‘People are out of pocket’: Andrews government under fire for ‘unfair’ building collapse scheme

Customers of failed builder Snowdon have slammed Dan Andrews for his lack of support, following another developer’s collapse.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Shattered customers who lost thousands of dollars in life savings to failed home builder Snowdon Developments are pleading with the Victorian Government to extend access to the Porter Davis compensation payments.

In July last year, the Supreme Court of Victoria ordered the embattled firm to go into liquidation, impacting 52 staff members, 550 homes and more than 250 creditors.

Now almost 12 months on, about half of the company’s deposit-paying customer base are still yet to receive a single cent they’re owed.

According to the company’s liquidator Dye & Co, an estimated $4,064,551 worth of deposits were paid by 282 customers to the company at the time of its collapse.

While some of these customers were insured under mandatory Domestic Building Insurance (DBI) and received their money back, the remaining customers were uninsured and left to face the same fate as Porter Davis customers.

IT worker Andy* is one of Snowdon’s unsecured creditors who has spent the last 10 months wondering if he’ll ever receive his $16,000 deposit back.

The Melburnian made the payment in May 2021 as he felt it was time to move out of his apartment into a bigger home that was suitable for his growing family.

Having migrated from overseas, Andy acknowledged he didn’t know much about the process of building a home.

“We were promised that they were going to start the build soon … but it just dragged on and on,” he told news.com.au.

“Because it was during Covid, we knew things took time … but never thought (the company) was about to become insolvent and was losing money.”

Like most Snowdon customers, Andy received the heartbreaking news from news reports before being notified less than 24 hours later the business had been partially bought out by Victorian construction company Mimosa Homes.

While the buyout was a saving grace for some customers, Andy quickly learned he was one of the unlucky ones.

“They straightforwardly said that the deposit was gone. So (to build with them) I had to pay the deposit again,” Andy explained.

A Mimosa Homes spokesperson told news.com.au last year the company partially purchased Snowdon on the condition it “will not be paying any debts incurred”.

Keep the conversation going. Get in touch - rebecca.borg@news.com.au

Snowdon’s similarities with Porter Davis collapse

Like Porter Davis, Snowdon breached its obligations to provide a portion of its customers with DBI, which would have provided protections to its customers against financial losses arising from incomplete or defective work.

Snowdon’s liquidator Shane Deane accepts the situation isn’t excusable, but says a large portion of clients didn’t have insurance.

“We spoke to the director in regards to why a lot (of customers) didn’t have insurance … and he said they didn’t want to start the insurance before they started building,” Mr Deane told news.com.au.

“Now whether that’s an acceptable excuse or not – I don’t think necessarily it is – the reality is, people are out of pocket.”

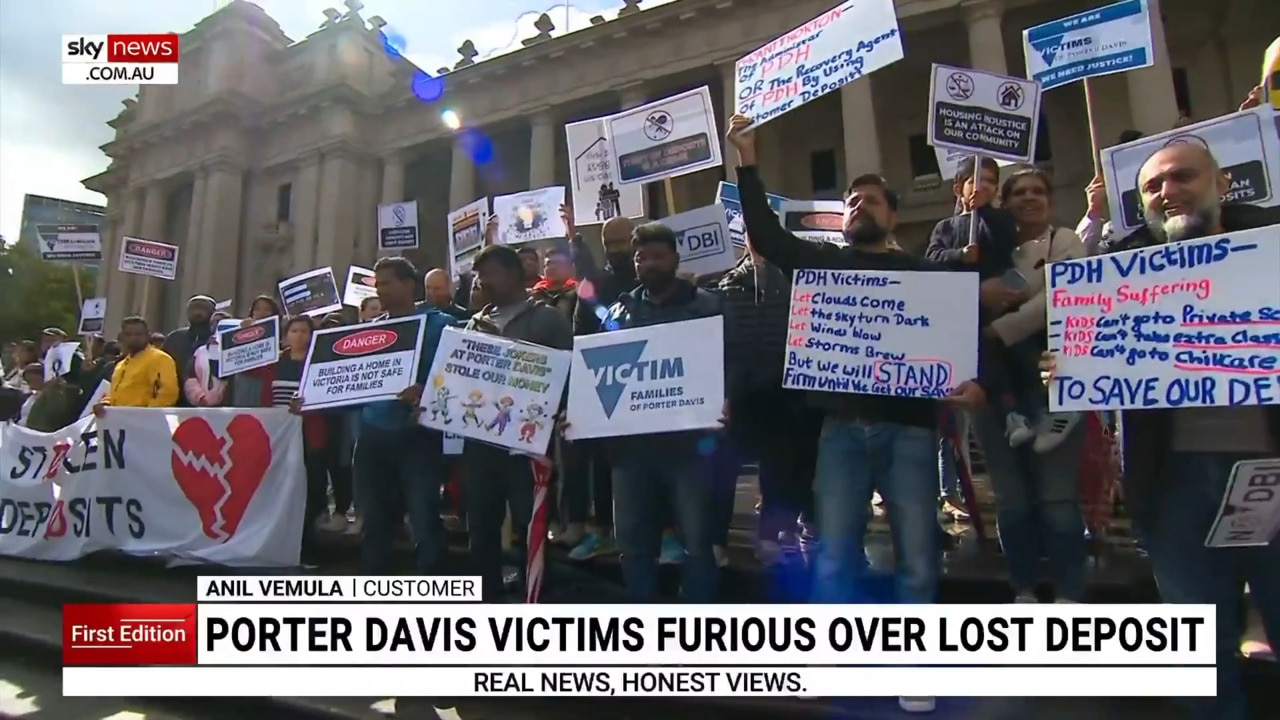

At the time of Porter Davis’ collapse in March, deposit-paying customers yet to have their builds commenced were due to face the same fate.

That was until the Andrews Labor government in Victoria offered a helping hand by announcing a new compensation scheme exclusively available to Porter Davis customers.

The announcement meant over 500 families who paid a deposit and signed a contract with the failed company would receive their money back under the Domestic Building Contracts Act.

“This one-off scheme is about making sure that hard-earned money of Porter Davis customers is refunded as quickly as possible and we’ll keep investigating the actions of Porter Davis to ensure this can’t happen again,” Mr Andrews said on the day of the announcement.

While the move was welcomed by struggling Porter Davis customers who only had to endure a month of uncertainty, it has come as a slap in the face to dozens of Snowdon customers who remain in limbo for almost a year now.

Snowdon customers call for fairness

While Andy’s family are still confined to their small apartment, left with a block of land they’re scared to build on, there are other Snowdon customers currently facing more dire situations as the cost of living climbs.

Mr Deane raised this point in a letter to Daniel Andrews and state Housing Minister Danny Pearson, calling on the government to deliver the same treatment to Snowdon customers as that of Porter Davis customers.

“Porter Davis customers didn’t have Domestic Building Insurance taken out through no fault of their own and the Premier said (supplying the compensation scheme) was the right thing to do,” Mr Deane said.

“The same thing should apply to Snowdon customers as they did not have domestic building insurance taken out for them … So you’d hope they wouldn’t be treated separately or differently.”

Mr Deane also pointed out Snowdon customers have been digging deep to pay off ongoing costs – like rent payments in addition to a mortgage – that they wouldn’t have to pay if their Snowdon home had been built.

Additionally, most are also in the process of saving up for a deposit for a second time – something they wouldn’t have to do if they received the same support as Porter Davis customers.

“If you believe the reports that we’re in a housing shortage and a housing crisis, what better way to relieve that than to let people have some of their deposit back so that they can then go and build their house and therefore alleviate a crisis at the same time?” Mr Deane said.

“That seems to make some sense.”

News.com.au approached the government to ask why Porter Davis customers exclusively received support and whether there was anything in the works for Snowdon customers.

A government spokesperson replied: “It is the government’s expectation that builders do the right thing and if they take deposits, they take out Domestic Building Insurance.”

While Andy said he felt “discriminated against” for not receiving any support, he posed the question: if the government doesn’t want this to happen again, why not tighten the laws?

“The laws are not being enforced enough, leaving businesses like Porter Davis and Snowdon to simply do business as usual (without DBI), without worrying about the penalties that come with that,” he said.

This point was also raised to the Andrews government, with the spokesperson telling news.com.au that “work is continuing to guide potential future reforms to protect consumers”.

What’s next for Snowdon

Investigations into Snowdon’s collapse remain ongoing, with Mr Deane’s team working tirelessly to find a way to support unsecured creditors.

As he patiently awaits a reply from the government regarding his letter, Mr Deane’s efforts are shifting towards conducting public examinations of various parties with the hope he can provide an update to creditors next month.

“We have a number of causes of action that we’ve identified where we want to pursue legally to try and recover some funds for the benefit of the creditors of the company,” he said.

“Because it’s a liquidation, the order of those creditors will be employees and superannuation entitlements first and then we’ll feed down into the other creditors and the unsecured creditors – so we’ve identified a large pool of actions that are available to us as liquidators.

“(But the reality is) some customers have been out of pocket for 10 months and Porter Davis customers only had to suffer the uncertainty for a month, so it’d be great to get some certainty around that quickly.”

* Name changed for privacy concerns

Originally published as ‘People are out of pocket’: Andrews government under fire for ‘unfair’ building collapse scheme