Horror reality of bank branch closures across Australia

More and more Aussie towns now have no bank, and it’s causing huge issues for thousands of Australians.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

People are being forced to drive up to $200,000 in cash thousands of kilometres while vulnerable customers are handing over sensitive bank account details to library staff – that’s the dire reality facing Aussie towns with a number set to lose their last remaining bank branch.

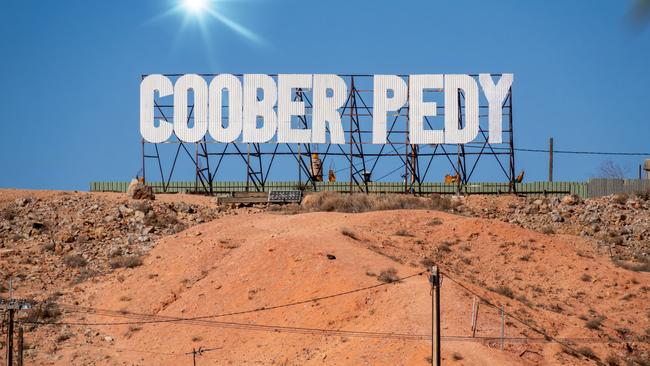

For the opal mining town of Coober Pedy in South Australia, their last bank branch – a Westpac – is set to close on February 17.

Residents will need to travel six hours to its nearest bank in Port Augusta, which is 550 kilometres away, or access banking through the post office, which will only offer limited services.

Coober Pedy Council CEO Tim Jackson has warned the bank branch closure will make things “very difficult” for the town’s residents.

He said there are the obvious vulnerable people impacted, such as the elderly as well as the Aboriginal population, with a “good portion” having difficulty using the internet.

“I’m told people used to be able to walk into the bank and because they were known to bank staff, they would be able to access their accounts and transact and do withdrawals,” he told news.com.au.

“That’s not to say that can’t happen in the post office, but I don’t know the processes if the person doesn’t have a debit card for instance, it’s going to be difficult.”

$100,000 to $200,000 in cash

Then there are the businesses that will be impacted with the opal town running a huge cash economy, according to Mr Jackson.

“I was talking to one opal miner and he said that buyers, when they come into town, they need access to $100,000 to $200,000 in cash as transactions are generally done in cash in terms of the opal industry,” he said.

“So they will need to withdraw in Port Augusta and drive 550km down the highway with that amount of cash in their car, so that’s a lot of risk issues and businesses will need to have personal safes. It’s certainly going to be challenging.”

With a daily deposit limit of just $7000 at Australia Post – this means that any business that takes more than $35,000 a week is facing issues.

Even the council is facing this problem – with Mr Jackson revealing they “take a lot more than that some” days as its responsible for the town’s water and electricity supply, along with ratepayer’s fees.

Mr Jackson said while they are trying to get a moratorium on bank branch closures and a commitment to the continuation of banking services in remote Australia – in Coober Pedy they have “run out of options”.

This is despite a face-to-face meeting with the state manager of Westpac in Adelaide, writing to the CEO of Westpac and receiving a “stock standard” answer back, as well as reaching out to South Australian senators and only hearing back from two.

He said when he first arrived in Coober Pedy four years ago Westpac had announced the closure but wound back the decision after protests.

“But this time I don’t think they will reverse it – not with two weeks to go,” he said.

“We have tried everything and they are not about to change their mind unless Canberra did something.

“Banks do have a social responsibility and they make significant profits.”

Federal government should step in

Mr Jackson wants to see the federal government intervene to stop bank branch closures as it was important to “social outcomes” adding it had shown it was capable of protecting locals such as mandating that streaming services spend a certain percentage of their revenue developing Australian content.

Westpac said there had been a 28 per cent reduction in customers using the Coober Pedy branch each month since the financial year 2020.

“Declining customer use of branches means that in some instances, we may take a difficult decision to leave a branch location,” a Westpac spokesperson said.

“In Coober Pedy, our team is working to assist customers with the transition, including co-ordinating with the team at Australia Post to help familiarise customers with Bank@Post services.

“Coober Pedy Post Office is located just 50 metres from our current branch and customers will be able to access many of the same cash services there including to withdrawing cash, depositing cash and cheques, and checking account balances.”

‘Incredible risk’ as bank details shared

The town of Berrigan, near the NSW-Victorian border, knows all too well the impact of losing its last remaining bank branch after NAB shuttered its outlet in October 2022.

Karina Ewer, CEO Berrigan Shire Council, said the outcome had been shocking for vulnerable residents, who were putting themselves as “incredible risk” by trusting others with their private bank details.

“We have seen people like our library staff are often called on by elderly citizens who can’t do online banking to manage their accounts, so they have passwords and identify information given to them to assist our residents and it makes them incredibly uncomfortable but they don’t have anyone else to trust,” she said.

“To me that just makes vulnerable people more vulnerable and they can’t manage banking on their own because they are forced online.

“If they are not coming to us and going to their family, we all know that not necessarily all family is trustworthy, so it worries me deeply that people are forced into positions.”

She said there another group of vulnerable people such as women working as cleaners and labourers on farms who are being forced into a cash economy and potentially being paid unfair wages as they can’t open a bank account.

‘Very expensive’

Junee, a town in the Riverina region of New South Wales is also set to lose itslast remaining bank branch — a Commonwealth – on March 3.

Like Coober Pedy, James Davis, general manager of Junee Shire Council, said the move would hit vulnerable or frail aged locals – many of who don’t own a smartphone – as well as causing security issues for businesses resulting in a “lot of anxiety” in the town.

Owners will be forced to travel with “large amounts of cash in the car” to the nearest town of Wagga Wagga, which is half an hour away, as the post office will only offer transfers and withdrawals up to a daily $6000 limit.

“Their insurance premiums go up if they are transporting large amounts of cash and the alternative is to have Armaguard or a similar facility to do that but that’s a very expensive cost to a business, so the economic impact is trickling down on businesses,” he noted.

Closure ‘stinks’

Mr Davis said the council had asked the Commonwealth Bank to “justify” the claim that the bank branch was no longer viable and had made a complaint to the Australian Financial Complaints Authority and requested a public hearing on the matter.

He also recently organised a meeting with 16 other councils who also risk losing their last bank branch but believes up to 40 communities could be impacted in the near future, adding the withdrawal of banking services as the big four raked in billions in profits “stinks”.

Norm Swift, CBA’s regional general manager said after a recent review it made the difficult decision to permanently close its Junee branch, which has had a 37 per cent drop in transactions over the five years before the pandemic.

“We’ve redeployed the vast majority of staff from branches that have closed, and are working closely with our people from Junee branch to support securing appropriate comparable roles suitable to their needs,” he said.

“We recognise some senior customers prefer to do their banking face-to-face and it’s one of the reasons we’re proud to maintain the largest branch network in the country.

“Customers who prefer over-the-counter service still have access to this option, with other branches in the region at Wagga Wagga, Cootamundra and Temora.”

Moral obligation

Berrigan Council has been forced to deliver banking services, which means more staff hired at a direct cost to ratepayers, while businesses are driving to the nearest bank – a couple of hours away – with considerable amounts of cash, Ms Ewer added.

“Farming businesses can be multi million dollar businesses,” she noted, with one local business also putting in an ATM in town at its own cost.

“I think the banks have not considered their social and moral obligations to the Australian community,” she said.

“Banks have a moral obligation to businesses and the community have equitable access to banking and for people not to be forced into system that is cheap for them to run. I think they make enough money to subsidise banking in communities.”

‘Crisis point'

According to the Finance Sector Union, bank branch closures are reaching “crisis point” with the big four closing more than 550 bank branches across Australia since January 2020.

The Australian Prudential Regulation Authority said 575 regional banks closed between mid-2017 and mid-2021.

Mr Davis issued a chilling warning that at the rate of bank branches across Australia, there won’t be any left in regional areas in three years times.

“The model for closing bank branches hasn’t changed. They just nominate branches to close in small clumps … but if you apply that model across Australia they could close them all tomorrow,” he said.

“But they wouldn’t as it will tick off the goodwill they have with the federal government and the banks are doing it piecemeal and the public know it.

“The federal government should be aware that the banks should ultimately be accountable to the public for banking practices but they are not supporting branches.”

More Coverage

Originally published as Horror reality of bank branch closures across Australia