Sad reason Kelly’s on King won’t sell some of Australia’s favourite beers

A popular Sydney watering hole has boldly declared that its taps will no longer flow some of the country’s favourite beers – but for good reason.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

It’s a modern incarnation of the Slim Dusty classic, a Pub with no Beer – but only if that beer has CUB or Lion on its label.

Kelly’s on King, a popular Newtown watering hole, boldly declared recently that its taps would only be flowing with independently brewed Australian beverages and not “corporate crafts”.

In Australia, it’s not commonly known that Australian companies don’t even own some of the country’s most loved beer brands.

Asahi, the Japanese food and beverage giant, acquired Carlton and United Breweries from AB InBev in 2019.

Classics like VB, Great Northern and Carlton are all owned by the $29 billion Japanese corporate giant.

As are acclaimed former independent craft breweries across the country, including 4 Pines, Balter Brewing, Green Beacon, Mountain Goat, Pirate Life, Matilda Bay and Yak Brewing.

Another Japanese giant, Kirin, acquired Lion Nathan (now Lion) in 2009 and is one of Japan’s largest beverage producers.

It recently acquired a number of craft beer brands in Australia, such as Little Creatures, James Squire, and White Rabbit as well as Fermentum Group, which includes Stone & Wood and Fixation.

And as the large corporates, which own as much as 85 per cent of the beer market between them, delve into and acquire Australian craft beer labels, it is becoming increasingly hard to spot a legitimately independent Aussie beer.

That’s where Kelly’s on Kings, in Sydney’s inner-west, has stepped in to help with the distinction.

In recent weeks, the pub favoured by Sydney’s Irish diaspora has been displaying a peculiar sign.

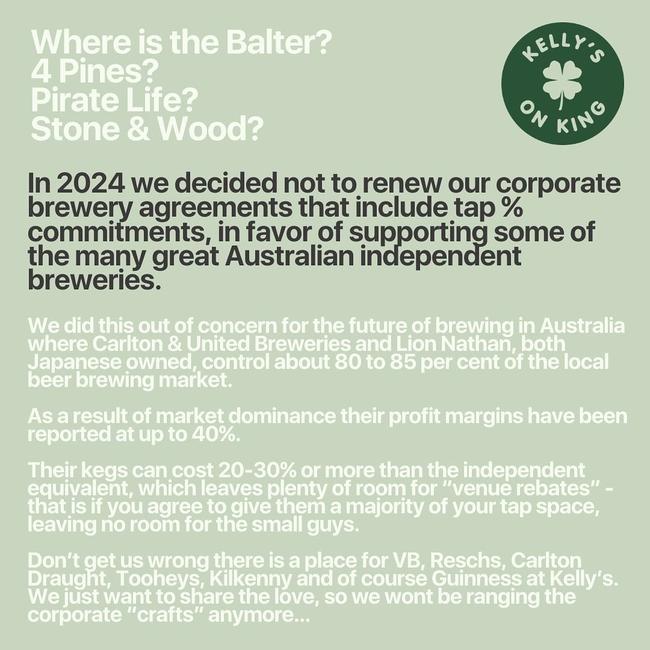

“Where is the Balter? 4 Pines? Pirate Life? Stone & Wood?” is reads.

All four of the latter have been acquired by the Japanese duopoly in recent years, and therein lies the point.

The sign continues to explain that earlier this year, the pub ended its tap contracts with corporate breweries, which essentially lease taps at any given bar at a high premium that independent brewers toil to compete with.

“We did this out of concern for the future of brewing in Australia where Carlton and United Breweries and Lion Nathan, both Japanese-owned, control about 80 to 85 per cent of the local beer brewing market,” the sign continued.

“As a result of market dominance their profit margins have been reported at up to 40 per cent.

“Their kegs can cost 20-30 per cent or more than the independent equivalent, which leaves plenty of room for ‘venue rebates’ – that is if you agree to give them a majority of your tap space, leaving no room for the small guys.

“Don’t get us wrong, there is a place for VB, Reschs, Carlton Draught, Tooheys, Kilkenny and of course, Guinness at Kelly’s. We just want to share the love, so we won’t be ranging the corporate ‘crafts’ anymore.”

Two side-by-side images posted on the pub’s social media show the taps before and after, with some glaring omissions on the new arrangement, including VB, Toohey’s New, and Carlton Draught.

Licensee Brodie Parish expanded on the pub’s rationale to news.com.au, stating: “(The duopoly) now has their own labels and they pass them off pretty well as independent brands,” adding that the pub had a contract with CUB until late 2023 but now offers no CUB or Lion products whatsoever.

“Don’t get me wrong, they make a good beers but part of the problem is that they’re able to push out some really quality beers having acquired those reputable breweries, but the duopoly has repercussions on the (independent) industry moving forward.”

Pre-tap takeover, in exchange for 60 per cent of tap space, he said, they received a $75 discount per keg from CUB.

Tap contracts are a significant concern for independent Australian brewers, along with increasing excise tax, rising interest rates, and lease costs.

So much so, an alarming number of other independent breweries have gone into administration in the past year including Brisbane-based Ballistic Beer Company, Adelaide business Big Shed Brewing, Melbourne-based Hawkers Brewery and the Wayward brand and Akasha Brewery, both from Sydney.

In January, Stef Constantoulas, co-founder of Marrickville’s Philter Brewing, which brews just a suburb away from Kelly’s on Kings, explained how difficult it was to secure a tap at any given pub.

“I can’t afford $50,000 to take some taps,” he said.

“It means there are hundreds of us independent craft breweries fighting for two taps on a ten-tap rack.”

In 2017, the ACCC investigated allegations that Carlton United Breweries (CUB) and Lion Pty Limited were using exclusivity provisions and volume requirements to lock craft brewers out of beer taps in various venues.

The investigation, which reviewed contracts and practices at 36 venues across NSW and Victoria, concluded that these practices were “unlikely to substantially lessen competition”.

Despite some exclusivity arrangements, most venues felt free to allocate taps to craft brewers, driven by consumer demand rather than contractual restrictions.

“Although some venues had exclusivity arrangements, most pubs and clubs said they did not feel constrained from allocating taps to smaller brewers,” ACCC Deputy Chair Dr Michael Schaper said at the time.

Mr Parish felt another look at tap contracts by the Watchdog is warranted as well as discussions on how to keep independent brewing competitive.

“I think that the time has changed and there’s different market,” he said.

“I don’t know if there’s anything illegal, as such, but there needs to be more political pressure to change the rules.”

And for those wanting to distinguish a “corporate craft” from an independent at the local bottle-o, the Independent Brewers Association launched the Independence Seal in recent years.

This seal includes a special logo only licensed to brands that meet authenticity criteria.

The Independent Seal helps consumers identify breweries that are less than 20 per cent owned by a large brewer and produce under 40 million litres annually.

The IBA aims for 85 per cent of its member breweries to use this seal on their products and marketing materials by 2025.

Originally published as Sad reason Kelly’s on King won’t sell some of Australia’s favourite beers