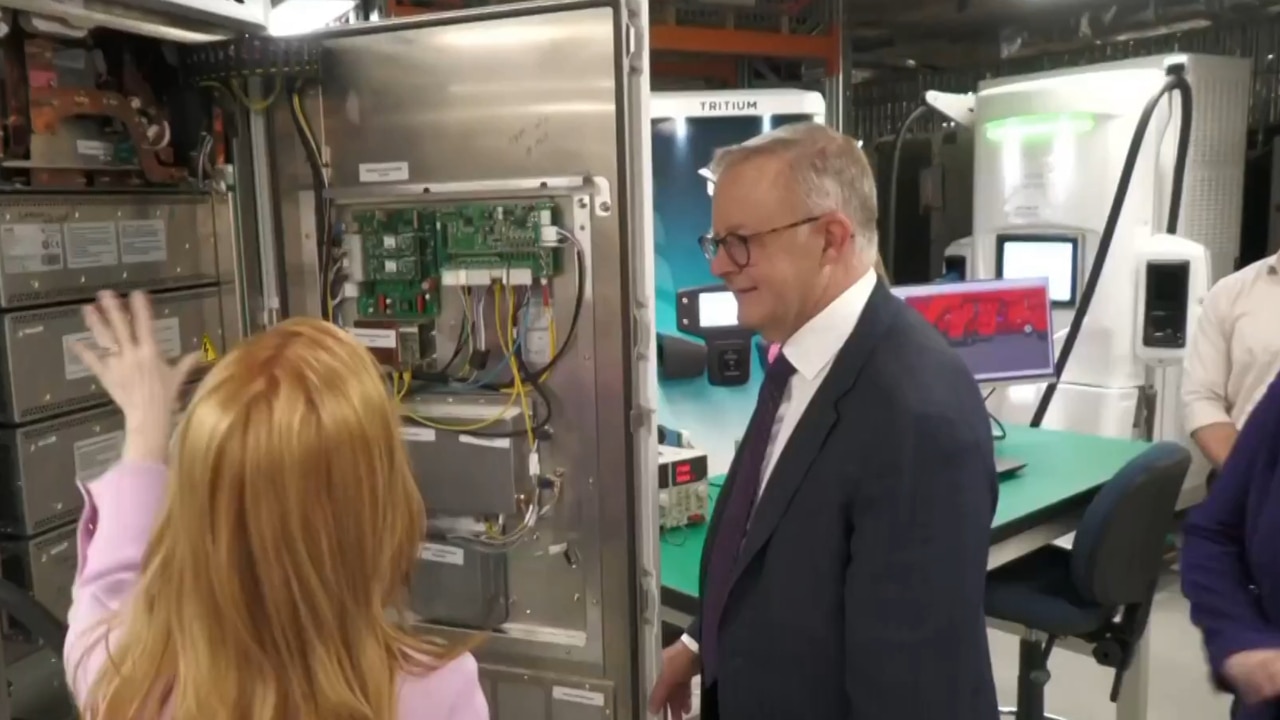

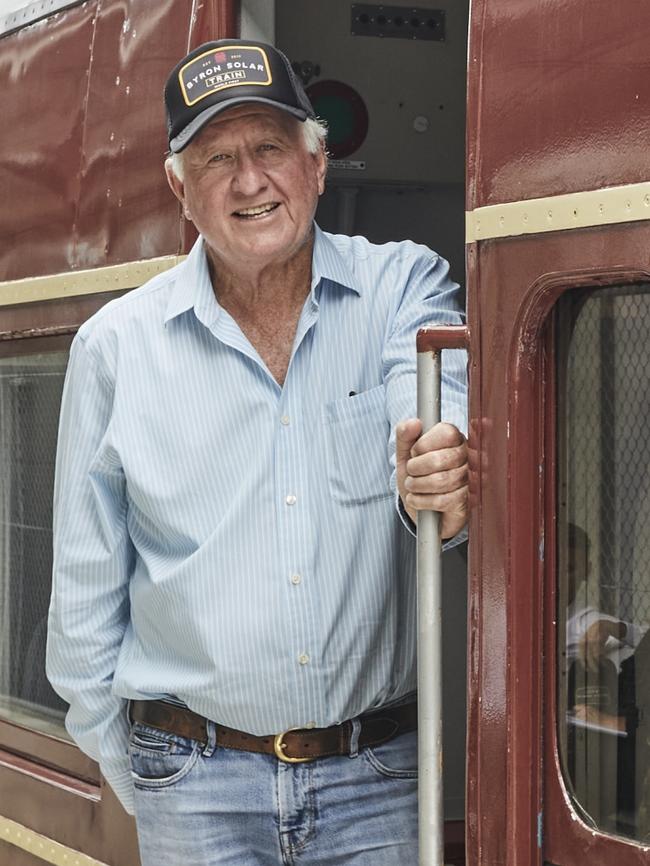

Energy richlister Trevor St Baker says funding is on the way and Tritium will survive

Tritium director Trevor St Baker is confident the Brisbane-based electric vehicle fast-charger company will receive enough funding through a rescue package to ensure its survival.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Energy richlister Trevor St Baker says an imminent funding rescue package for troubled fast-charging company Tritium will be enough to pull it out of a financial death spiral.

Mr St Baker, a director of Tritium who controls about 22 per cent of the firm, told The Australianon Friday that an announcement on further funding for the company would be revealed soon and he was confident Tritium would survive. He declined to give further details.

Mr St Baker noted that Brisbane-based Tritium was operating in a very competitive market where rivals were prepared to lose money to attract customers.

Last year Tritium chief executive Jane Hunter was standing next to US President Joe Biden as the most powerful man in the world extolled the virtues of the company’s role in the electric vehicle revolution.

Now Ms Hunter is in a fight to save the financially-stricken manufacturer whose appeals for a funding lifeline have been spurned by the same politicians who had previously flocked to its HQ for advantageous photo opportunities.

Ms Hunter was not available for interview, but said via a LinkedIn message this week she was “not sure why the press is creating a story out of nothing and damaging the business”.

Tritium’s shares are down almost 90 per cent this year on the US Nasdaq. the company has burned through $US40m in cash in the past 12 months as it progressed ambitions to open a huge factory in Tennessee for its EV fast chargers,

That has tested the patience of its deep-pocketed investors such as Brian Flannery, who have pumped millions of dollars into the company in recent years.

Tritium, founded in 2001 by engineers David Finn, James Kennedy and Paul Sernia, has won deals with, among others, BP and Shell to supply fast chargers across the world. But as the same time as Ms Hunter shared a White House podium with Mr Biden, Tritium was losing millions as it attempted to grab market share in an increasingly competitive market.

The Biden administration is providing $US7.5bn in funding for EV charging infrastructure as well as tax credits for both new and used electric passenger vehicles.

Even Tritium admits its operating model has risks in a fast-changing market. Tritium has so far focused exclusively on developing public DC fast-charging stations as well as for government and corporate fleets.

Many of its competitors, however, offer cheaper home-based AC charging equipment which may in the long run reduce demand for Tritium’s public charging stations.

Another competitive threat comes from EV giant Tesla, which has a large public DC charging network in the US, using its North American Charging Standard (NACS).

Billionaire Brian Flannery, who owns about 5 per cent of Tritium, said he would not be investing any more money into Tritium after declaring its Brisbane factory, that employs about 400 people, could never make any money given high energy and labour costs in Australia.

Mr Flannery said similar EV chargers could be made in China or Estonia for a fraction of getting them made in Australia and that Tritium should have shifted its manufacturing to the US earlier.

Mr St Baker, who was an early investor in Tritium and has provided at least 10 rounds of funding in the past decade, noted there “were a lot of loss leaders in the market”.

PwC said the number of charge points in the US was poised to grow from about four million to an estimated 35 million in 2030.

The industry is expected to expand from $US7bn to $US100bn by 2040 as the number of EV on American roads surges to 92 million. But PwC said many companies in the sector were facing high upfront costs for research and development and that such “expenditure was needed to stay competitive”.

The concerns is that Tritium’s competitors, such as ABB and Siemens, may have the financial firepower to stay in the game longer. It’s not unusual for early-stage tech companies to experience heavy losses but investors such as Mr Flannery have expressed shock at the extent of the red ink. The company reported losses of almost $190m this year.

Tritium, in a filing with the US Securities and Exchange Commission in September, revealed cash reserves over the past year had fallen from $US71m last June to $US29m.

In the same filing, it warned investors that it was a growth-stage company with a “history of losses” and was expected to incur significant expenses and continuing losses. Importantly, it said it faced significant competition as the EV charging market developed.

“We rely on a limited number of suppliers and manufacturers of certain key components for our charging stations,” the filing said.

“A loss of any of these partners, including as a result of a global supply shortage, major shipping disruption, or insolvency or acquisition, could negatively affect our business, financial condition and operating results.”

Tritium said future revenue growth would depend on its ability to increase sales across all types of clients, including public network operators, fuel retailers and fleet operators.

“Failure to effectively expand our sales and marketing capabilities could harm our ability to increase our customer base, maintain and grow our market share and achieve broader market acceptance of our solutions,” the company said.

Both the Queensland and federal governments have indicated they would not put any money into the company, so the funding announcement foreshadowed by Mr St Baker will be vital if Tritium is to survive.

Federal Industry and Science Minister Ed Husic said from London this week the he would be reluctant to provide funding to Tritium.

“We haven’t made a call about whether or not we’ll back them in and I’d be reluctant to make a call on that,” Mr Husic told a forum.

“Investors will be obviously working with the management team to determine what they will do next. As for approaching the government, we haven’t received one yet but I’d be very reluctant to necessarily make a positive decision given that there’s a lot more that needs to be worked out within that company.”

Earlier, the Queensland government rebuffed a request from Tritium for $91m.

Originally published as Energy richlister Trevor St Baker says funding is on the way and Tritium will survive