Gaw Capital, BW Group create Valent Energy in Australian battery roll-out

Former Clean Energy Finance Corporation boss Oliver Yates, who will chair the big battery firm, has warned of the one risk to Australia’s renewables target.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Former Clean Energy Finance Corporation boss and chair of a new $2bn grid-scale battery venture Oliver Yates says Australia is on track to achieve its renewable energy target but warns investment in the nation’s transmission network is desperately needed to keep up with the rush of new projects.

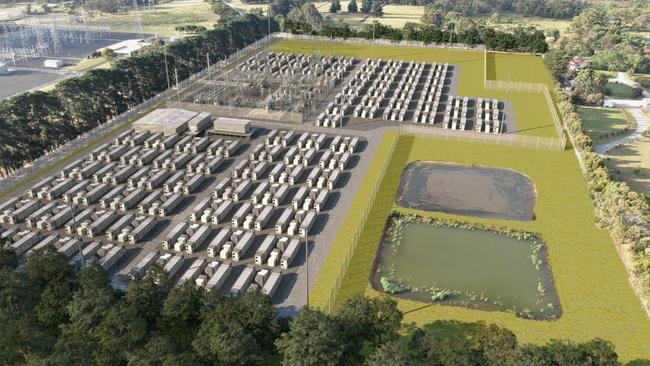

The new investment platform, Valent Energy, brings together private equity group Gaw Capital Partners and energy and maritime infrastructure firm BW Group, who have joined forces to roll out a 1.6GW portfolio of new storage projects across Australia.

They will contribute and raise more than $2bn to fund the projects, which include seven grid-scale batteries and a solar farm in NSW’s Hunter region.

A 240MW battery on Victoria’s Mornington Peninsula, the 250MW Pine Lodge battery near Shepparton and the 120MW Aspley battery south of Dubbo in NSW have each secured development and connection approvals and are expected to commence construction later this year.

The portfolio consists of projects taken over by Gaw Capital as part of its 2022 acquisition of GMR Energy, and includes three other battery projects which are expected to secure connection approvals early next year.

Mr Yates, who was the inaugural chief executive of the CEFC from 2012 to 2017, said government support for new projects and a history of developing renewables at pace put Australia on a strong path to achieve its renewable energy target, despite fears the country is slipping behind the government’s ambitions of having renewables generate more than 80 per cent of the country’s energy by 2030.

Modelling released by AEMO Services earlier this week suggested the country could at most install 4GW of new clean energy capacity each year, compared with a 6GW target.

“People have bet against renewables being able to be deployed as fast as what people have imagined year after year,” Mr Yates said.

“It is clearly a challenge. The transmission network is a challenge in terms of being able to bring more new renewable energy to the market, but I remain pretty positively inclined to believe that we will be able to achieve the targets that are set by the government.

“We’re moving power from diverse facilities - solar and wind across the country towards major cities, and that’s the inverse of the way the grid has operated historically. So there’s significant grid investment that needs to go on at the same time.

“We need to work out how we use the existing grid infrastructure to its absolute maximum scenario, and then we need to work more closely with communities about appreciating the need, in certain circumstances, to extend the grid.

“There needs to be clear discussion with communities about how we balance the need to protect our environment by reducing emissions, and yet we are going to impact on people’s environment by putting up new transmission, and that’s a balance that we need to get right.”

Valent joins a flurry of local and international investors seeking to capitalise on government incentives and the increasing need for firming infrastructure to support Australia’s transition to renewable energy.

In a bid to accelerate the rollout of renewable energy, the government late last year promised to underwrite a massive expansion of 32GW of new wind, solar and battery projects via its capacity investment scheme, which sees developers guaranteed a minimum return on new projects.

Mr Yates said any plans to bid for federal support through the scheme would be determined by Valent’s financial backers, who were ramping up their investment in Australia due to the strong fundamentals offered as part of country’s energy transition.

“The dynamics of the Australian energy market are such that, and the need is very clear - we need batteries in the system,” he said.

“Government support can come and it can go, as governments can come and go. And these projects need to be able to stand up and operate from time to time in their own right. So there’s a commercial decision that Australia is an excellent area to invest in.

“The government support is very welcome and will be used from time to time, but the fundamental economics of battery investment in Australia remains strong.”

Outside of Valent Energy, BW Group’s energy storage arm BW ESS has a portfolio of more than 1.5GW of battery projects in the UK and Nordic countries.

More Coverage

Originally published as Gaw Capital, BW Group create Valent Energy in Australian battery roll-out