coverage

Originally published as LNG buyer JERA warns of significant Australian job losses unless local industry fixed