Kenneth Hayne’s Bank Royal Commission: Maleficent Seven companies revealed

It was a little known word until Angelina Jolie made it famous. “Maleficent” befits the allegedly evil deeds of seven companies damned in the Royal Commission. Find out which ones.

Criminal court action must be brought against finance giants damned in the royal commission to help restore community confidence in the regulatory system, legal experts say.

The most serious charges to flow from Commissioner Kenneth Hayne’s final report could be alleged breaches of the dishonest conduct prohibitions in the Corporations Act, with AMP, CBA and NAB most likely to be in the cross hairs of the Australian Securities and Investments Commission (ASIC).

Commissioner Hayne said section 1041G of the act “accurately reflects both the nature and the gravity of the conduct described” in the fee-for-no-service scandal that included taking money from dead people.

A contravention of the section carries a potential penalty of nearly $10 million, or three times the value of the benefit. Any executive convicted under 1041G faces up to 10 years’ jail.

University of Melbourne law professor Elise Bant said the final report spelt out what ASIC needed to do.

MORE: Kochie: Dodgy advisers betrayed us all

MORE: Five-minute guide to damning banking report

“I would be surprised if ASIC wouldn’t do everything they could to try to act on the guidance Commissioner Hayne has provided,” she said.

Griffith University lecturer Craig Cameron said for ASIC there was now a community-confidence cost if it didn’t bring proceedings.

The year-long inquiry revealed the regulator had often been reluctant to take rogue operators to court, instead preferring negotiated outcomes.

“My opinion is that in the short to medium term there will certainly be more civil actions and the possibility of a criminal action,” Dr Cameron said.

These are the Maleficent Seven — the companies suspected of the most serious and widest number of law breaches in the view of the former High Court justice.

CBA

As well as potentially facing criminal charges under the Corporations Act, Australia’s largest company was referred to ASIC for investigation of possible breaches of that law’s conflicted remuneration provisions, which could lead to a fine of as much as $1 million.

Its Colonial First State division has admitted to breaching another part of the act, plus superannuation laws, while CommInsure was accused of having failed to act reasonably as is required by insurance contracts law.

While Commissioner Hayne was impressed with the contrition of CEO Matt Comyn, he said the relatively new chief had a lot of work to do.

But he made more ‘please investigate further’ requests of ASIC and APRA regarding CBA than he did any other company.

AMP

AMP is in deep trouble too. The Commonwealth Director of Public Prosecutions and ASIC are already investigating possible criminal breaches of 1041G over the fee-for-no-service scandal. The CDPP did not respond to a request for comment.

Mr Hayne found AMP may have failed super law’s requirement to act in the best interests of members over the interests of others including AMP.

Freedom Insurance

In perhaps the most troubling of all the evidence heard by the commission, Freedom may have breached a section of the Corporations Act that requires financial services to be “provided efficiently, honestly and fairly”.

It sold funeral, accidental death and accidental injury insurance to a young man born with Down syndrome. The young man’s father got a recording of the sales call and told a commission hearing he did not think his son had any understanding of what he was signing up for. “I agree,” Mr Hayne said in his final report, suggesting it was prohibited unconscionable conduct, which can be punished with fines of up to $2.1 million for a company and more than $400,000 for a person.

Freedom could have broken conflicted remuneration provisions, too, which attract a further financial penalty.

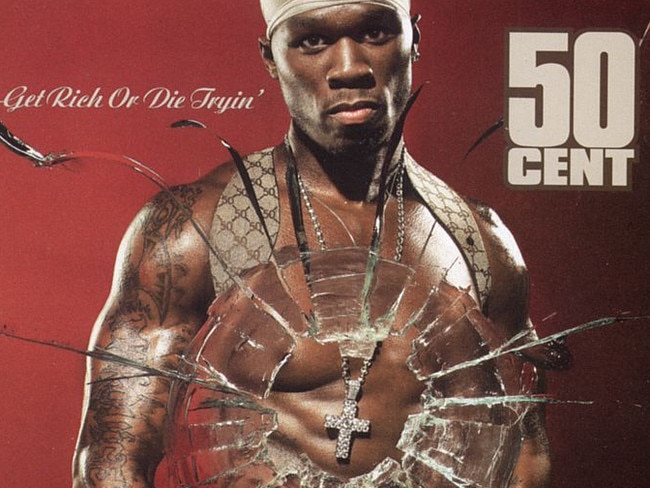

Senior Counsel Assisting the inquiry Rowena Orr revealed a Freedom executive’s email that invoked the famous line from the movie Jerry Maguire — “show me the money” — and another that used an image of rapper 50 Cent holding a stack of cash. His best-known album is Get Rich or Die Tryin’.

Freedom is also in the frame over anti-hawking provisions.

Since Freedom was examined at the commission its share price has fallen 95 per cent because it had to stop selling most of its products.

NAB

On Thursday NAB joined AMP in losing both its chair and CEO due to the inquiry. The companies themselves could also share the ignominy of facing criminal charges over fees for no service.

Commissioner Hayne made this clear in the hearings when he interjected to ask a question of a NAB employee who oversaw more than $90 billion of super belonging to 1.3 million people: “Did you think, yourself, that taking money to which there was no entitlement raised a question of the criminal law?”

The answer was no.

NAB is also accused of numerous breaches of superannuation laws.

Suncorp

May have failed to exercise due care and skill as a superannuation trustee. It has been referred to the Australian Prudential Regulation Authority. Also referred to APRA were possible breaches of its covenant to prioritise the interests of members over others, such as financial advisers. Elsewhere in his report, Mr Hayne noted APRA has never been to court. Ever.

IOOF

Is accused of making misleading statements, prohibited under the ASIC Act. This can attract seven-figure penalties per breach.

It may also have broken superannuation laws. It is alleged to have prioritised its own interests above fund members’, by, among other things, allowing “other parties to receive large amounts of money directly generated from members’ funds with nothing in return”.

TAL

After setting a private investigator on a young woman who had work stress-induced depression, she was told she needed to complete a daily activity diary because it was industry “standard practice”, which it was not. The company admitted this was “bullying”.

TAL’s conduct fell short of community expectations in seven different ways, according to the commission’s final report.

“I refer TAL’s conduct to ASIC,” Mr Hayne said, “for ASIC to consider what action it can and should take.”