Energy regulator warns households, bills could skyrocket

The Australian Energy Regulator has warned households to brace for a potential spike in their electricity bills. But why?

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

While wholesale energy prices have continued to moderate, the Australian Energy Regulator this morning warned Australians their electricity bills may spike, as volatile spot prices plague the National Electricity Market (NEM).

The mounting unreliability of ageing coal-fired power units has seen the frequency of unplanned outages soar in the latter half of this year, which according to the regulator may flow through to household electricity prices.

From July to September there were more unplanned coal outages than in any other quarter since the settlement period for spot prices were changed in October of 2021.

Governments in NSW and Victoria have been scrambling to keep giant coal-fired power plants operational while extra dispatchable capacity is added to the grid. Extensions to the lifespan of Origin’s Eraring power plant are expected to cost the government up to $225 million a year.

Late last month the energy market operator called upon the industry to cancel planned outages in the wake of significant demand and unexpected outages across NSW coal-fired plants. Australian have been told to prepare for a summer of rolling blackouts, with “load shedding” expected across the country.

Chairwoman of the Australian Energy Regulator, Claire Savage acknowledged that while prices have moderated, price spikes continue to wreak havoc.

“Wholesale electricity spot prices have fallen since late 2022, thanks to lower fuel costs, increased renewable energy, and government actions. However, the market remains unpredictable, with outages, weather variability, and high demand contributing to price spikes,” Ms Savage said.

“Greater spot price volatility can flow through to higher forward contract prices that then impact household electricity bills.”

As the market continues to manage the shift away from coal-fired power towards renewable generation, AER Chair Clare Savage emphasised that, “Structural reforms and timely investments in dispatchable and renewable capacity are needed to address price volatility, market stability and competition.”

Ms Savage said these reforms would be key to ensuring lower costs for consumers while also maintaining the investment essential to the transition.

Labor’s 82 per cent renewable energy target by 2050, alongside the Capacity Investment Scheme and its flagship Future Made in Australia policy has seen developers flock to invest in the renewable energy sector.

Intermittent renewable power sources now represent over 30 per cent of total electricity generation.

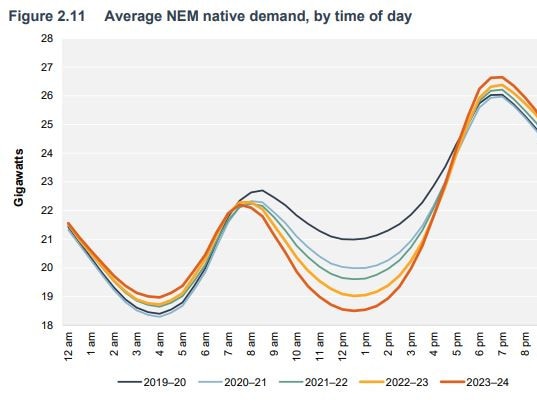

And while the proliferation of solar, wind and other renewables has greatly reduced spot prices during the day, the report identified that “market outcomes vary considerably between when renewables are operating and when they are not.”

“Outside of solar hours, dispatchable generation (primarily coal, gas, hydro and batteries) still sets the price over 90 per cent of time,” the report said.

Meanwhile during the day, where solar generation is high and electricity demand is low, spot prices plummet into negative figures. The report identifies this is a gap in the market for battery operators to arbitrage, capitalising on the difference between spot prices.

Talking to the AFR, Ms Savage addressed this market saturation. “People sometimes talk about solar cannibalising itself,” Ms Savage said.

“You get so many negative prices in those solar hours that it becomes difficult to build more solar commercially.”

The report also conducted a deep-dive on the South Australian energy market which now generates more than 70 per cent of its electricity from renewable sources. The state has been rocked by severe price volatility, with the report identifying competitive inefficiencies and shifting market dynamics as the source of South Australia’s pain.

The findings of the report come as the Federal Government is set to kick off its own review of market settings in the NEM, aiming to prepare a road map to promote investment into renewable generation and storage capacity.

Originally published as Energy regulator warns households, bills could skyrocket