The big themes shaping Australia’s $300bn fund

Australia’s biggest pot of investment funds is quietly reshaping its vast investment portfolio to navigate a choppy year ahead.

Australia’s biggest pot of investment funds is quietly reshaping its vast investment portfolio to navigate a choppy year ahead.

A Queensland mum was left stunned after her bank told her she could not withdraw cash. It’s a sign of a much bigger problem.

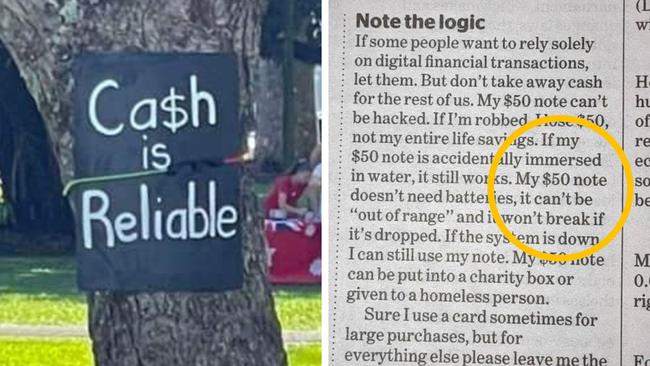

A Melbourne woman’s rant to her local newspaper about the dangers of moving to a cashless society has resonated with thousands of Aussies online.

Six years after the big four banks ‘dropped’ ATM fees for non-customers, experts are warning of a trend that’s hurting Aussies’ pockets more than they may realise.

A week after pleasing borrowers by passing on the Reserve Bank’s rate cut, the big banks are starting to penalise savers.

ANZ and Westpac are two of the big four banks that have refused to reduce variable mortgage rates following the Reserve Bank’s cash rate cut.

Hackers attacking a Westpac online banking feature have exposed the private details of almost 100,000 Aussie banking customers.

Josh Frydenberg has issued a stern warning to the big banks ahead of today’s expected interest rate cut by the Reserve Bank.

An Aussie bank has announced a home loan rate of 2.99 per cent described by industry watchers as completely game-changing.

It’s the awe-inspiring competition that has the power to change the lives of athletes. And a new partnership is set to give it a huge funding boost for now — and in the years to come.

Email security company takes ANZ customers through a step-by-step guide to avoid being scammed and having your life savings swiped.

Big changes are coming to banking laws and it’ll be a better deal for you — but not all groups are convinced.

A huge sum of money went missing from a bank in the late 1980s. And now a former fraud detective is calling on the police to investigate.

The housing market was a big issue during the election so now it’s over, everyone wants to know what happens next to prices.

Original URL: https://www.dailytelegraph.com.au/business/companies/banking/page/199