Why Costello has gone to battle with the Reserve Bank

The former treasurer’s real interest extends to the $242bn investment portfolio he sits on at the nation’s sovereign wealth fund.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

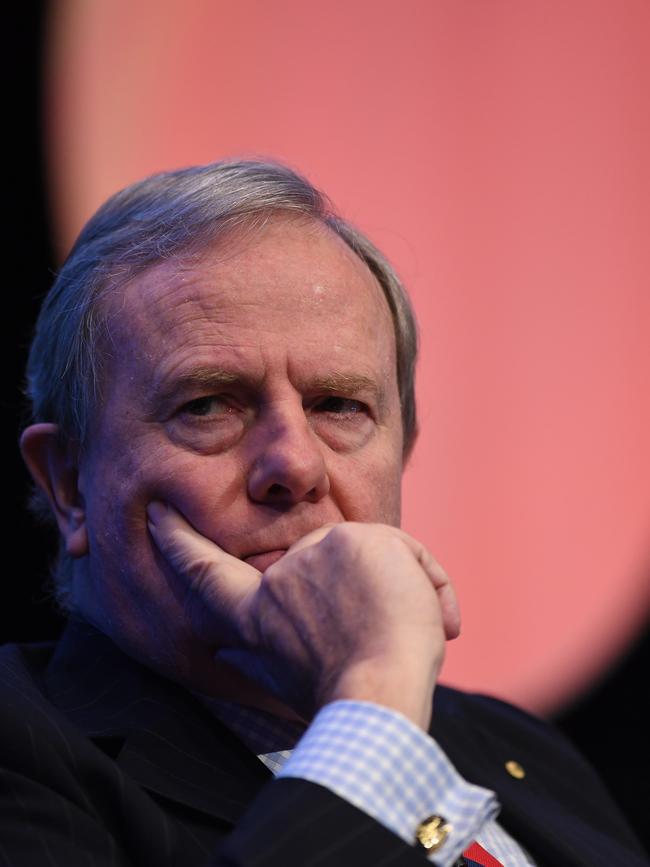

Former treasurer Peter Costello has left little doubt about where he sees responsibility for the inflation explosion, pinning the blame on Australia’s Reserve Bank, among global central banks, for lighting the fuse.

The comments by Costello, chairman of the Future Fund, are likely to add ammunition for those pushing for change at the RBA.

It’s a precarious time for the bank with its credibility to be tested by more rapid-fire interest rate rises, as a wide-ranging review of its Covid response and mandate gets underway.

As a former treasurer, who kickstarted the modernisation of the RBA and is now overseeing an organisation on the front line of investment markets, Costello’s criticism of the bank and its leaders packs extra punch. But his real interest extends to the $242bn investment portfolio he sits on at the nation’s sovereign wealth fund.

Inflation, which is running at the fastest rate in more than two decades, is playing havoc on investment returns as markets are betting on more tough medicine in the form of rate rises to come. This is driving down shares, with global markets taking another rocky turn this week, while the valuation of unlisted assets including high-flying tech companies and property has been marked down heavily by the fund.

Combined this saw the Future Fund post a negative return of 1.2 per cent in the past financial year, its worst result since the global financial crisis. This is the third annual negative return in its history, the others being the GFC-crash (minus 4.2) and the onset of the Covid pandemic in the 2020 financial year (minus 0.9).

Costello points out the Future Fund essentially ignored the forward guidance of the RBA that interest rates would remain low until 2024. The fund also moved early in anticipation of an inflation breakout. This has put the fund on an ultra-defensive position – low returns to protect losses – and this setting is likely to remain for at least another year.

In doing so the Future Fund has slashed its exposure to equities and moved more of its portfolio into infrastructure and property to protect against inflation. It has also put more into hedge funds, which will be looking to profit from the inflation stresses. All up, tens of billions of changes were made to the portfolio which means it is $4bn better off than if it had stood still.

Costello has narrowed in on two areas where he believes the RBA got it wrong. This was on the forward guidance of telling markets that rates were going to stay rock bottom until 2024, which he argues saw the bank straying a long way from its explicit inflation-targeting mandate.

The other area was actually stepping into the market to buy more than $100bn of bonds to artificially depress the price of money.

“The guidance turned out to be wrong,” Costello says. “The bank intervened to try and produce the outcome. And of course the money that it used to intervene was wasted. So you can say it wasn’t a very good chapter for the Reserve Bank,” he says, adding that he believes RBA governor Philip Lowe should be held accountable.

All this will be put under scrutiny in the Wilkins review of the RBA. The probe, headed by former deputy governor of the Bank of Canada Carolyn Wilkins, is due to deliver its final report to the government by March next year.

Unsurprisingly Costello believes there is no need to change the inflation target, after all it was his doing as treasurer that explicitly put the 2-3 per cent range in place when a new RBA governor John Macfarlane was appointed under his watch. This was designed to give the bank a “pure and narrow” focus on monetary policy. “And it worked,” he says.

Lowe has previously issued a strong defence of the RBA’s position, telling The Australian’s Strategic Forum in July that the central bank – like most others around the world – over-insured against the possible “catastrophic economic consequences of the pandemic”. Taking out too much insurance is only noted in hindsight, Lowe said. “I recognise that while this approach meant we avoided some damaging long-term scarring, it has contributed to the inflationary pressures we are now experiencing.”

–

Tough medicine

With pressure rising on home builders due to surging costs, site delays and the pipeline of new work drying up, one Melbourne-based builder has taken tough action by cutting nearly 70 jobs and pulling back its order book.

Simonds Homes, which remains profitable, has taken the action as a preventive measure as the home building sector faces its toughest test in more than a decade. Simonds ranks as one of the nation’s biggest residential builders with nearly 2400 site starts last year across several states.

The move shines a spotlight on how companies are bracing for the building recession to come. Several high-profile builders across the country have collapsed in recent months after being squeezed as surging costs for building materials and labour shortages have pushed them to the brink.

At the same time the near-term outlook remains tough, particularly as fast-rising interest rates are driving away first home buyers, a major market for builders.

The crisis in the home building sector has highlighted the two-speed economy with conditions across mining, retail and infrastructure still booming.

Simonds Homes CEO Rhett Simonds says his company is taking a strategic response to see it through the tough conditions. He says there “is no risk of Simonds failing or defaulting on any of our home building contracts”.

“We will absolutely build every home we are contracted to build,” he says. “As we have no core debt and sound financials, Simonds can focus on strengthening our operations and ensuring we have the agility to respond to changing market conditions while remaining sustainable and profitable.”

Simonds says the decision to make 69 jobs, or nearly 10 per cent of its workforce, redundant “was a decision we did not take lightly”.

“We are doing all we can to support our employees through this process. But it is critical that we act now to ensure Simonds can respond effectively to market changes and remain agile.”

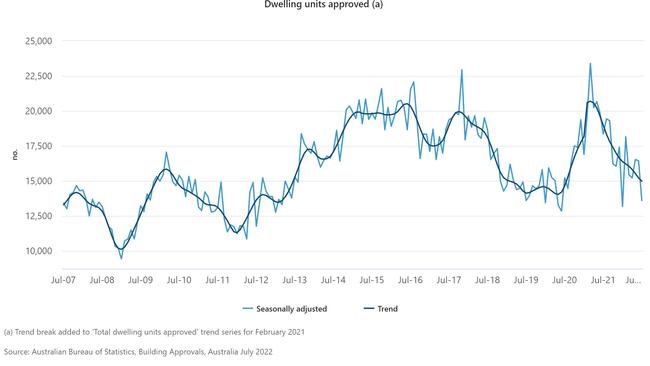

ABS figures released this week show housing approvals – a barometer of forward work – are down more than 17 per cent on the year.

Among other moves for Simonds was a reduction of contracts for new builds, pulling back its home display and sharply cutting administration costs.

Over the past year Simons generated revenue of $687.5m, up 4 per cent on the previous year. Full-year earnings collapsed to just $3.7m from $23.8m a year earlier as payments to suppliers and labour costs jumped.

During the year it was buffeted by slower starts due to labour shortages, supply squeeze and heavy rain and flooding in NSW and Queensland.

It was forced to increase prices to pass on the higher cost of building materials. Its forward order book has “significantly higher average contract values” as a result of the price rises.

Simonds did not declare a dividend to preserve cash. The company, which has virtually no debt on its balance sheet, said it has a strong forward order book of homes but highlighted the residential market was softening.

One bright spot for the industry is the prospect of a ramp-up in immigration levels in the coming year which will help both demand and ease the labour squeeze.

johnstone@theaustralian.com.au

More Coverage

Originally published as Why Costello has gone to battle with the Reserve Bank