Household bills considered the number one financial burden for Australians

Rent and mortgages have long been considered our biggest financial burden but a new cost is causing headaches for more households.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

For years Australia’s housing affordability problem has been the main culprit for stretching personal and family budgets to the limit.

But rent and mortgages have been knocked off the number one money worry spot as household bills are now considered the biggest financial burden for Australians.

According to news.com.au’s latest Cost of Living survey, bills including energy, groceries, insurance and school fees have overtaken housing as our greatest money drain.

The detailed survey, run in February, asked readers to share the major household money challenges they were facing. The results are now in and news.com.au has kicked off The Money Project, revealing the financial hardships and tests Australians are facing as well as offering practical advice on how to get your money shipshape in 2021.

WHERE YOUR MONEY IS GOING

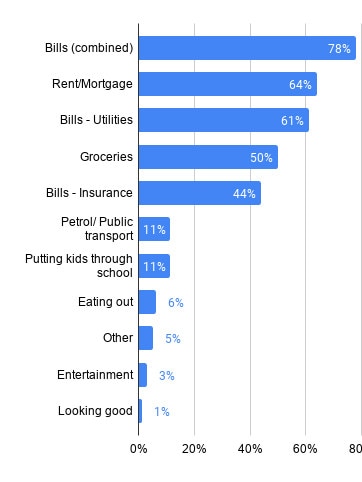

More than 10,000 people responded to the survey, with 78 per cent saying their number one household expense was bills, an 11 per cent increase from the previous survey in 2019.

As part of the survey, respondents were asked if they felt they were on ‘Struggle Street’, ‘Barely Coping’, ‘Doing OK’ or on ‘Easy Street’ based on how they felt they were faring financially – and the impact of bills came up again and again for readers.

“General expenses are taking all of my pay I have no money to save beyond just living,” one respondent on ‘Struggle Street’ said, while another who identified themselves as ‘Barely Coping” said their husband had lost his job and with one wage coming into the house, they couldn’t manage to pay the bills as “they all keep increasing”.

Another described how one unexpected cost can derail their single-income household budget, “Something like car repairs can cause us not to be able to catch up on bills for months, it’s a struggle to pay rent and all bills and at this rate, I will never be able to afford to buy a house as I can’t save,” they said.

According to leading economist Chris Richardson, cost of living pressures stand out in a couple of ways.

“Most notably necessities have gone up more in price over the years. Electricity, water, food - certainly healthier food - has become relatively more expensive, whereas there have been big falls in price on nice to have items like big screen TVs,” he said.

“If you’re among Australia’s worse off, such as the unemployed, that is a squeeze. We finally have $25 a week increase in JobSeeker but the prices that are of most relevance to the unemployed have substantially gone up already.”

Mr Richardson said although there has been a financial squeeze for a while, due to the pandemic, it’s not as bad as we think.

“Many people think wages have gone down and prices have gone up disproportionately to one another, but official statistics tell a more moderate story,” he says.

The statistics he’s referring to come from the Australian Bureau of Statistics, which reports that wage growth sat at 1.4 per cent last quarter, while the Consumer Price Index, which measures household inflation, rose by 0.9 per cent.

OTHER TOP MONEY WORRIES

Closely following bills in the list of top money worries in the survey were rent and mortgage costs at 64 per cent, down from 66 per cent in 2019, and groceries at 50 per cent, down from 54 per cent.

Insurance came next at 44 per cent, followed by petrol and public transport at 11 per cent, putting kids through school at 11 per cent, eating out at 6 per cent, entertainment at 3 per cent and looking good at just 1 per cent. “Other” expenses accounted for 5 per cent.

Although bills were a universal issue for Australians, different demographics had their own challenges and specific priorities outside of that.

Younger respondents were more concerned with lifestyle spending while older Australians spent more on providing for their families.

For 25 to 34-year-olds, the biggest expense was eating out, followed by entertainment and rent or mortgage, while the biggest expense for 18 to 24-year-old respondents was looking good.

In the 35 to 44 age group, putting kids through school came out on top, followed by rent and mortgages, while those aged 55 to 64 and above spend most of their money on petrol or public transport.

The impact of the pandemic could be seen as spending on non-essentials like looking good, entertainment or eating out hit lowest levels since the survey began. And last year’s nationwide lockdown meant spending on petrol and public transport also hit its lowest level.

More than half of respondents spent between 26 to 50 per cent of their pay on rent or mortgage. Just over one third of those who are on ‘Easy Street’ spend up to 25 per cent of their pay on housing (down from 73 per cent from 2019). Compared to previous years, the percentage share of those using more than 50 per cent of their salary on housing was more consistent across all age groups.

RELATED: Tax break you need to know about

HOW TO SAVE

Although some household bills (namely health insurance) will go up this year others (energy) are actually set to decrease.

Private health insurance will rise by an average of 2.74 per cent on April 1, which will hit the hip pockets of the average Australian family by around $127 extra a year.

According to Uta Mihm, health insurance expert at CHOICE, you can avoid having to pay the extra if you act before April 1.

RELATED: Combining energy bills could save hundreds

“The easiest way to delay or avoid the premium increase is to pay your full annual premium at the old rate by March 31,” advises Ms Mihm.

“To prepay is especially important if your premium has increased by an above average rate, as you then have a full 12 months to find a better value-for-money policy.”

Meanwhile, the cost of electricity and gas is expected to plummet from 1 July 2021. So far only those who live in Victoria can definitely expect their bills to fall, although other deregulated states (NSW, SA & SE QLD) are expected to follow soon, but that doesn’t necessarily mean your provider will automatically pass any savings onto you.

“With prices decreasing, there’s no better time to check that you’re getting the best deal,” says Luke Blincoe, CEO of independent electricity retailer ReAmped Energy.

“The single biggest mistake people make with energy bills is thinking that your loyalty will count for something. People think switching energy providers will be hard, but it literally takes a few minutes and you’ve got a pretty high chance that you’ll end up saving hundreds of dollars. That few minutes might be the most productive use of your time all year!”

RELATED: Clever tricks to ditch pesky bill hike

Read more stories about the Cost of Living here.

Originally published as Household bills considered the number one financial burden for Australians