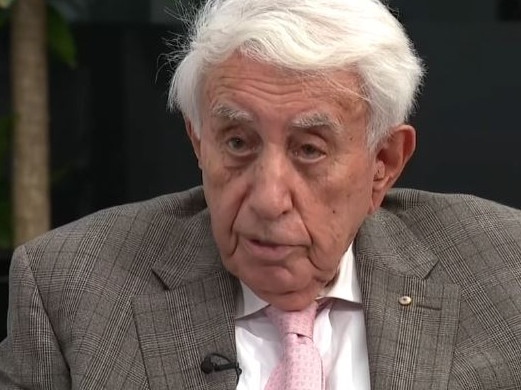

Meriton boss Harry Triguboff predicts Australia is headed for recession

One of Australia’s richest men has claimed the country is destined for recession without urgent government action, and has also blasted the RBA.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

A billionaire developer has claimed the country is destined for recession without urgent government intervention, and has also blasted the RBA’s handling of our inflation crisis.

Speaking to Seven News reporter Chris Reason this week, Meriton founder Harry Triguboff said interest rate hikes would do little to battle the nation’s skyrocketing cost of living – and claimed the only way out of the housing shortage was by building up.

The 90-year-old also said the government needed to act fast to avoid an economic disaster – an outcome he was seriously concerned about.

“Unless we improve the way we run the place we could easily have a recession,” he told Channel 7.

“I don’t believe that by raising interest rates you stop inflation – I don’t believe it.”

Mr Triguboff added that the current housing and rental nightmare plaguing the nation could only be eased by increasing supply.

“We have to build more, we all agree on that,” he said, adding that he supported NSW Premier Chris Minn’s plans to build up instead out of out in Sydney via apartment developments.

“He makes the right noises, he says we need apartments – 100 per cent right,” Mr Triguboff said, but insisted better communication was needed between governments and developers.

“We have to know what they want to do, and they should know what we want to do,” he said.

With only half of the estimated 350,000 new homes Sydney needs currently in the pipeline, Mr Triguboff said it was important for federal, state and local governments to cut red tape, slash charges and speed up approvals in order to address the shortfall.

“We have to also approve smaller ones and quicker,” he said, insisting it was time for parts of Sydney that have traditionally resisted large developments to open up, and adding that prices would be eased with more approvals.

His comments come as finance guru Mark Bouris spoke out about rumours of distressed homeowners quietly selling their properties, in what he described as a “bad indicator” for the market.

The executive chairman of mortgage broker Yellow Brick Road on Wednesday issued a dire prediction for next month’s Reserve Bank meeting, saying it was “more than likely” the board would raise rates for the 12th time.

In its May meeting, the board voted to raise the cash rate by 25 basis points to 3.85 per cent, once again putting the squeeze on struggling mortgage holders.

“Given what’s going on overseas, the UK just put their rates up, the US are considering putting their rates up, irrespective of the fact that inflation looks like it’s declining, I think there’s every chance of a couple more rate rises,” Mr Bouris told Sky News.

“Inflation is proving to be extraordinarily stubborn at 7 per cent.”

His comments came as fresh data showed wages growth increased to a decade-high of 3.7 per cent in the year to March, up from 3.3 per cent.

But the 0.8 per cent quarterly increase in the Australian Bureau of Statistics’ wage price index was slightly below economists’ forecasts of 0.9 per cent, weighing against the likelihood of the RBA raising rates again as early as June.

APAC economist at Indeed Callam Pickering said while wages were growing at their fastest annual pace in a decade, the “reality is that the purchasing power of Australian incomes has crashed”.

“The disconnect between wage growth and inflation is devastating for households across the country, with cost of living pressures easily outstripping wage gains,” he said.

“Adjusted for inflation, Australian wages have fallen by 3.2 per cent over the past year and by 7.2 per cent since their peak. More than a decade of hard-won wage gains – our blood, sweat and tears – lost over the course of just one year.

“Unless you’ve received a promotion or changed employer recently, there is a good chance that your salary buys a lot less now than it did a year ago.”

It also follows new research which revealed a staggering number of Aussie businesses are planning to lay off staff in 2023 as the grim economic conditions plaguing the globe start to wreak havoc locally as well.

Almost two in five business leaders (38 per cent) expect to let employees go this year, according to data from a new research report by global HR firm Deel and YouGov, with 15 per cent saying it will impact up to 20 per cent of their team.

Deel’s new “Australian Business Leader Pulse Check: Business Growth, Workforce and Hiring” report found that 92 per cent of bosses are battling rising costs and inflation at the moment, with 75 per cent of respondents indicating their businesses will take measures related to staff, including 32 per cent who plan to review or reduce overheads and 20 per cent who expect to consolidate departments or functions.

Meanwhile, 45 per cent of senior business decision-makers cite rising operating costs as the top challenge in Australia in 2023, with 47 per cent opting to not offer pay rises at all as a result, or to offer raises to high performers only.

Originally published as Meriton boss Harry Triguboff predicts Australia is headed for recession