Gupta’s deal-making days are well and truly over after Whyalla mess

The sorry state of the Whyalla steelworks represents beginning of the end for the British magnate. The bigger InfraBuild is next n line to fall.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The sorry financial state of the Whyalla steel mill was laid bare through a creditors’ meeting, but it also painted a stark picture of how close to the edge Sanjeev Gupta is running his GFG businesses in Australia and possibly across the world.

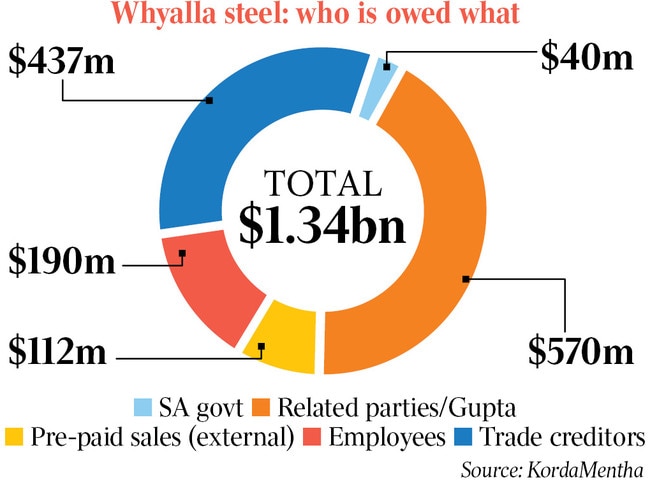

With debts of $1.35bn and just $8m left in the bank, Whyalla was lucky to have made it this far.

Administrator KordaMentha’s early, but damning, assessment was the steelmaker was hardwired to make losses, as it was mostly buying and selling steel to Gupta’s other key Australian business, the scrap and steel distributor InfraBuild. And untangling this relationship will be just as fraught. This is the second time around for KordaMentha who eight years ago sold Whyalla to Gupta when it was in receivership.

InfraBuild – which itself is financially teetering – represents Whyalla’s main source of income as well as a key supplier of raw materials. This is what makes Gupta the biggest single creditor to his own steelworks, claiming more than $530m.

Whyalla had only survived because of the goodwill and support of employees and hundreds of trade creditors. That means a lot of people were prepared to sacrifice something to keep Whyalla going, except, it seems, Gupta.

There is no suggestion Gupta had broken any laws. However, operations were not well in the business of Whyalla.

Given the high profile, ASIC last week launched an investigation into the collapse.

Whyalla still trades under the old OneSteel name BHP gave it in a spin-off more than two decades ago. It was on track to deliver annualised losses of nearly $550m this financial year, given it was losing $1.3m a day. The steel mill was running hand-to-mouth, paying essential things such as gas, electricity and diesel daily, meaning OneSteel was hit every time there were wild swings on the spot market. It was dragging out payments to suppliers and running its own wafer-thin capital.

The comments by KordaMentha’s Sebastian Hams in Whyalla mean Gupta’s chance of doing any deal making at scale in Australia again are all but over – if they weren’t already.

What it really shows is the Australian leg of Gupta’s GFG empire was largely built on the illusion of shifting funds around. But buying and selling to yourself is eventually going to be result in a diminishing returns.

“One of the reasons this business is still here is because of its goodwill and the human capital and the supplier capital that’s been put in place to keep this business running,” Hams says.

To stem the bleeding, KordaMentha is busy renegotiating agreements with InfraBuild and other parties related to Gupta entities.

“Those are losses that have been incurred over the last few years have been funded by the prepayments of stock and so on,” Hams says. “Getting down to around 4000 tonnes of coke (coal), which is somewhere between two or three days of operations, is a really dangerous position to get into. So what we’re trying to do is build a buffer into the business such that we’ve got, we’re not having these daily payments.”

For much of past year OneSteel’s main blast furnace was down and even when it was running it was at just a quarter of the capacity. KordaMentha is now talking to BlueScope to bring in the Port Kembla steelmaker as an outside adviser, including assessing whether the furnace can continue to run safely.

“On appointment we had $8m in the bank for a business that turns over somewhere around over a billion dollars, that is just crazy,” Hams says. And the working capital position was “scary”.

After running OneSteel for more than a year, during the first appointment back in 2017, Hams’ view is the capex that has been spent on the business is “immaterial”. That follows Gupta’s promises of spending $1bn upgrading the plant.

“That just haven’t spent money on this business by virtue of the cash flow shortages. And I think the expression that we’ve used, and it’s come through, is the business is running on empty.”

Hams says the plan now is all about stabilisation, recapitalisation and then considering options for a sale. The problem is the main creditors are not deep-pocketed banks, but Gupta’s own companies, and they are in no capacity to fund a bailout. This, leaves both the South Australian government and Canberra on the hook to finance any shortfalls. So far they have pledge $384m to keep it alive.

In a statement, Gupta’s GFG said OneSteel has faced significant operational and financial challenges due to a combination of internal and external factors, including the plant being out of action for most of 2024.

GFG said even as the plant was down, OneSteel workers remained on full pay. It, too, had a program in place to return Whyalla to profitability, adding the program was working.

“GFG Alliance management and entities, including InfraBuild, remain committed to working cooperatively with the administrators to ensure the sustainability of Whyalla’s operations and a long-term solution for steel manufacturing in Australia.”

The insights serious questions over InfraBuild which is equally stretched and given its sales to numerous infrastructure projects around the country, could set off even bigger financial shockwaves if it does collapse. That could have implications in Victoria and NSW, where multiple InfraBuild operations are based.

InfraBuild is already trading with a credit rating deep in junk territory, and its bonds recently priced at a one-in-five chance of default in the near term. One UK bondholder in recent days launched a legal action, claiming InfraBuild had defaulted on bond payments.

There’s mess all over the $1.3bn debt. Gupta and associated entities claimed to be owed $570m from Whyalla. With next to no cash in Whyalla, this means InfraBuild could struggle to find the funds to pay the next tranche of interest on $US550m of bonds. KordaMentha is yet to test the validity of Gupta’s security over the Whyalla debt and its some of the claims may never be tested.

It was in early 2017 that Gupta launched his campaign to seize Whyalla. Then a relative unknown he was doing the rounds in Sydney, including The Australian’s offices to make his case. At the time he was complaining that the then receiver, KordaMentha, installed by the banks, wouldn’t even take his call. He argued, then, he had a superior offer. Even in the lead-up to that meeting there had been doubts from Europe about his funding sources; few knew how much Australian banker Lex Greensill’s supply chain financing scheme was propping his activities around the world.

At the time, KordaMentha had an in-principle agreement to sell OneSteel to a consortium led by Korean steel giant POSCO. Things would have worked out a lot differently, however Gupta lobbied creditors and wooed state and federal governments, and eventually broke through the bidding process to secure Whyalla with plans to spend $1bn recapitalising the business.

The British businessman had seemingly come from nowhere to snap up a string of struggling steelmaking operations and mines around the world into a $US15bn privately-owned commodities empire. The collapse of Greensill, through the Covid pandemic, essentially cut off Gupta’s funds.

Today the OneSteel administration risks being the beginning of the end for Gupta not just here but around the world. Until now, he has nearly always managed to keep the creditors from his door.

While he has a firewall built around his various businesses, OneSteel is starting to look like the thread that brings the whole GFG house crashing down.

And while the SA government’s reasons for tipping Whyalla into administration were more about politics than recovery of its relatively small $40m debt, there will be questions about the chain reaction it is about to set off.

Originally published as Gupta’s deal-making days are well and truly over after Whyalla mess