Credit card sweeteners aimed at getting you to sign up can leave a bitter taste

SUPERMARKET vouchers, cashback, gift cards and Frequent Flyer points are among the sweeteners being used to entice new customers — but watch out.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

SUPERMARKET vouchers, cashback, gift cards and Frequent Flyer points are among the sweeteners lenders are using to entice new credit card customers.

But be warned as these deals may not always be as good as they sound.

Analysis from financial comparison website RateCity shows there are more deals being rolled out by financial institutions including perks such as a $100 Coles supermarket voucher, $100 Woolworths gift card, no annual fee charge or tens of thousands of bonus Frequent Flyer points.

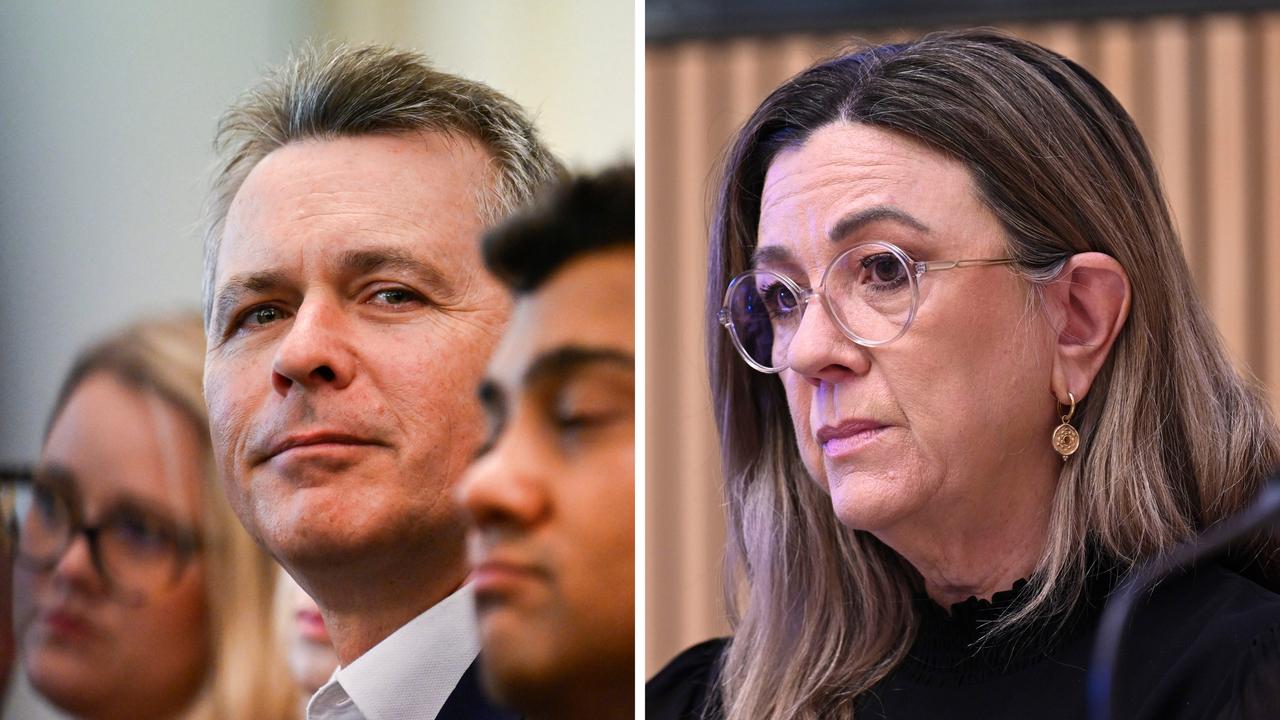

RateCity spokeswoman Sally Tindall says these deals are often just “marketing ploys by banks to get you to switch to their credit card”.

“They can look better than they actually are, but look for the annual fee as your first point of call,’’ she says.

“There’s no point getting 10,000 Frequent Flyer points if the annual fee runs into the hundreds of dollars and you keep the card for a number of years, it means you will be going backwards.”

Credit card interest rates remain high and, in many cases, are above the 20 per cent mark so unless the cardholder pays the card off in full there’s little gain to be made.

Reserve Bank of Australia figures show the nation owes an eye-watering $51.9 billion on credit cards and $33.2 billion of that is accruing interest.

So for anyone paying interest on their plastic they will, in nearly every case, outdo the rewards gained from signing up to the card.

Tindall says always do the maths yourself to work out how much you are spending on your card and whether you will really gain an advantage by signing on the dotted line.

“The average Australian is probably better off on a no annual fee, low-rate card than any of these rewards cards offering special offers,’’ she says.

Crown Money Management founder Scott Parry says these types of offers are designed to suck you in and you often won’t benefit.

“Spending $300,000 to get a kettle isn’t worth it (especially when you are) getting sprayed with an interest rate of 16 per cent,’’ he says.

“These cards are not as good as they used to be and consumers need to be aware of that.”

Originally published as Credit card sweeteners aimed at getting you to sign up can leave a bitter taste