Real cost of inflation and interest rate rises to average Aussies revealed

Australians might not realise exactly how much they are out of pocket as the economy falters. Now the real cost to each of us has been revealed.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Sure as eggs, rising interest rates are making asset values fall. It’s like synchronised swimming. As the central banks pop up their heads, the markets pull theirs down.

Australia’s central bank, the Reserve Bank of Australia (RBA) raised interest rates by a hefty 0.50 percentage points this month.

The US central bank, the Federal Reserve, did even more, raising rates by 0.75 per cent. Central banks are prowling because they are trying to crush inflation, and asset prices are collateral damage. Crypto is down, housing is down and shares are down.

All around the world people are lining up to sell assets they held happily through the past few years, and finding few willing buyers. Prices are falling left and right. That hits Aussies right in their wealth centre. As the next chart shows, we’re out of pocket an estimated $3500 on average. And that’s a conservative estimate. Let’s look at just the past three months.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Your super

Local shares have fallen 8.7 per cent. That’s bad news because we each, on average, have $21,000 in superannuation invested in local shares. We’ve lost an average of $1837 there.

International shares have fallen an estimated 6.3 per cent. We have even more of our super invested in those, $23,760 each on average. Those have gone down an estimated $1504.

So we’ve lost over $3000 in super alone, per person. This is a conservative estimate because share investments only account for a bit over half of super. It’s likely many of the other investments fell too, but they are harder to account for so we won’t include them.

We’re also not including shares held outside super.

Cryptocurrency

Crypto is not a huge asset class – just 20 per cent of Australians own any crypto, and it’s not much – a few hundred bucks worth on average. But when an asset falls like crypto has done in the last three months, i.e. spectacularly, even a small holding can generate a considerable loss.

We will simplify matters by just looking at bitcoin, which is down 41 per cent in AUD terms in the last three months. That works out to a loss of $347 per Australian on average. (Of course the average is a funny way to look at it. The reality is that people who own bitcoin took a bigger whack while the median Australian lost absolutely nothing because they don’t own crypto. Still, the average per person is useful to help us compare how buying power per person might have shrunk.)

Housing

Housing is down just 0.1 per cent in the past three months for Australia on average, although prices have fallen rather more than that in Sydney (-1.8 per cent) while rising in Adelaide (+5.6 per cent). A fall of 0.1 per cent on our roughly $10 trillion worth of homes nets out to a loss of $40 per person in the past three months. Not that much. Which is lucky, really, because housing is by far our biggest asset. But watch this space. Big banks are predicting significant house price falls that could make the average Aussie feel considerably less wealthy.

But why now?

All these asset price falls are making Aussies poorer. If a $750 stimulus payment per worker on the way into the pandemic was supposed to spark the economy to life, then sucking $3500 per person out could certainly help cool the economy down.

Which is how monetary policy is supposed to work. They want to make us feel a bit poorer, spend a bit less, so shops have fewer customers and less reason to raise prices. That’s one of the ways in which raising interest rates cools down inflation.

Putting water in the petrol tank

I like to explain the economy as a car. Income and wealth are like how fast the car is going while inflation is just an accidental by-product of going too fast: It’s like the heat of the engine. The RBA tries to manage the health of the engine over the really long run. Not by looking at the speedo (the growth of our incomes and wealth) but by the temperature gauge (inflation). When the economy gets too hot, the RBA cools things down by raising interest rates. It’s painful to go slower in the short run but it stops us getting into an inflation spiral (in theory at least).

The good news

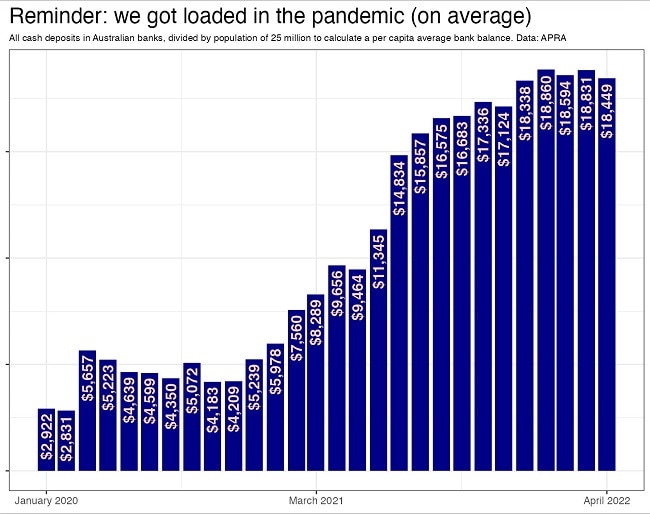

The good news is that recent falls in wealth are pretty small compared to the build-up during the pandemic. Let’s just look at bank accounts. There was an absolutely massive tidal wave of money handed out in the pandemic, and it ended up in bank accounts, as the next chart shows. This is the money that will be funding the higher grocery bills and higher mortgage repayments over the next little while.

Of course, that’s just an average. Not everyone has this much cash. The RBA governor Philip Lowe went on TV last week to talk about how interest rate rises are hitting and he said this:

“We know already for some households they are finding it difficult.”

His message to those people, however? It was basically: sorry not sorry, we have to do this.

“At the end of the day, though, our responsibility is a national one. We want to make sure that inflation is low and stable, the country gets to full employment, the financial stability of the country is preserved,” he said.

Originally published as Real cost of inflation and interest rate rises to average Aussies revealed