First home-buyers warned over no-deposit loans

Aspiring homeowners struggling with property prices — and the conservative lending approach of banks — are being tempted by no-deposit loans. But there’s a catch, experts warn.

Budgeting

Don't miss out on the headlines from Budgeting. Followed categories will be added to My News.

Exclusive: Aspiring homeowners with no savings have been given fresh hope to buy property without having to stump up a deposit.

It comes amid a long-running crackdown in the mortgage market and fallout from the financial services’ Royal Commission, forcing lenders to be more conservative on who they dish out loans to.

Restrictions have resulted in many lenders moving away from offering loans with small deposits and also reducing interest-only lending.

Many first-time buyers have been pushed out of the market due to soaring house prices in many capital cities.

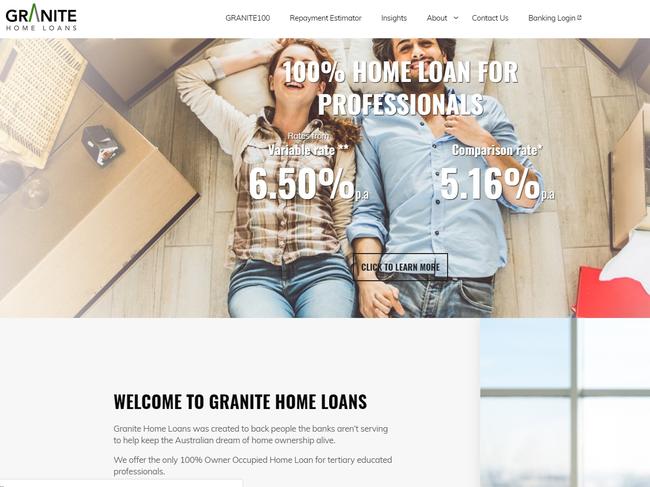

Sydney-based lender Granite Home Loans has rolled out a 100 per cent home loan where no deposit is needed.

MORE: How the shock rate rise will affect you

MORE: Slash $14,000 your from home loan interest charges

MORE: Five things you must know before refinancing

Successful applicants must be tertiary-educated and have been employed in the same professional industry for at least three years.

They can borrow up to $1 million and escape lender’s mortgage insurance (LMI), an expensive charge that protects the lender if the borrower defaults on the loan.

LMI can cost tens of thousands of dollars.

Granite’s first customer father-of-two and professional Mallikargun Pandey, 37, signed up the to the no deposit loan to buy a four-bedroom home for $945,000 in Sydney’s western suburbs.

He had cash savings of $60,000 to go towards stamp duty and legal costs but had no actual deposit saved.

“It helped because I didn’t need a deposit and I could move into the home straight away,” Mr Pandey.

His household income with his wife is $275,000 per year.

“I had the option of staying and renting where I was and save for a deposit or move into a house where the kids could play in the backyard straight away,” Mr Pandey said.

The Granite loans charge a hefty establishment fee of $3500 and attract a high variable interest rate of 6.5 per cent.

This is almost double some of the lowest rate offerings at just 3.5 per cent.

For a borrower with a $500,000 their monthly repayments at a rate of 6.5 per cent would be $3160.

This is compared to customers paying a rate at 3.5 per cent — repayments would be $2245 per month.

Once the customer has 20 per cent equity in their home the customer’s interest rate drops to the standard variable rate which is significantly lower.

Granite Home Loans’ co-founder Craig Mackenzie said the loans are designed to help those struggling to get into the market but on a good salary to make home ownership happen sooner.

“Many people are having to rely on the bank of mum and dad to enter the housing market,” he said.

“People are often renting and trying to save in parallel, it enables people to get into their home now and start building their equity.”

But Home Loan Experts’ managing director Otto Dargan said the “best way for first home buyers to get into the market is with a guarantor loan.”

“This is where their parents provide their property as additional security,” he said.

“Most major lenders will lend up to 95 per cent of the property value.”

Originally published as First home-buyers warned over no-deposit loans