All eyes on bank stocks after Hayne report

National Australia Bank’s CEO Andrew Thorburn has defended his job performance — and his decision to take extended leave — while bank stocks have bounced after yesterday’s royal commission report.

NAB boss Andrew Thorburn has defended his decision to take extended leave ahead of the royal commission’s final report, saying it’s “unfair” to criticise a CEO for taking a break for “their own physical and mental health”.

The chief executive also responded to royal commissioner Kenneth Hayne’s scathing criticism of him and NAB chairman Ken Henry this morning, saying it was “harsh”, “upsetting” and “hard to read”.

“I respect the commissioner’s view … I don’t share it. I feel that we are acknowledging, that we are making decisions, actions that are proving that we want to rebuild trust with customers,” Mr Thorburn told Sky News this morning.

“I feel that the way he is describing me is the polar opposite of what I want to be and what I am.”

Australian financial institutions enjoyed a surge on the stock market today, presumably driven by investor relief that the Hayne report did not mete out further punishment than had been expected.

Of the Big Four, Westpac rose 7.36% to close at 26.70, while ANZ climbed 6.44% to close at 26.85 and the Commonwealth Bank put on 4.69% to finish at 73.60.

The embattled NAB increased by 3.11% to end at 24.99, and the AMP - which was also savaged during the Royal Commission - rose by just under 10% to close at 2.43.

MORE: Turnbull throws Libs under the bus after report release

MORE: Five-minute guide to Commission’s findings

MORE: Royal Commissioner’s stern words to bank bosses

MORE: Ten new judges for criminal banking cases

MORE: What banking report means for home buyers

Andrew Thorburn made the decision to return early from long-service leave after the final report was handed down yesterday.

The report singled him and Dr Henry out as failing to learn the lessons from the past.

He defended his call to take the leave in the first place, saying his job was “demanding” and that he was being a role model to his staff by taking time off.

“You need energy, you need a break,” he told Sky.

“You have a life outside the company. I mean, I’ve got a marriage, I’ve got children, I’ve got elderly parents — they’re the people who I want to spend some time with.

“I don’t think it’s unreasonable that, particularly as I’ve been in the bank for 14 years and you build up long-service leave, that I do take that.

“I think it is important for mental and physical health and to lead in a sustainable way. And I will be a role model inside the company that it’s okay to do that.”

He added that a CEO of a big bank would always going to be open to criticism for taking extended leave.

“I think it’s unfair to think a CEO can’t take leave that is due for their own physical and mental health when they’ve got an army of very good leaders who are carrying out that strategy,” he said.

Mr Thorburn also said the bank had a clear strategy and a competent management team to implement it in his absence.

But veteran banking analyst Brian Johnson of CLSA said change at the top of NAB was likely.

BANKS ENJOY SHARE PRICE BUMP

While shares in the big banks surged, mortgage brokers took a hit in early trade after the Hayne report recommended reforms to trailing commissions, with Mortgage Choice down more than 32 per cent and Australian Finance Group losing more than 30 per cent.

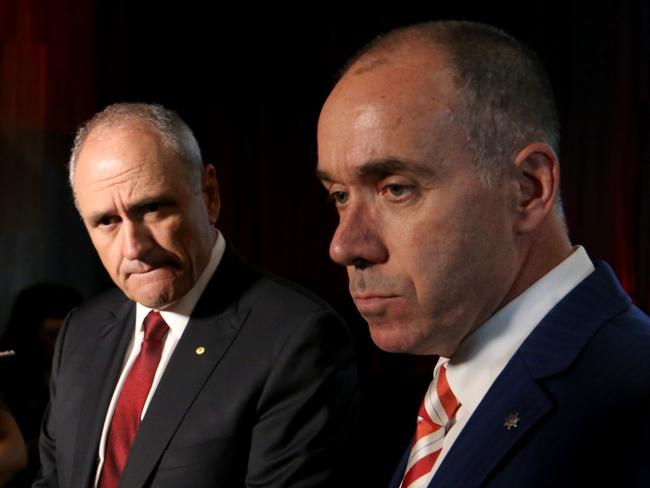

All eyes were on the NAB after it was singled out by Commissioner Hayne, who called out chairman Ken Henry and chief executive Andrew Thorburn over the banks’ perceived unwillingness to address past wrongs.

“Having heard from both the CEO Mr Thorburn, and the chair Dr Henry, I am not as confident as I would wish to be that the lessons of the past have been learned,” the Commissioner wrote.

The NAB board met this morning to discuss the royal commission findings.

In a statement released this morning, Mr Thorburn and Mr Henry responded to Commissioner Haynes’ findings.

Mr Thorburn also released a video statement on Twitter.

“The report references matters concerning the NAB Group which have been referred to the relevant regulator. We will engage constructively on these matters,” he said in the written statement.

“In addition, the Commissioner has expressed his view that we at NAB may not be learning the lessons we need to from the past and, in particular, that we don’t know what the right thing to do is.

“As the CEO, this is very hard to read, and does not reflect who I am or how I am leading, nor the change that is occurring inside our bank.”

Mr Thorburn said he will lead the bank’s response to the royal commission “personally and visibly”, and that he had cancelled his planned two months’ leave.

Mr Thorburn’s future has been subject to speculation from analysts and investors since December, when he announced he was going on leave both before and after the release of the Hayne report.

Dr Henry said: “In his final report Commissioner Hayne said I seemed unwilling to accept criticism of how the Board had dealt with some of the issues raised by the Commission. I am disappointed that the Commissioner formed this view. I know that it is not so.”

He added the NAB is the only bank to publicly release their assessment, which outlines 26 areas they are focusing on to be a “better bank”.

WHY NAB BOSSES INCURRED HAYNES’ FURY

In his final report, Commissioner Hayne welcomed noises from rivals CBA and ANZ but said NAB stood apart from the other big four banks in its response to industry failings aired at the commission hearings.

Hayne took issue with Dr Henry’s contrived responses as shocking revelations were made public.

The NAB chair appeared to take no responsibility laying blame on administrative errors when the problem was systemic.

Dr Henry, a multi-millionaire who was once Australia’s most powerful and revered public servant, sparked public outrage when called to give evidence by grunting responses, scoffing at questions or refusing to answer, and talking under his breath.

The former Treasury Secretary told senior counsel assisting, Rowena Orr, QC, the questions he thought he needed to answer, and those he didn’t.

Posters on Twitter believed his “snide” and “flippant” responses should lead to his stepping down from the NAB board and one called him a “dinosaur”.

But today the Australian Banking Association leapt to the defence of the NAB bosses.

ABA head Anna Bligh said the commissioner had formed an opinion based on one session of evidence at a hearing last year.

“All I can say is that I have seen both of these men on a number of occasions at meetings in rooms where they have had to put their hand up for reform and change and they have always been adopters and promoters of change, not resisters,” she told the Nine Network.

Other bank stocks may hold up better, given most have promised to ‘do better’ in the wake of the inquiry.

THE REACTION OF THE OTHER BIG BANKS

Commonwealth Bank CEO executive Matt Comyn said late yesterday there was a “clear need for change”.

“We note that the commissioner has concluded that a number of matters regarding the group’s conduct including in relation to superannuation warrant further investigation by relevant regulators and we will co-operate fully with these investigations,” Mr Comyn said.

Kochie: Dodgy advisers betrayed us all

Barefoot Investor: Greed isn’t going away

ANZ described the Hayne report as a “defining moment” for the bank and the financial services industry.

“It has been a humbling experience for me, our leaders and all our people — we have learnt from this and accepted responsibility for our failings,” chief executive Shayne Elliott said last night.

Westpac said it had already taken steps to address some of the issues raised.

“Our focus remains on learning from the mistakes of the past and preventing them from happening again,” chief executive Brian Hartzer said.

Shares in all the four major banks gained about one per cent yesterday ahead of the report’s release.

Market analysts suggested shares could rise again today given most of the negative sentiment flow from the Hayne report had been priced in over recent months.

BANKS BENEFIT FROM MORTGAGE BROKER CHANGES

Meanwhile, the mortgage broking industry has attacked the banking royal commission saying it “failed” to understand its role in the home lending market.

Finance Brokers Association of Australia managing director Peter White also warned borrowing costs would increase if Commissioner Kenneth Hayne’s recommendation that trailing commissions be dumped is accepted.

“This could force upfront commissions to rise in order to compensate for reduced revenues to brokerages, which in turn will lift interest rates and make housing affordability more difficult,” he said.

The Hayne report took aim at the industry, recommending it move from a commission-based pay structure to a to fee-based model.

Under this proposal, borrowers would pay a fee rather than trailing commissions over the life of a home loan.

More than half of home loans in Australia are written through mortgage brokers.

Mr White said the commission recommendation would “hand even more power to the big banks” and showed “just how out of touch he (Commissioner Hayne) is when it comes to brokers”.

BANKS OFFER OF HELP FOR FLOOD, FIRE VICTIMS

As Australians reel from the royal commission findings, the Australian Banking Association today released a statement on behalf of Australia’s banks offering assistance to Queensland flood and Tasmanian fire victims.

Whether it’s floods, drought, bushfires or any other times of hardship Australia’s banks stand ready to help their customers through a difficult time,” ABA CEO Anna Bligh said in a media release.

The banks help includes deferring loan payments, waiving fee and charges and assisting with debt consolidation.

Originally published as All eyes on bank stocks after Hayne report