Bill Shorten proposes huge small business tax cut in his Budget reply speech

BILL Shorten has vowed to slash small business tax to an historical low of 25 per cent in a challenge to the Government’s 1.5 per cent cut announced in the budget.

Fed Budget

Don't miss out on the headlines from Fed Budget. Followed categories will be added to My News.

BILL Shorten has flagged tax rates for small business to be cut to a historic low of 25 per cent in a challenge to the government’s 1.5 per cent tax cut announced in the Budget.

Accusing Prime Minister Tony Abbott of not going far enough in efforts to reignite the economy, the Opposition Leader called for bipartisan support for a policy to reduce small business tax by five percentage points.

The policy, estimated by the Opposition to cost the budget a further $2 billion on top of the government’s already promised cuts, is unfunded and would have to be phased in over a number of years.

But Treasury estimated last night that it could cost as much as $4 billion.

The Labor leader admitted in his Budget reply speech that it would take longer than the life of one parliament to implement and called on the Coalition to support it.

“A 1.5 per cent cut for small businesses might be enough to generate a headline — but it is not enough to generate the confidence and long-term growth our economy needs for jobs,” Mr Shorten said.

“I invite you to work with me on a fair and fiscally responsible plan to reduce the tax rate for Australian small business from 30 to 25 per cent. Not a 1.5 per cent cut, a 5 per cent cut.”

In his second Budget document since becoming Opposition Leader, Mr Shorten unveiled several new policies, including his own $353 million jobs plan.

If elected Mr Shorten said he would introduce a mandatory requirement that digital technology become part of the national curriculum for all primary and secondary schools.

“Digital technologies, computer science and coding — the language of computers should be taught in every primary and secondary school in Australia,” he said.

“And a Shorten Labor government will make this a national priority. We will work with states, territories and the national curriculum authority to make this happen.”

Promising to take politics out of infrastructure spending, Mr Shorten also said he would make Infrastructure Australia an independent authority with the status of the Reserve Bank, to assess projects without interference from government, and to act as a broker between private sector and state governments on projects.

New as well was a $500 million fund to stop the brain drain. Mr Shorten said he would invest in partnerships with new hi-tech start-ups to keep Australia’s intellectual capital in Australia, while delivering a return to the government on its investment.

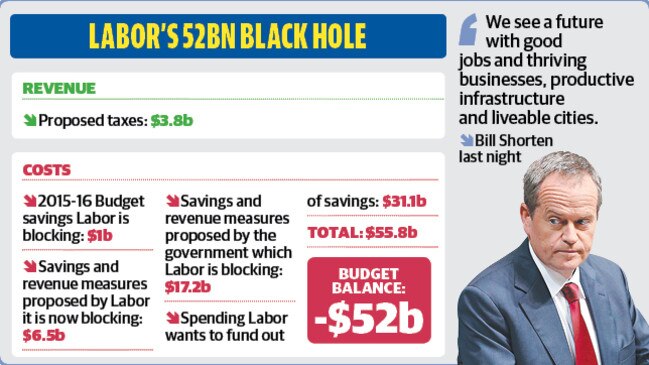

But Mr Shorten, under attack by the government for failing to support existing savings measures to fund his promises, unveiled no new savings other than the $20 billion already announced from cuts to superannuation concessions for high income earners and tax crackdown on multinationals.

Mr Shorten confirmed he would back the government’s $5.5 billion small business package. It is understood he will likely back other savings measures in the Budget, including almost $1 billion worth of cuts to FIFO concessions and a backpackers’ tax.

Mr Shorten, however, was still committed to blocking an estimated $17 billion in savings posted by the government including $7 billion in family tax payments that the Coalition want to use to fund its $4.4 billion Families package.

Mr Shorten attacked Treasurer Joe Hockey’s Budget for maintaining the unfair measures of the past Budget and accused the government of doing nothing to tackle bracket creep — which will see a million more Australians pushed into the highest tax bracket by the end of the decade.

Will there be a bang for Bill’s big bucks?

Comment

Simon Benson

FOR a bloke who the Abbott government has accused of having no idea, Bill Shorten last night came up with at least two new ones in his Budget reply speech.

The Opposition leader’s call for a tax cut for small business is worthy of examination.

At least there is now bipartisan political support for reducing taxes in this country that are crippling small businesses — the engine room of the economy.

The fact that it is an unfunded policy should not diminish it as an idea worth debating.

Opposition costings put the Budget bill at $2.1 billion on top of the $1.45 billion bill for the government’s 1.5 per cent reduction.

Treasury figures suggest that this is on the low side, with the high side getting close to $4 billion.

The question is in the bang for the buck.

Would the cost of the extra cut generate more in economic activity? And how many more jobs would such a move create.

At least the Opposition leader has entered the conversation.

Last night he presented a second idea worthy of consideration: the requirement that digital technology be made a mandatory subject in the national curriculum.

Labor has promised to fund its promises through a tax on superannuation and multinational companies.

It will have to do better than this.

Shorten talked of the future, which is commendable, but he did not address the issues of the present.

Fundamentally, until Labor owns up to its responsibility for the debt and deficit legacy the nation has now been conscripted into fixing, its promises ring hollow.