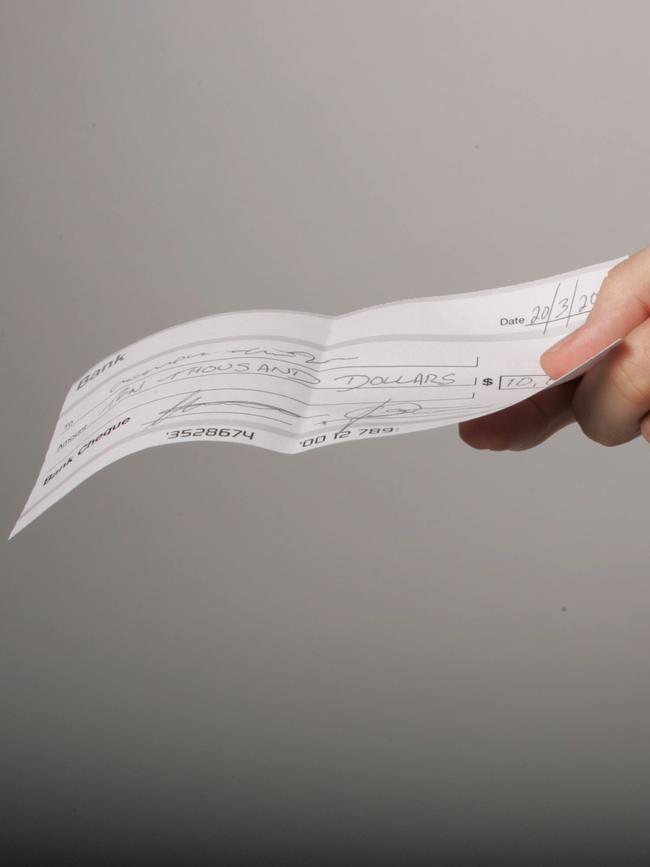

Cheques and cash will become ‘niche’ payment systems in the future

Australia’s top banker responsible for setting interest rates and printing our banknotes says cheques are being phased out and paying by cash will become a “niche” payment system.

The cheque is as good as dead and cold, hard cash hasn’t got long to go, says the banking boss whose signature is on our banknotes.

Reserve Bank of Australia governor Philip Lowe says cash will become a “niche” payment system — used mainly by tax avoiders, crims and investors concerned with privacy — and cheques will be phased out shortly.

Mr Lowe said Australians have rapidly adapted to contactless payments, with tap and go technology surging from just 20 per cent of all transactions in 2013 to a whopping 60 per cent in 2016.

MORE NEWS

David Klemmer signs big money Knights deal

Labor leader rules out paying $700m stadium rebuild

Big shake-up could spell the end of the Opal card

He said yesterday the nation had reached a crossroads with cash, with fewer and fewer Aussies choosing to use it to pay the bills.

“It looks like a turning point has been reached,” Mr Lowe said. “It is now easier than it has been to conceive of a world in which banknotes are used for relatively few payments; that cash becomes a niche payment instrument.”

But despite the decline of cash, the value of banknotes on issue relative to the size of the economy is close to the highest it has been in 50 years. For every Australian there are currently about 30 $50 notes and 14 $100 notes. And privacy is a big issue.

“The main explanation is that some people, including nonresidents, choose to hold a share of their wealth in Australian banknotes,” Mr Lowe said.

He said in some cases paying with cash is more convenient than paying electronically, and that banknotes allow people to pay for things anonymously without leaving a digital fingerprint.

“This privacy aspect is valued by some people,” Mr Lowe said. “In some circumstances this desire for privacy is entirely legitimate, but in others it has more to do with tax evasion and illegal activities.”

He said one thing holding Aussies back from ditching cash was the reliability of contactless payment systems — with a common problem being EFTPOS terminals breaking down due to errors at banks or telecommunications providers.

Mr Lowe said in the mid-1990s Australians made about 45 cheque payments per year; with this figure dropping to just three per person today.

“Given this trend is likely to continue, it will be appropriate at some point to wind up the cheque system, given the high fixed costs involved in operating the system,” he said.

“We have not reached that point yet, but it may not be too far away.”