‘Everyone broke?’: 32-year-old’s question reveals wealth gap in Australia

A young Aussie couple who both work super hard have been left feeling “overwhelmed” amid the housing crisis.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

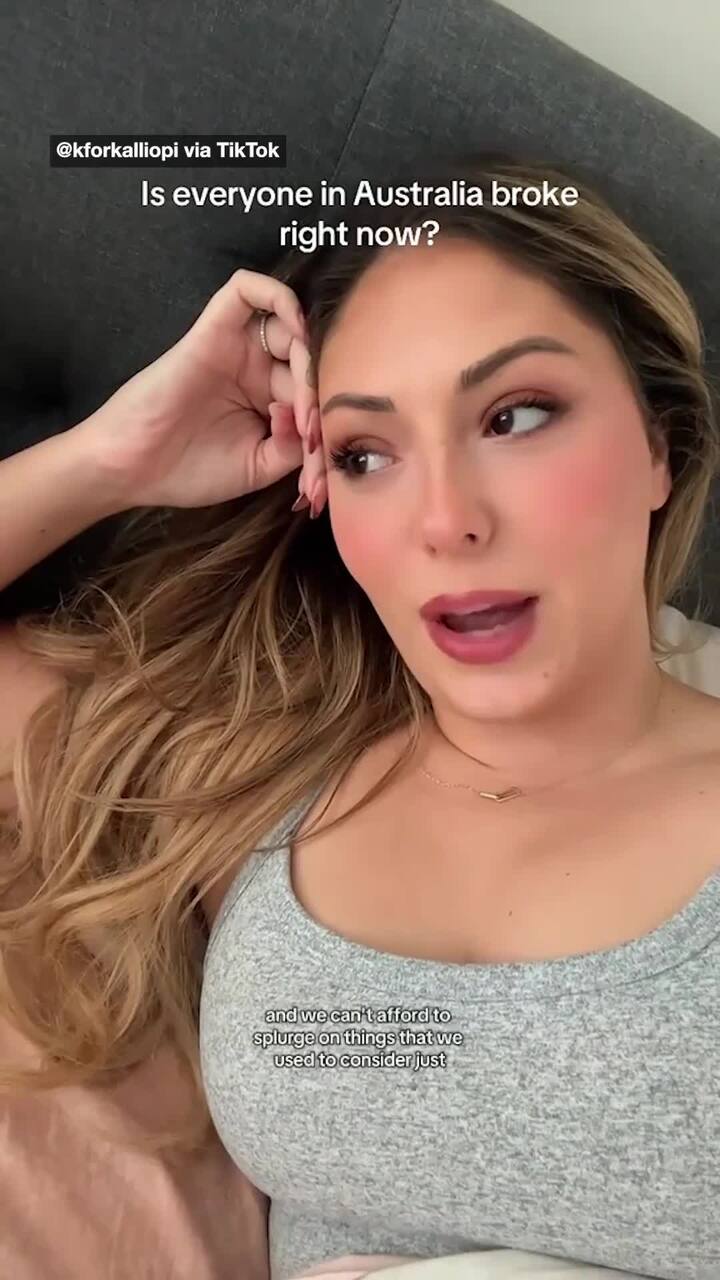

“Is everyone in Australia just broke right now?”

The response to this question has exposed how much Australia’s wealth divide is widening.

Kalliopi Roditis lives in Sydney, and she took to social media to ask if everyone feels like they’re in the same “sinking boat” because of the cost of living crisis.

The 32-year-old said that what used to be considered “normal purchases” have become splurges, and buying groceries is painfully expensive in 2025.

“I used to consider Dior and Chanel luxury, not eggs,” she shared online.

MORE: A guide to the average salary in Australia

MORE: Australia’s fastest growing salaries

The Sydneysider’s remarks immediately hit a nerve with Australians, but the response was divided.

Of course, some Aussies immediately agreed with Ms Roditis, sharing how tough they were doing it.

“I’m 37, no house, $3000 in the bank,” one wrote.

“There is no middle class anymore. Rich and poor,” someone else observed.

“Yep. I hate how this country has become,” another said.

“I’m struggling emotionally, spiritually, mentally and physically. Your girl is exhausted,” one wrote.

Plenty of people also replied and claimed they weren’t struggling at all.

“I’m fine actually,” one said.

“I’m 26-years-old and doing damn well,” another bragged.

“I don’t know anyone financially struggling,” someone else declared.

“Full make-up, nails done, lives at the hairdresser, home on a weekday, not at work, I think your boat is fine,” another trolled.

The divided response might seem unexpected, but the financial comparison website Finder has found that the wealth divide in Australia is becoming more acute because of the cost of living crisis.

Finder’s Consumer Sentiment Tracker revealed 16 per cent of households earning up to $100,000 would exhaust their savings within a week if unemployed, more than double the seven per cent found in households earning over $100,000.

More than half of lower-income households would deplete their savings within a month, compared to 35 per cent of higher-income households.

Almost 1 in 4 higher-income households could sustain themselves for over a year, while only 16 per cent of lower-income households could achieve the same.

This comes as a recent survey from Finder revelled 45 per cent of lower-income households have less than $1000 in savings, compared to 27 per cent of higher-income households.

Speaking to news.com.au, the 32-year-old said that she feels the cost-of-living crisis is “getting worst” rather than getting better.

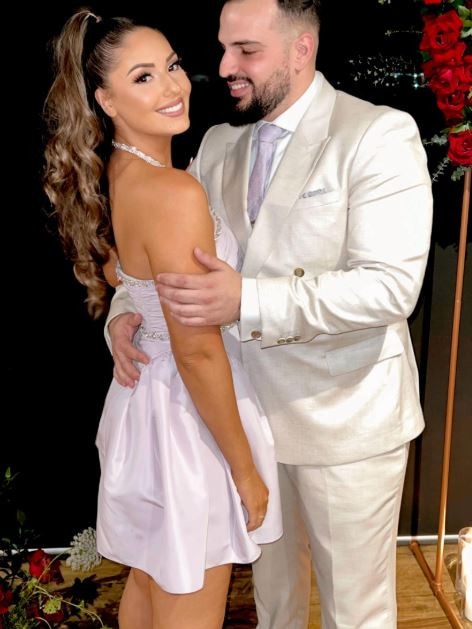

Ms Roditis said that 2025 has hit particularly hard. She got married last year and, instead of buying a home, they’re shopping at Aldi and still renting.

“Everything in the past year has been getting worse. I was never someone that shopped at Aldi before, not because there is anything wrong with it, I was just more of a Coles and Woolies shopper,” she explained.

It has now gotten to the point where she has become so anxious about her grocery bill that she’s started shopping around for the best deals.

She’s also changed the way she lives. Going to the shops, regular self-care, nail appointments, and hair appointments have all had to become irregular.

The 32-year-old is trying to cut back in every way she can, but even then, it isn’t enough.

For instance, she and her husband live in a small apartment and pay $550 a week, which is cheap for a place in Sydney, but the “bedroom is basically in the kitchen” and they’ve been there for five years.

Their plan was to rent somewhere small to save up and buy a place, but even with a $150,000+ combined income, they are struggling to get ahead.

“We had plans to buy a house after getting married, but we’re back to renting, and they’ve upped our rent by $100 per week,” she said.

“We can’t buy. We have had meetings with brokers and even they’re telling us, ‘It is really tough, you might have to wait longer’,” she said.

The plan was to borrow between $750,000 and $800,000, and the couple based in Sydney’s east are prepared to move out west to buy, but they can’t even get that deal underway.

“All my friends have moved to buy and are now in the middle of nowhere,” she said.

Ms Roditis said she’s now “overwhelmed” and disheartened, claiming the Australian dream of home ownership feels rigged and impossible.

“We are trying so hard,” she said.

“On paper, our salaries are huge, but we can’t get anything.”

More Coverage

Originally published as ‘Everyone broke?’: 32-year-old’s question reveals wealth gap in Australia