Credit card balance-transfer deals can lead to financial quicksand

CONSUMERS who are trying to crush credit card debts could be spending hundreds of dollars a year in unnecessary charges by signing up to the wrong deal.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

IF you’re trying to crush credit card debt you may be spending hundreds of dollars a year in unnecessary charges by signing up to the wrong deal.

Honeymoon card offers are often riddled with fees that slug customers trying to kill debt quickly.

Latest findings from financial comparison website RateCity show there are more than 170 balance transfer deals available and the honeymoon periods range anywhere from 11 to 24 months.

However exorbitant annual fees can range from as little as $11 up to $700.

Interest rates are as high as 22 per cent if you don’t pay the debt off during the interest-free period.

Balance-transfer cards can be used to transfer one card debt to another and then take advantage of the interest-free period to slash the debt.

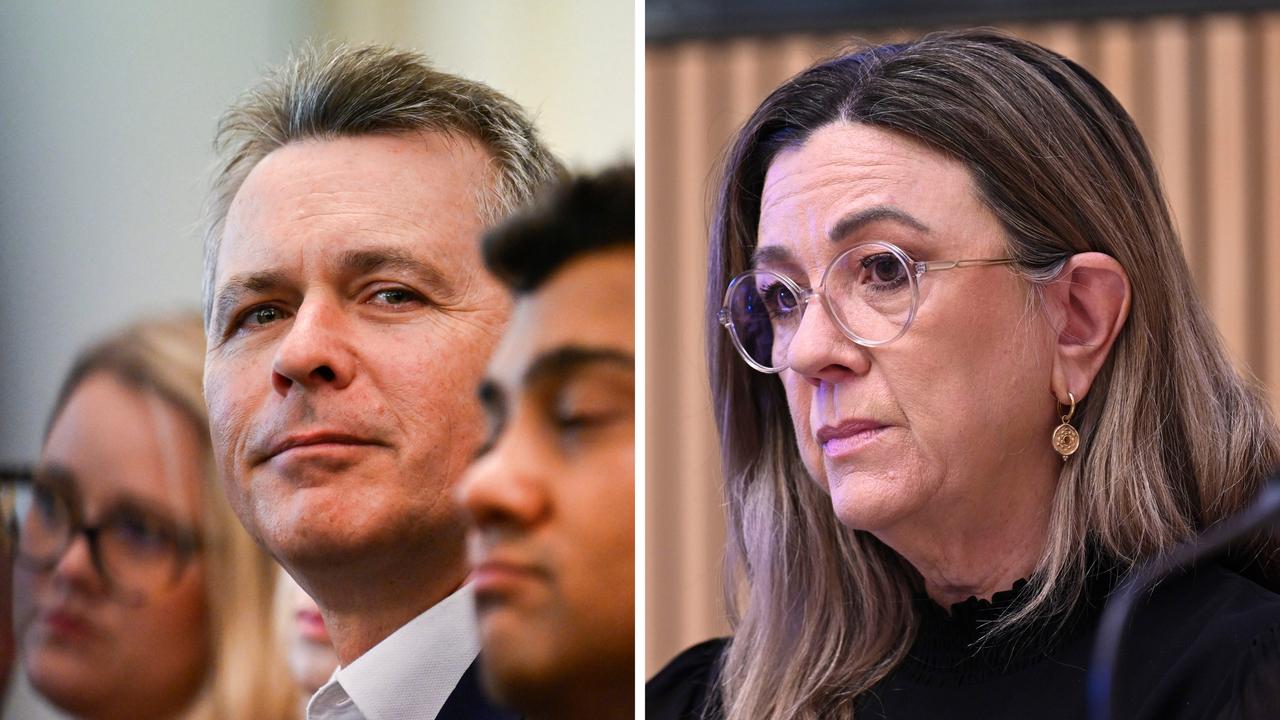

RateCity’s spokeswoman Sally Tindall has urged consumers to carefully understand all the costs associated with these cards as they can make a big difference to how quickly you pay off the debt.

“Don’t just look at how long the zero per cent interest-free period is for, you have to also look at the annual fee and the balance-transfer handling fees,’’ she says.

“Also look at the cash advance and revert rates and the number of interest-free days on purchases going forward.

“There are a few cards on the market that have no annual fee and no balance-transfer handling fee however they can be hard to find and are usually only for 12 months.”

She also warns customers against taking out long honeymoon interest-free periods spanning more than 12 months because you will face two lots of annual fees.

On a $4300 card debt the average cost to transfer the debt is $327, RateCity figures show.

Crown Money Management founder Scott Parry says once you get a balance-transfer card, destroy the card.

“Never ever use it, it is financial quicksand and they are dangling the carrot and they know we as humans will spend when we have it,’’ he says.

“If you spend on the card and have a transferred debt on it, you incur interest instantly on the new purchases and you can’t pay that off until you have paid off the original debt put on the card.”

Originally published as Credit card balance-transfer deals can lead to financial quicksand