‘Disaster situation’: Top economist’s warning about RBA rate cut

Mortgage holders celebrating today’s long-awaited rate cut by the RBA might not be smiling for long, a leading economist has warned.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

A leading economist has warned mortgage holders they could face interest rate hikes later this year as a result of the Reserve Bank of Australia’s (RBA) decision today.

Judo Bank chief economic adviser Warren Hogan predicted a “disaster situation” unfolding because it’s still too early for rates to come down,

Mr Hogan believes the RBA board risks driving up inflation before it’s truly under control.

“It might sound attractive to a lot of Australians with mortgages to get a rate cut or two and save $50 a month in the short-term over the next six months, maybe even 12 months,” Mr Hogan said.

“But if that puts at risk rates going up by a percentage point or two, and then having to come up with actually not just that $50 back, but then another $100 or $150, do they really want that $50 right now and then putting at risk that it’s going to go up later?

“Cutting just as the economy is picking up and before inflation comes down [runs the] risk of not only stopping inflation coming down, but inflation going back up again, and then having to raise rates and not just a few times, a lot.

“That’s the disaster situation that we really must avoid, is rates going up a lot from here.”

MORE:Sneaky bank trick that will stop RBA cut

Mr Hogan isn’t alone in his view that it might be too soon.

Noel Whittaker, an adjunct professor at the Queensland University of Technology, felt the RBA board could’ve waited a little longer.

“The problem is inflation in the building industry remains massive, labour shortages are severe, and the job market is still strong – keeping inflationary pressure on the economy,” Dr Whittaker said.

“Right now, I don’t see how a rate cut can be justified, even though I have enormous sympathy for mortgage holders doing it tough. It’s a sad system when they bear the brunt of the fight against inflation.”

MORE: Home loan trap taking years to escape

Professor Richard Holden from UNSW’s Business School said discussions about inflation are excluding one important detail.

“Adjusting for subsidies, core inflation is still sitting at 3.3 per cent,” Professor Holden said, and that’s outside the target range.

His colleague Evgenia Dechter, an expert in macroeconomics and an adjunct professor at UNSW, also shares concerns about core inflation remaining “elevated”.

Stella Huangfu, an economist and associate professor at the University of Sydney, thinks the RBA should have held today.

“Inflation has only just returned to the target range, so it’s probably too early to cut rates,” Dr Huangfu said. “Plus, the job market is still strong, which shows the economy is holding up well.”

Oxford Economics Australia’s head of macroeconomic forecasting, Sean Langcake, said the RBA board’s deliberations were likely “a close run”, with a few unanswered questions likely to weigh heavy.

“There are still questions about where underlying inflation will be once the impact of subsidies wash out,” Mr Langcake said.

“Services inflation is still looking very strong – a by-product of the labour market still operating beyond its capacity.”

Leading business figure Peter Boehm, managing director of Pathfinder Consulting, doesn’t share the view that rates must come down because inflation is easing.

“Inflation has been impacted by government subsidiaries and it is unclear whether the reduction is sustainable,” Mr Boehm said. “If it’s not, reducing rates will be inflationary.”

He added: “The strength of the labour market has seen low unemployment rates. You don’t reduce rates in these circumstances because they will have an inflationary impact.”

On top of that, the Australian dollar is weak against both the US dollar and the currencies of major trading partners, pushing up imports prices and putting upward pressure on inflation.

“Reducing interest rates may further exasperate this position,” he said.

And the intense uncertainty in global trade and financial markets, thanks to US President Donald Trump’s hefty tariff threats, is cause for concern.

“This could have negative impacts on the Australian economy, and in such circumstances, it would be better to wait and see what these impacts might translate into.

“Reducing rates now would therefore not be a prudent move.”

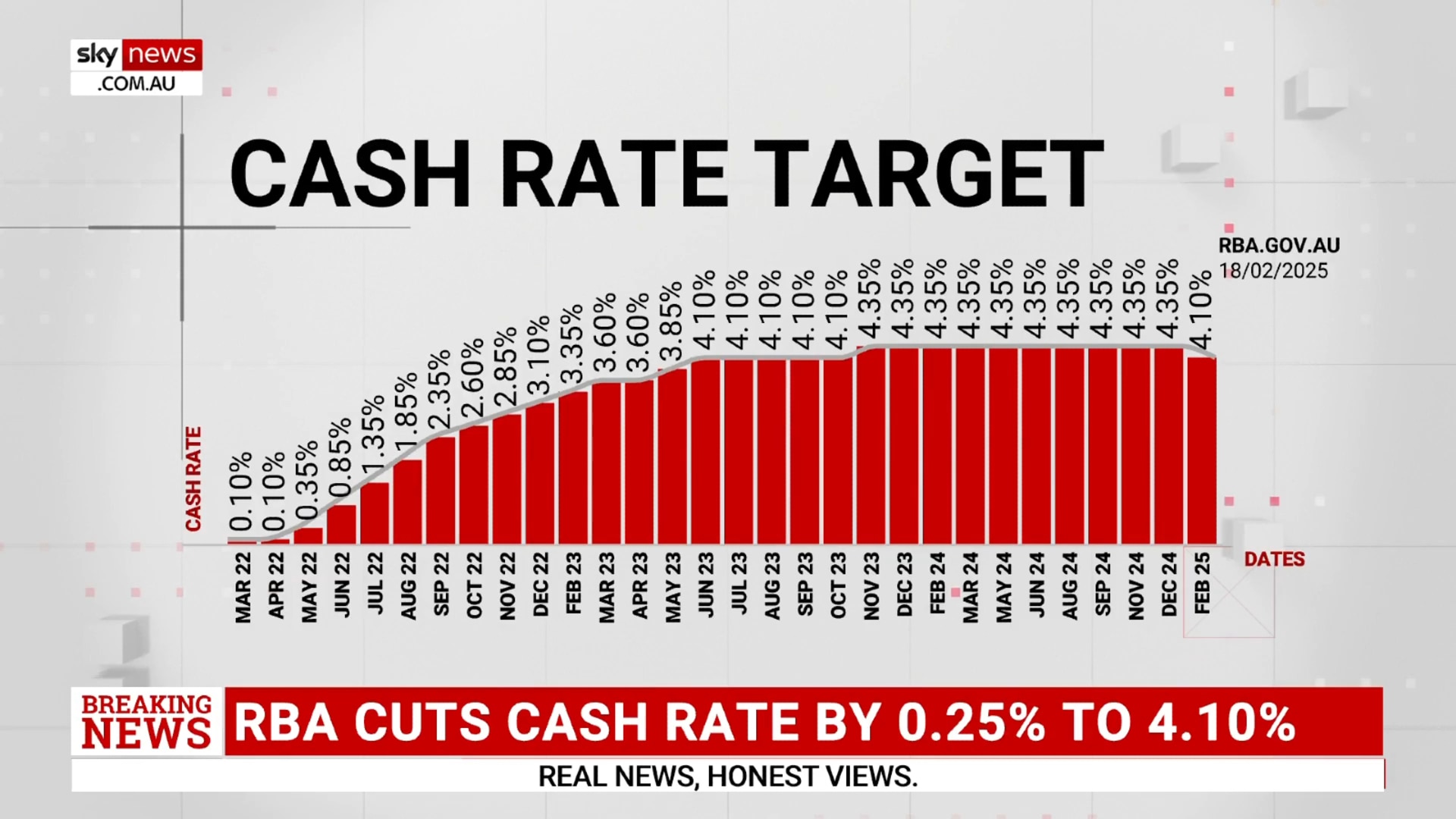

It has been almost four year since the RBA began hiking interest rates, taking the cash rate from a historic low of 0.1 per cent to 4.35 per cent currently via a whopping 13 increases.

A rate cut today of 25 basis points brings it down to 4.1 per cent.

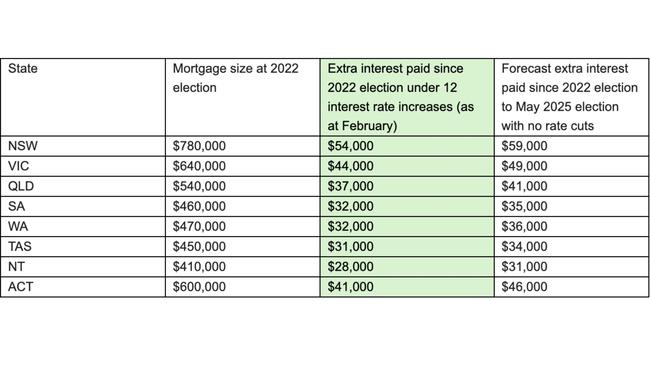

Aussies paying off the average mortgage balance of $641,416 will save about $100 each month.

Those who’ve purchased a home more recently will keep even more in their pockets.

With the average home price in Sydney sitting at $1.13 million, and based on a loan-to-value ratio of 80 per cent, the monthly savings equate to about $145.

Originally published as ‘Disaster situation’: Top economist’s warning about RBA rate cut