CommBank faces more compensation over insurance

A simple handwritten note allegedly shows the bank’s top bosses knew they were short changing customers. It could cost millions to fix.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

It was the handwritten note from the chief executive that has revealed just how far Australia’s largest bank sank in it’s single-minded pursuit of profit.

And putting it right could cost Commonwealth Bank millions.

The banking royal commission has heard CommBank knew for years it was selling customers dud insurance policies but did nothing about.

But despite current CommBank Matt Comyn once being in charge of the division that sold the financial products, he said he actually tried to axe them. Throwing his one-time boss under the bus, Mr Comyn said his predecessor in the top job, Ian Narev, repeatedly overruled him. And he said he had the notes to prove it.

CBA may end up compensating more than half a million customers who were sold the consumer credit insurance products.

CommBank is already paying $46 million to 154,000 customers over the mis-selling of credit card and loan protection insurance.

An independent review in September raised concerns about the sales process or value of the consumer credit insurance products for another 374,000 customers.

Mr Comyn said CommBank will extend its remediation program to cover those people if necessary, agreeing it would likely have to compensate a significant number of additional customers.

The royal commission has heard CommBank knew about problems with its credit card plus product and the risk of mis-selling of its loan protection products in 2015.

It announced it was dumping the credit card and personal loan policies — but keeping home loan insurance — in March this year, days before the issues came up at a royal commission hearing.

Mr Comyn said he tried to get rid of them three years earlier while CBA’s retail banking head, saying he was willing to forgo the $150 million the bank made annually from the consumer credit insurance products, reported AAP.

An April 2015 audit revealed 64,000 CBA customers were sold credit card plus insurance when they were unemployed and therefore ineligible to make a claim.

Mr Comyn said he took the issue to Mr Narev but after “enthusiastically pursuing” his argument he was overruled during a May 2015 meeting.

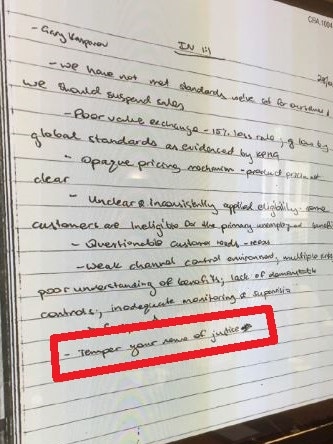

He produced a handwritten note, that was shown to the commission and photographed by a Fairfax reporter. Beneath phrases such as “questionable customer needs” and “opaque pricing mechanism” was a line Mr Comyn attributed directly to the then-CEO.

Mr Comyn’s notes state Mr Narev told him to “temper your sense of justice” when it came to axing the products. Slightly irritated by the comment, Mr Comyn said he took that to mean “calm down”.

“He was referring to — I was enthusiastically pursuing my argument, which I thought was right. And he was telling me to temper it.”

Mr Comyn raised the issue again in 2016. “I was insufficiently persuasive,” he said.

He admitted issues such as the mis-selling of add-on insurance and the charging of fees for no service, for which CBA is paying $116 million in remediation, revealed the bank prioritised short-term profits ahead of customers.

“We didn’t sufficiently prioritise customers,” he said on Tuesday. “We didn’t understand the potential for harm.”

Mr Comyn said CBA had not had the right leaders in the past. Did it now?

“We will see,” he said. “I hope so. Yes.”

Mr Comyn said the culture of the bank must change and strike the right balance between delivering good outcomes for customers and delivering sustainable, long-term returns to shareholders.

Originally published as CommBank faces more compensation over insurance