Aussie business on brink of collapse after scammer steals $40,000

An Australian company is on the brink of collapse after scammers stole nearly $40,000 from it and the bank refused to reimburse the business.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

An Australian company is on the brink of collapse after scammers stole nearly $40,000 from it and the bank refused to reimburse the business.

Roland Sharman, 80, has been running a successful company selling DIY sail shades internationally for 18 years.

Instead of taking a pension, the Aussie relies on his business, Sail Shade World, as his sole income, but he might be forced to shut it down for good after scammers crippled his operations through no fault of his own.

In July, Mr Sharman received an order for $38,000 worth of goods and shipped these to the requested addresses in the Middle East.

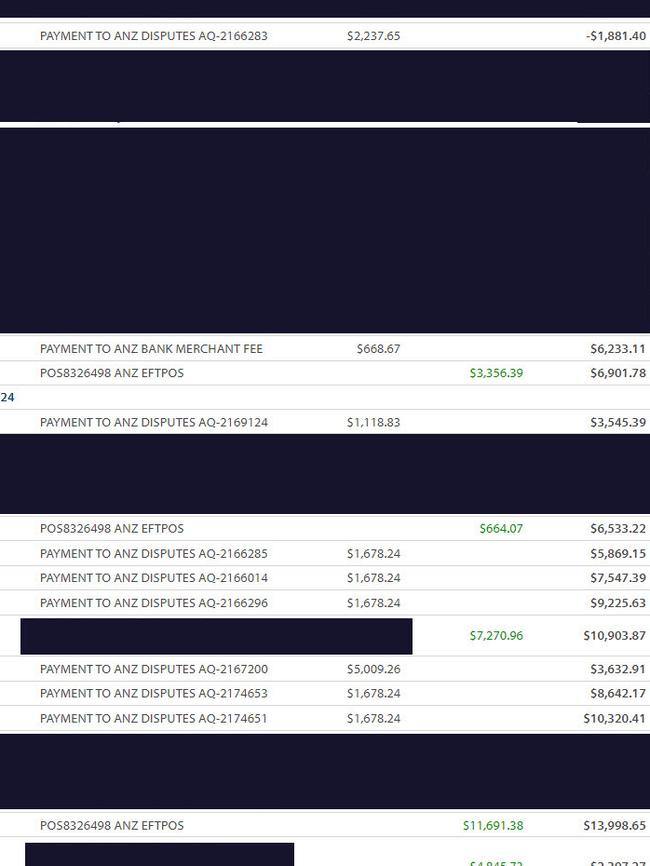

But in August, this same amount of money was then taken out of his company’s account in what’s known as a ‘chargeback’, which is when a customer disputes a transaction.

This meant the money then disappeared from his business account, despite the sails already having been sent overseas.

It turned out a fraudster had purchased goods using stolen credit cards and the rightful owners wanted their money back.

But the worst was yet to come. When Mr Sharman alerted his bank, ANZ, it washed its hands of it and blamed him for not installing an extra layer of security, which he claims he had never heard of.

“I don’t know if we’re going to survive this,” Mr Sharman told news.com.au.

“It has rocked the boat, in terms of cash flow. We’re a small business. It’s a totally steady, nice little cash machine, we don’t (usually) have to worry about anything. We didn’t think we needed to put money aside.”

The scammer made 171 attempts at purchasing Sail Shade World’s products, all with stolen credit cards, which is why most of the attempts failed.

But unfortunately, 21 purchases went through, totalling $US24,787 ($A37,200), triggering the refund known as a chargeback.

Despite banking with ANZ for the better part of two decades, Mr Sharman was shocked by the bank’s response when he alerted them to the scam.

Instead of scrambling to stop the chargebacks and save his money, the bank absolved themselves of any blame.

He said he was told that although he banked with ANZ, his merchant agreement had been transferred to ANZ Worldline in 2022, a joint venture between ANZ and another business.

ANZ Worldline had another response that infuriated Mr Sharman.

The bank told him he had failed to install 3D Secure, a security measure that would have protected him against this kind of fraud.

But Mr Sharman said that was the first time he had ever heard of it.

And ANZ Worldline was not backing down, telling him it had the power contractually to recover the chargeback funds from his business account and also any other accounts he might hold.

As a result, the chargebacks came out of his accounts.

Mr Sharman has launched a GoFundMe to raise money in the wake of the scam.

Have you been scammed? Get in touch | alex.turner-cohen@news.com.au

“The fraud itself, emotionally, mentally, you take that in your stride, sh*t happens,” Mr Sharman lamented.

“The issue is the bank’s reaction.”

Rubbing salt in the wound for Mr Sharman is the hundreds of thousands of dollars in processing fees he has paid to the bank over the past 18 years of running his business.

With the cost of these prices fluctuating between one and three per cent of his transactions, Mr Sharman estimates the bank has taken $300,000 from him over the years in transaction fees.

He called it a “betrayal” by the bank and “a clear breach of trust”.

Mr Sharman lodged a claim with the Australian Financial Complaints Authority (AFCA) last month.

The Aussie says most of his sales comes from the Northern Hemisphere so this is the slowest time of year for his shade business as half the world heads into winter.

“It’s the worst time of the year,” he said. “It’s not good times (for my business) because of this one massive fraud.”

In a statement to news.com.au, an ANZ Worldline spokesperson said that Mr Sharman should have made arrangements with his gateway provider to enable the extra security measure, 3D Secure.

“3D Secure would need to be enabled by the merchant’s gateway provider. In this case, ANZ Worldline Payment Solutions isn’t the gateway provider,” the spokesperson said.

“ANZ Worldline Payment Solutions does however provide all customers with information about 3D Secure through operating guides, our website and proactive communications, and encourages them to confirm 3D Secure is available from their gateway if using a third party provider.”

alex.turner-cohen@news.com.au

Originally published as Aussie business on brink of collapse after scammer steals $40,000