Cash-strapped tenants advised to access superannuation for rental payments

Real estate agents in Melbourne and Brisbane have been slammed for advising financially-distressed tenants to access their superannuation early to pay rent.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

Real estate agents have been criticised for suggesting tenants in financial distress draw on their superannuation early to make rental repayments.

News Corp Australia has seen multiple emails sent by real estate offices in Victoria and Queensland, suggesting tenants explore a range of financial measures to pay rent on time.

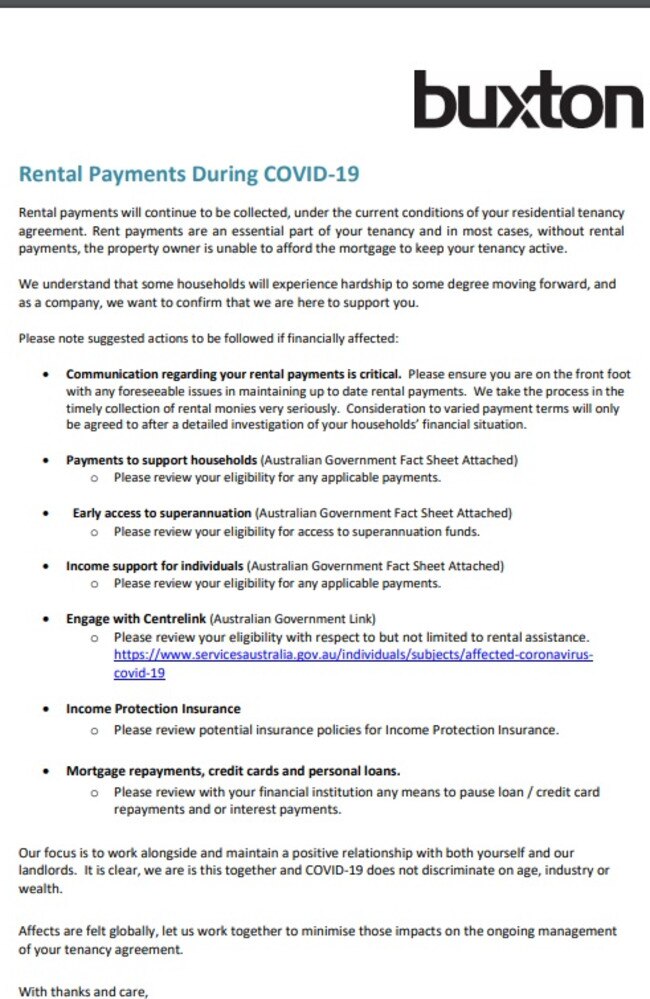

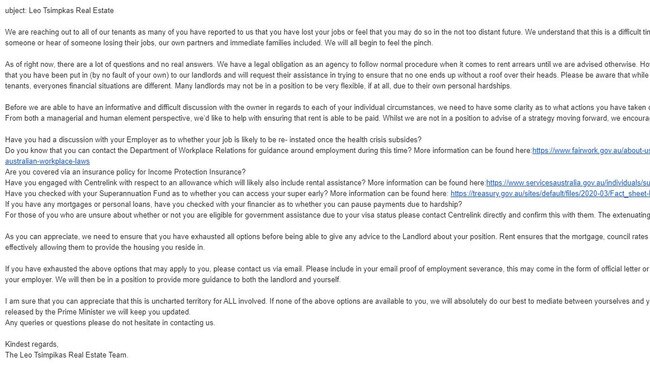

Renowned Victorian real estate chain Buxton and Leo Tsimpikas Real Estate in Brisbane both provided a list of suggested actions tenants could take if their income had been affected.

Both agents suggested tenants could access superannuation early, apply for Centrelink payments and asking financial providers to pause loan repayments.

An email from Buxton said in most cases, an absence of rental payments meant the landlord would be unable to afford the mortgage to keep the tenancy active.

Buxton CEO Nathan Jones said it was up to tenants to assess their options.

“The letter drafted by Buxton lists all financial options currently available to tenants based on Federal Government advice,” he said.

“It is at an individual’s discretion to assess which option is right for them.

“Our focus is to work alongside and maintain positive relationships with all our tenants and landlords at Buxton, particularly during this stressful time.

“We are doing our best to keep our tenants informed and will continue to assist any experiencing financial distress as much as possible.”

Leo Tsimpikas Real Estate said it had to follow its normal rent collection procedures until it was advised otherwise.

It said some landlords could help alleviate the financial distress of tenants, but others could not.

An email from the agent said tenants would have to exhaust all options, including attempting to access their super, before the office provided further advice to landlords.

The Federal Government recently announced those experiencing financial hardship during the coronavirus could withdraw $10,000 from their superannuation this financial year, and a further $10,000 in the following financial year.

A $20,000 withdrawal could cost Australians $100,000 in their retirement.

It comes as renters will be offered a moratorium on evictions for six months, in a bid to deal with the economic impact of the coronavirus pandemic.

Labor’s Shadow Assistant Treasurer Stephen Jones said he was aware of at least six letters of similar nature that had been distributed, and that it was “improper” of real estate agents to suggest tenants should draw on their super early.

“It should be a last resort. If you’re in your 20s access $20,000 today, that’s worth about $100,000 in retirement,” he said.

“Chucking somebody out on the street in the middle of a pandemic is not a sensible term.”

NSW Tenants’ Union senior policy officer Leo Patterson Ross attacked the advice, saying only a qualified financial planner should advise whether tenants should withdraw their super.

“The government needs to step in and give clear guidance, and provide options to negotiate rents so that it is affordable,” he said.

Mr Patterson Ross said the banks should include a halt on interest capitalisation so landlords were given relief and could offer more flexibility to tenants.

He said landlord insurers should also cover lost rental payments if property owners had negotiated with tenants — not just when landlords moved to evict a tenant.

“These are both barriers for people to negotiate in a generous spirit,” he said.

He said it was also likely property managers feared losing commission on rental payments.

“It’s an understandable concern, but unfortunately we’re facing a situation where one million or more Australians might be out of work,” he said.

“From the perspective of the whole economy, it is far better for the little income people to have to be spent on food and groceries and healthcare than to be spent on rents and debts.”

Mr Patterson Ross said even if someone was on Centrelink payments, it did not mean they could make rental payments.

Industry Super Australia chief executive Bernie Dean said superannuation funds had a responsibility “to help Australians keep a roof over their head and food on the table during these difficult times”.

“Funds are working to ensure members who need to access their super early to pay for life’s essentials can do so with a minimum fuss, but we’d encourage people to tap into the governments other generous support first,” Mr Dean said.

“Most people get that cracking open your super now comes with a steep price, for many it could be as much as six figures from your retirement balance.”

Leo Tsimpikas Real Estate did not return News Corp’s calls for comment.

Originally published as Cash-strapped tenants advised to access superannuation for rental payments