Cost-of-living squeeze blow as wholesale electricity prices jump

A combination of record demand for electricity, depressed renewable energy generation and a spate of coal power outages threaten to add more pressure to bills next year.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Households face the fresh threat of higher electricity bills after the cost of power jumped over 20 per cent in the last quarter amid a renewable drought and coal outages, with the price surge threatening to punch a hole in Labor’s promise to slash $275 from bills by 2025.

The cost of producing electricity across the national market averaged $133/MWh in the three months to June 30, 23 per cent higher than the same period one year earlier, Australian Energy Market Operator data shows.

Several states endured massive price spikes during the quarter, a separate study by the Australian Energy Regulator shows. Tasmania’s wholesale price soared 110 per cent or $71MWh compared to the same period a year earlier while Victoria jumped 45 per cent or $96MWh and NSW lifted 28 per cent or $41MWh. Queensland bucked the trend, falling 22 per cent while South Australia edged up 9 per cent.

East coast gas prices rose 19 per cent to $13.76 a gigajoule, the AER said, consistent with winter spikes where demand surges through the network.

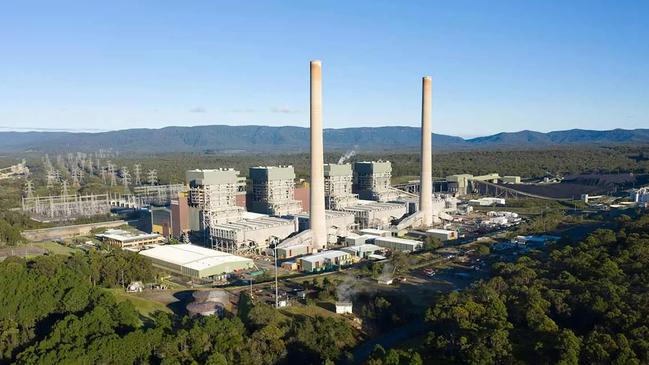

The hike in prices was driven by record demand for electricity during the June quarter, which occurred at the very time renewable energy generation tumbled and Australia endured a spate of unplanned coal power outages.

AEMO chief executive officer Daniel Westerman said the increased demand stemmed from bitterly cold weather, but the toll was exacerbated by low supplies of renewable energy.

“On the east coast we have seen low temperatures and persistent cold snaps, especially in Victoria, which have driven higher morning peak demands through the tail end of autumn and the first month of winter,” said Mr Westerman.

“Extended periods of low wind have led to reduced wind generation output, which was down 20 per cent from last winter to a quarterly average of 2657 megawatts, with wind availability down to their lowest levels since Q2 2017.”

The increase in wholesale prices will not be immediately felt by households and businesses, but the jump will form a major component on the next default market offer — the benchmark price for annual bills.

The price spike also heaps pressure on Labor’s promise to slash $275 from household electricity bills by 2025, a key election pledge and central plank of the federal government’s Powering Australia plan.

Only a small minority of households and businesses are on the default market offer, as retailers typically offer discounts to entice customers, but higher wholesale prices will put upward pressure on bills when the default market offer is reset on July 1, 2025.

An increase in the default market offer would be a hammer blow to Labor, which has seen its standing with voters fall amid the cost-of-living squeeze.

Labor in May sought to sway disillusioned voters by offering all households a $300 handout to assist with their annual bills, a move widely seen as an effort to lower inflation and allow the Reserve Bank of Australia to cut interest rates.

Federal energy Minister Chris Bowen acknowledged the pain of higher electricity prices, but said wholesale prices are lower now than when the Coalition left office.

“Energy prices are a serious issue for households and businesses. Australians deserve a plan to bring them down. The Albanese Government’s plan means wholesale prices are now lower than when the Coalition left office,” said Mr Bowen.

“The data shows renewables provide cheaper power, and when we’re forced to rely on coal generation and ageing unreliable assets, it drives prices up. The faster we can get more reliable renewables into the system, the better it will be for energy bills and energy reliability.”

While wholesale prices are down in recent months, electricity bills are up substantially under the Labor government amid a global energy crunch — a trend which has seen a record number of Australians struggle to pay their bills.

The quarterly result will also be seized by the Coalition as evidence of the dangers of Labor’s energy transition plan. Labor has set the ambitious target of having renewable energy produce 82 per cent of the country’s power by 2030 — a target which some say leaves Australia too exposed to periods of insufficient renewable energy generation.

The Coalition has said, if elected, it would ditch the proposal and build seven nuclear power stations and provide consistent electricity,

Critics insist the plan will be too costly and take too long to replace coal, and the latest AEMO quarterly report will stoke alarm within Australia’s energy industry about the prospect of coal being extended.

The Coalition has yet to reveal how it intends to power Australia’s grid, but has hinted it could look to run coal until nuclear is ready.

AEMO, however, noted a decline in coal generation during the quarter, underscoring the unreliable nature of Australia’s coal fleet — many of which are near the end of their technical lifespan.

Labor insists its plan will eventually work, as spring — which will likely see increased solar and wind generation and reduced demand for heating as temperatures rise — is expected to herald lower wholesale prices.

But, Labor is struggling to placate concerns about what power source the country will use during periods of no sunshine or wind. Australia has seen a flood of new batteries being developed but many only have sufficient power for less than four hours and the only viable solution in the minds of most is gas.

Australia’s east coast, however, is rapidly running out of gas and the main source to the region is expected to be depleted by 2028 — heightening pressure on Labor to unlock new supplies.

In a nod to the woes, Labor on Tuesday said it had approved a series of new exploration licences for major companies such as ExxonMobil, Chevron, INPEX, Melbana and Woodside Energy.

The issuance was heralded by Australia’s gas industry as long overdue, but new requirements prohibiting seismic testing was criticised by EnerGeo Alliance — an industry body which promotes the practice.

“With this action, the Albanese government is confirming that its Future Gas Strategy does not have the teeth to be a viable long-term strategy to supply Australia and its allies with the energy required to meet growing demand,” EnerGeo Alliance said.

The default market offer is calculated annually; the Australian Energy Regulator considers the wholesale cost of electricity, the toll of transporting electricity and the cost of compliance with government rules and regulations.

Originally published as Cost-of-living squeeze blow as wholesale electricity prices jump