Lithium bubble bursts as Pro Medicus named ASX 200’s top stock in 2023-24

A radiology imaging software and services business was the top performing ASX 200 stock in FY24, as the bubble burst for lithium miners.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Two Australian tech innovators delivered the goods with mammoth returns for the 2024 financial year, riding high on a broader international bull run for the sector, while last year’s lithium kings saw their bubble well and truly burst after a stellar run.

Medical technology company Pro Medicus was the best performing stock on the ASX 200 over the last 12 months, rising 118.3 per cent.

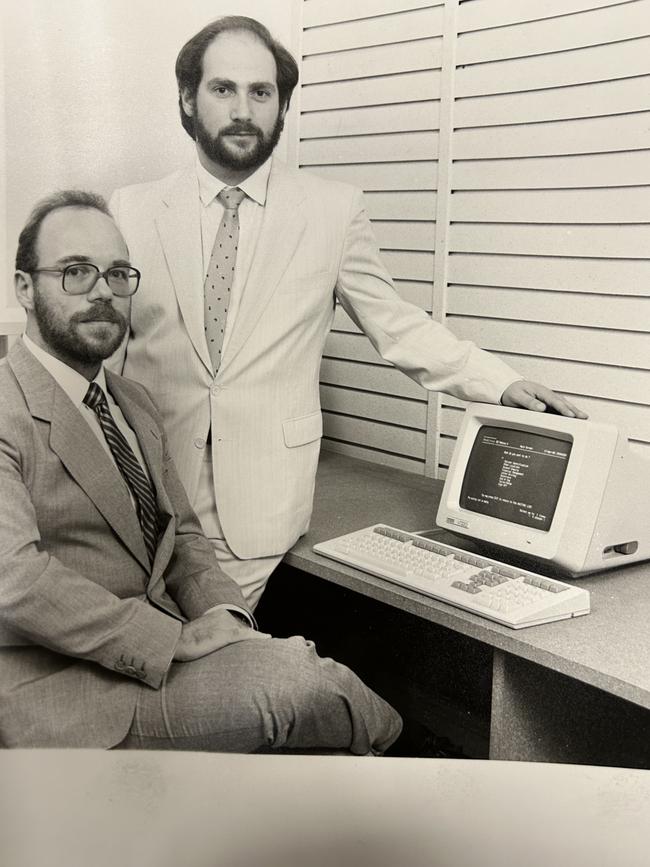

The brainchild of Dr Sam Hupert and Anthony Hall over 40 years ago, Pro Medicus survived the tech wreck of the 1990s followed by the Global Financial Crisis, and with a market capitalisation just shy of $15bn, its US radiology imaging software and services business contributes the lion’s share of its revenue.

Close behind was Chris Hulls’ San Francisco-based Life360, the dual-listed family safety and location-sharing app firm, whose shares soared 115.4 per cent on the back of phenomenal growth.

At the end of March the company boasted 66 million users worldwide and, since 2021, downloads of the app have doubled in the US and tripled internationally.

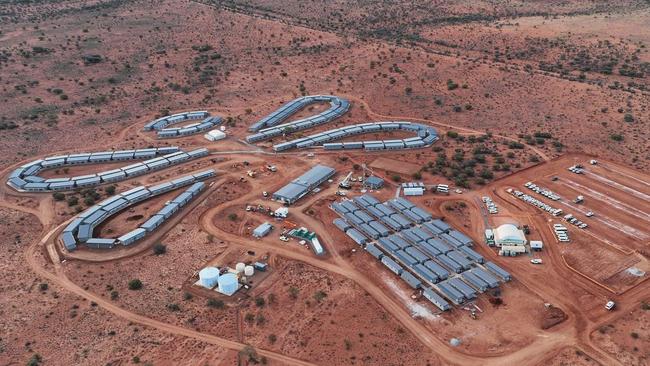

Last year’s lithium popularity triggered takeovers, sky-high valuations and newly minted billionaires. However, a supply glut, falling prices and slower than expected demand hurt lithium miners in the 2024 financial year.

Hunter Green director Charlie Green called it saying: “The bubble burst for the EV stocks.”

Major lithium shareholders such as Australia’s richest person Gina Rinehart and Perth-based mining investor Timothy Goyder would have added millions to their bank balances in 2023 when WA-based lithium player Liontown Resources soared 168.3 per cent higher to top the ASX 200 list 12 months ago.

However, Liontown’s shares plunged 68 per cent in the past 12 months to leave it on top of the worst performing listings in FY24.

Fellow WA lithium player IGO Ltd, which was the second top stock last year with a 167.6 per cent increase, was the second worst stock in 2024 after a 62.9 per cent fall.

They were joined by Arcadium Lithium, which fell 51.9 per cent, Pilbara Minerals which dropped 37.2 per cent, while with rare earth specialist Iluka Resources was 41 per cent lower for the year.

While lithium was on the nose in resources, gold still shone for Red 5, up 89.5 per cent, and West African Resources, which soared by 86.1 per cent. Uranium miner Deep Yellow was 76.8 per cent higher.

Industrial-focused property giant Goodman Group also had a strong year and was up 73.1 per cent.

However, two of Australia’s gambling giants took a battering in 2024.

Headline grabber Star Entertainment Group, still swamped by regulatory issues and executive movements, was the third worst-performing stock on the market, falling 54.1 per cent, which followed its 55.1 per cent drop in FY23. Tabcorp Holdings came in at 9th worst performed following a fall of 36.9 per cent.

Mr Green said gambling stocks still had “mountains to climb”.

“Tabcorp and Star are the old economy gambling stocks and they’re facing stiff competition which they are trying to grapple with, although to be fair Star has its own issues,” he said.

“They’ve facing a tidal wave of regulatory oversight.”

Dual-listed New Zealand-based building materials company Fletcher Building’s shares plunged 46.2 per cent on a wave of bad news that triggered earnings downgrades, while healthcare company Healius fell 49 per cent on a number of issues including a $603m impairment that slashed the value of its pathology division.

More Coverage

Originally published as Lithium bubble bursts as Pro Medicus named ASX 200’s top stock in 2023-24