Cracking some simple money myths

DEBUNKING money myths including whether all credit cards are bad.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

AUSTRALIANS remain confused around several financial myths and whether they are doing themselves more harm than good.

While many plastic users know credit cards can be damaging financially — they’re not necessarily always bad.

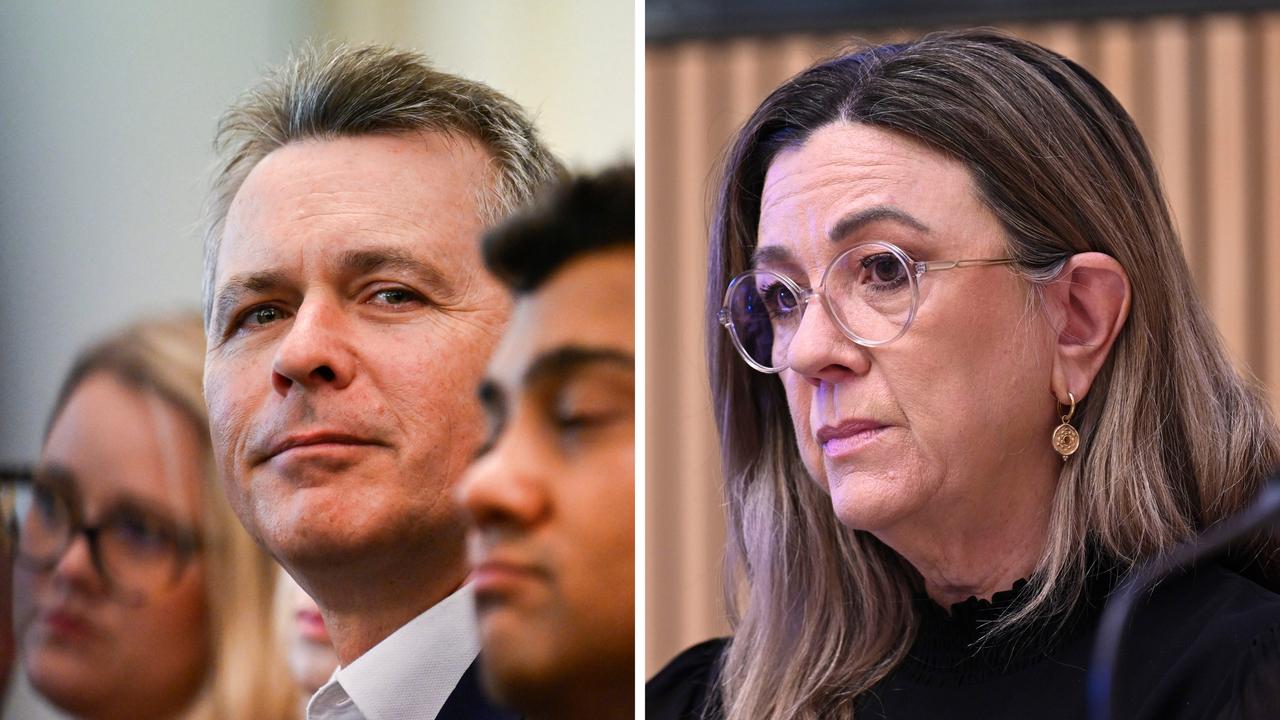

Financial institution ME’s head of deposits and transactional banking Nic Emery says there are a few key things credit card users need to do.

“Don’t pay more for your card than you have to, look for a low-rate card charging the same rate for purchases and cash advances with zero annual fees,’’ he says.

“Aim to pay off the card in full each month before interest charges apply and it can be hard to go wrong.”

Many credit cards have interest rates around the 20 per cent mark, so if you are not paying your card off in full each month it can hurt you financially.

On the flip side, savers may question whether an online savings account is a good way to stash their cash.

Introductory rates can catch out savers who think they will consistently get a good interest rate, but after a certain period it’s fallen lower.

Financial comparison website RateCity’s spokeswoman Sally Tindall says “anyone with money in the bank will know that it’s been a tough 12 months for savings rates.”

“But there is a huddle of online banks still offering competitive rates as high as 3.6 per cent if you are prepared to jump through a few hoops to get them,’’ she says.

She urges savers to shop around for short-term promotional deals and keep switching financial institutions every few months to get good value on your savings.

And for home loan customers, it is a myth that you’ll never be able to pay off your mortgage.

One in three Australians own their home outright — meaning they are mortgage free.

ME’s head of home loans Patrick Nolan says there are a few ways to debunk this myth and make it happen.

“Check the rate on your home loan,’’ he says.

“It’s harder to clear the slate if you’re paying more than necessary, switching to a lower rate loan can see you enjoy home loan freedom sooner.”

Some variable and fixed rates loans are below the four per cent mark so savings can often be made if you switch lenders.

Originally published as Cracking some simple money myths