‘Absolute rollercoaster’: Huge interest rates prediction revealed as RBA decision looms

A massive interest rates prediction has been revealed as a major RBA decision looms – but it’s not what millions of us want to hear.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

ANALYSIS

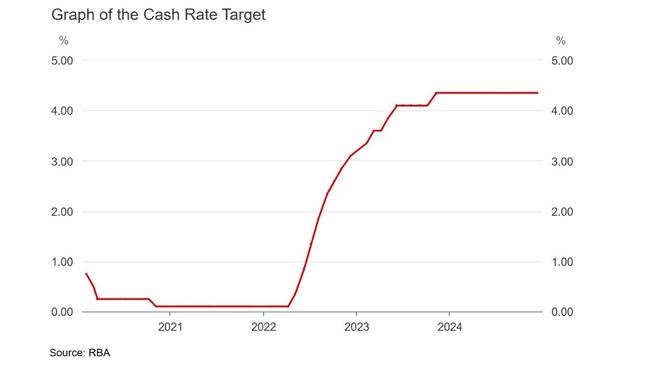

Since the Reserve Bank of Australia first started raising interest rates in May 2022, it has been an absolute rollercoaster ride of wildly unexpected twists and turns.

Seemingly as soon as rates were raised, there were already calls for the rises to cease and that cuts should be forthcoming.

In reality though, rates would go higher than almost any mainstream economist predicted and would stay higher for longer than almost any other rate rise cycle in Australian history.

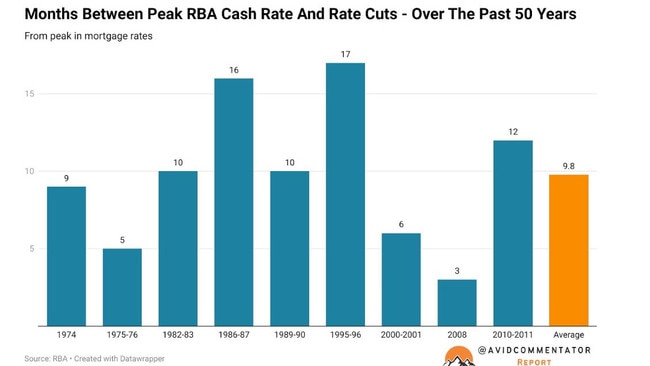

If a rate cut is postponed until April, the current cycle will represent the equal longest ever time spent at the cycle peak cash rate.

MORE:RBA cut predicted: Why you won’t get it

A little over a month before the RBA raised interest rates in May 2022, the Australian Financial Review surveyed 36 economists on how much the RBA cash rate would rise and when. Of the 36 who provided a forecast out to the end of 2023, the average prediction was for the cash rate to close out the year at a level of 1.5 per cent.

In reality, the 2023 calendar year would see the cash rate hit a level of almost three times the average forecast, hitting its peak of 4.35 per cent in November of that year.

MORE:Big bank shocks with double rate cut

The cutting room floor

With underlying inflation in the recent quarterly consumer price index surprising to the downside, economists increasingly view rate cuts in the first half of this year as a when, no longer an if. The market is now pricing in a 95 per cent chance of rates being cut by 0.25 per cent in February.

The next 0.25 per cent rate cut after that isn’t priced in until the July RBA meeting. Overall, the market is tipping 0.88 per cent worth of cuts in the cash rate over the next 18 months, with the cash rate priced to plateau around 3.47 per cent (down from 4.35 per cent at the moment).

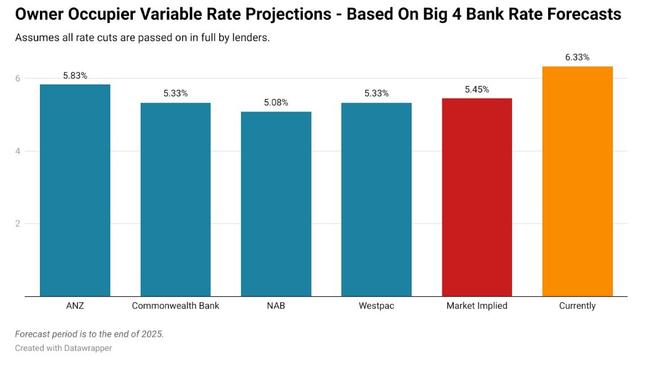

The projections for the path of rates until year’s end from the major banks are as follows:

●ANZ: Two 0.25 per cent cuts to a cash rate of 3.85 per cent

● Commonwealth Bank: Four 0.25 per cent cuts to a cash rate of 3.35 per cent

● NAB: Five 0.25 per cent cuts to a cash rate of 3.10 per cent

● Westpac: Four 0.25 per cent cuts to a cash rate of 3.35 per cent

Currently, the average payable owner occupier variable rate is 6.33 per cent. Assuming that all cuts are passed on in full, which is an open question, the average payable owner occupier variable rate will fall to between 5.08 per cent and 5.83 per cent.

Time at peak rates

In the past 50 years or so, prior to the current cycle, Australian interest rates have only spent 12 months or more at their cycle peak on three occasions – 1986-1987, 1995-1996 and 2010-2011. In most instances, rates at their highs were very much short-lived, with recessions or financial crises defining factors in four out of nine cycles.

If rates are cut at the RBA’s February meeting, we would have recorded 15 months at the cycle peak in rates.

If the RBA holds off until its next meeting in April, then it would be a record equalling 17 months of rates at their cycle peak.

The takeaway

Since the RBA slashed the cash rate from 17.5 per cent to 8.75 per cent between February 1990 and July 1993, Australians have been increasingly conditioned to expect large relative cuts in mortgage rates, and rates more broadly trending lower.

But like the era of interest rates seemingly heading ever higher in the long term that began in 1970 and persisted to 1989, these cycles eventually come to an end and reverse.

While three or more rate cuts is now the odds-on favourite from financial markets and economists alike, the size of the inevitable rate cut cycle may leave some mortgage holders disappointed.

Any cut in rates is likely to be appreciated, but the current projected low in the cash rate of a bit under 3.5 per cent is a long way from what mortgage holders have become accustomed to.

Prior to the pandemic, the cash rate sat at 0.75 per cent. During the pandemic and shortly after it sat at just 0.1 per cent, and three-year fixed rate mortgages at less than 2 per cent were the norm for a time.

Ultimately, how the nation’s mortgage holders will fare in the long term as the upcoming rate cut cycle comes into focus remains to be seen, but what is clear is that rates are not tipped to go back down to the realm of their pre-pandemic lows any time soon – at least not without some sort of major hit to financial markets or the economy.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Absolute rollercoaster’: Huge interest rates prediction revealed as RBA decision looms