For financial security in retirement, sharpen your animal instincts

OVER the past few nights the foxes in our area have been dining out on our newborn lambs.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

OVER the past few nights the foxes in our area have been dining out on our newborn lambs.

"I lost six little ones last night. It was an absolute massacre", squawked my neighbour.

This horrifying news presented a genuine conundrum for Mrs Barefoot, a kind-hearted woman who describes herself as an animal lover (and often while eating lamb chops smothered in mint jelly).

She loves all creatures great and small. Growing up in fashionable inner-city Fitzroy, the chickens weren't just free range - the council provided them with their own bike lane.

This explains why so far, she has resisted my pleas to get a shotgun like the rest of my neighbours, and why her mood darkens every time I'm invited out spotlighting to bond with the locals.

On Saturday evening, Mrs Barefoot triumphantly announced she'd googled a solution to our fox problem: "We'll get alpacas."

Until this lightbulb moment, the only thing I knew about alpacas was that they are weird, aggressive looking things - kind of like Sam Newman. Yet the more I opened myself up to the idea, the more I realised that they were in fact the perfect financial role model for all of us. Let me explain.

When you introduce an alpaca to a flock of sheep, they intuitively take the role of protector: if a fox approaches they will stand in front of the sheep and eyeball the fox with terrific stink-eye ability - stopping them in their tracks. The fox is then forced to re-think their attack, coming from a different angle. Then bam, the alpaca will spit on them - their last chance. If the fox dares to move within striking distance, the alpaca will stomp them to death.

So I asked myself, what causes people to work their guts out for forty-five years, earn upwards of $5 million - but retire with less than $500,000? Financial foxes.

Financial foxes can be different for everyone, but make no mistake, they are just as deadly as the one's roaming my paddocks. They manifest in the form of status anxiety that causes you to buy a home in a trophy suburb that you can't afford (like all your friends). It's the banker encouraging you to "do something" with the equity in your home. It's being too busy to put in place a plan to get wealthy. And it's choosing the wrong financial adviser when you finally do.

The only way to trample a financial fox and protect your family is with alpaca-like intensity. So if anyone in your life makes a move for your money, eyeball them for a good while. If they try and convince you to buy an investment property they've "sourced" from a developer or anything else they'll likely get a kickback on, spit on them. And if they set up emotional road blocks that stop you from treading your own path - stomp right over them.

Rank the banks

Now, let me tell you about a different type of protector - financial counsellors - and a strange-but-true story of how a couple of overworked, underpaid renegades battled the multi-billion dollar banks . . . and won.

The standard way to attack the banks is to complain about how much profit they make. But let's be honest - bank-bashing stories taking this approach have lost their punch - they're cliches. The reality is that if you're a regular punter and you feel that you're getting a raw deal from your bank, all you need to do is shop around and find a better deal. With lending growth at generational lows, the banks are fighting each other for your business.

But if you've fallen on hard times - have a terminal illness, been retrenched from your 40-year job, or graduated into a tight labour market - it's a totally different story. The banks can be bastards, and the only alternatives are not really alternatives at all. Rather they're businesses that hang out at the burning gates of financial hell: Cash Converters, Amazing loans, Money3, and payday predatory loan shark shops that specialise in the debt merry-go-round of misery.

And it's important to understand that financial hardship isn't something that just happens "over there". From years of writing this column, I can tell you it happens to people everyday, everywhere:

You go to the doctor for a checkup and are diagnosed with aggressive cancer.

You develop a gambling addiction (Tom Waterhouse knows what punters want).

You lose your job. You lose your self-respect. You can't get another.

Your husband beats you, and you flee with your kids.

In all these cases, depression often ensues. And while you struggle with the black fog, the penalty fees and interest compounds. And that's when a not for profit financial counsellor steps in.

They stand in your corner, and negotiate with the banks on your behalf.

And for their hard work and dedication, most of these counsellors get paid less than bank tellers (especially when you factor in the bonuses tellers make for flogging credit cards). Yet these counsellors are uniquely qualified to shine a light on how the banks treat their most vulnerable customers. You might say they are the ultimate financial alpacas.

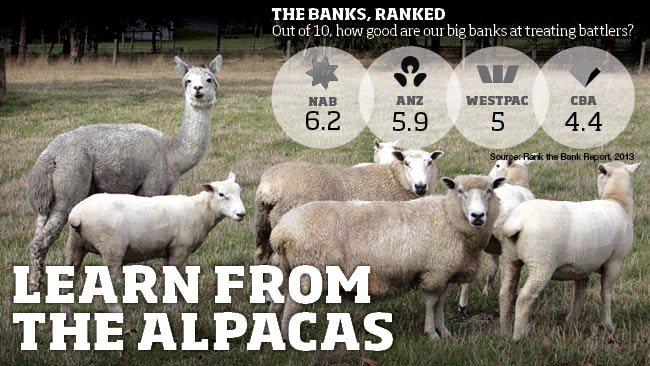

And that's the idea behind the bunch of renegades standing firmly behind the annual Rank the Banks Report: instead of beating the banks over the head, they created positive competition by ranking them according to their ability to show mercy and humility.

Last year the Financial Counsellors Association ran a pilot survey in Victoria. When they released the results, ANZ were unhappy with their ranking, and made positive steps to move themselves off the bottom of the rankings this year - and thankfully for all involved - they achieved it by investing in their hardship processes.

And this wasn't the only ranking system unveiled this week - cue the BrandZ Top 100 Most Valuable Global Brands by marketing conglomerate WPP.

It found that three of Australia's big four banks were among the most valuable brands in the world: Commonwealth's brand value was $US17.7 billion, ANZ (US16.6 billion), and Westpac ($US10.1 billion).

Ironically, one of the world's most valuable brands, the CBA ranked as the worst bank for battlers to deal with of the big four, according to Rank the Bank. (Of the second tier banks that were also ranked, a special mention goes to Citibank and Macquarie who were the bottom of the barrel).

I was proud to launch the first national Rank the Bank report in Sydney earlier this week, and salute them for their hard work. Even though the financial counsellors couldn't afford to print the report - they could rest assured that the big banks are right now working out how to get themselves off the bottom of the tables next year.

So if you're worried about financial foxes, call the nationwide financial counselling hotline on 1 800 007 007.

When you combine their expert counselling with your own alpaca styled intensity - you can achieve anything.

Tread your own path!